Irs Form 4506t

What is the IRS Form 4506-T?

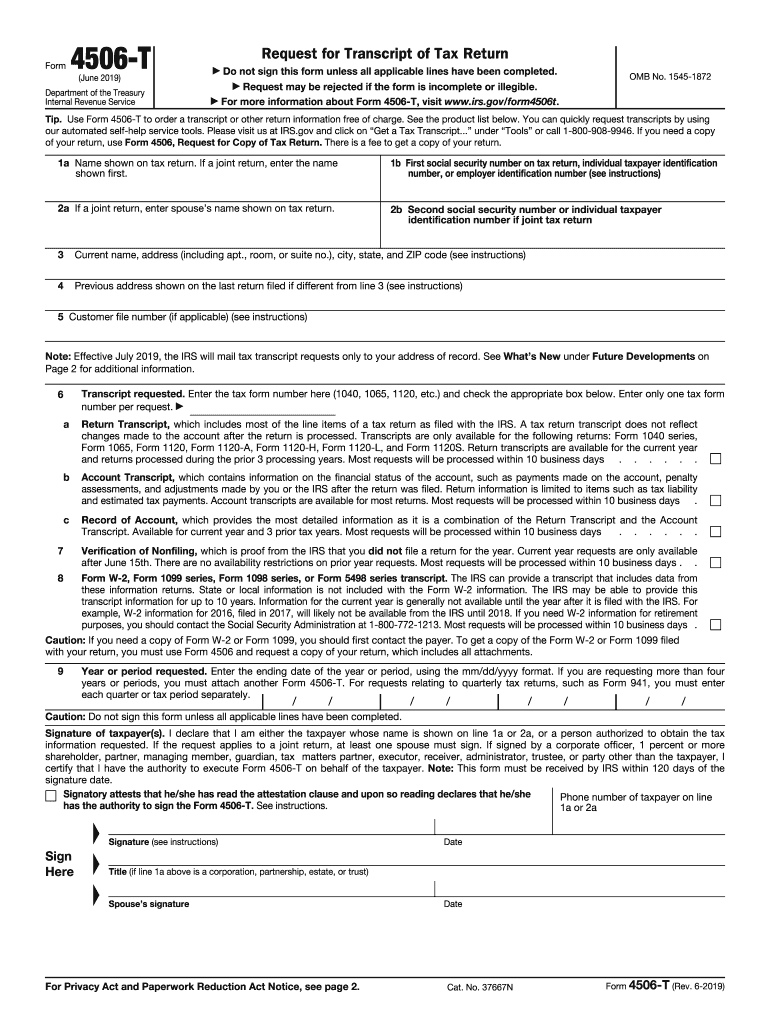

The IRS Form 4506-T, also known as the Request for Transcript of Tax Return, allows taxpayers to request a transcript of their tax returns from the IRS. This form is essential for individuals or businesses needing to verify their income, especially when applying for loans or financial aid. The transcript can provide a summary of tax information, including adjusted gross income and filing status, without requiring the full tax return.

How to Use the IRS Form 4506-T

Using the IRS Form 4506-T is straightforward. Taxpayers must fill out the form with their personal information, including name, Social Security number, and address. They should specify the type of transcript they need and the tax years for which they are requesting information. Once completed, the form can be submitted to the IRS via mail or electronically, depending on the method chosen.

Steps to Complete the IRS Form 4506-T

Completing the IRS Form 4506-T involves several steps:

- Provide your name and Social Security number in the appropriate fields.

- Enter your current address and any previous addresses if applicable.

- Select the type of transcript you need, such as a tax return transcript or account transcript.

- Indicate the tax years for which you are requesting transcripts.

- Sign and date the form to validate your request.

Legal Use of the IRS Form 4506-T

The IRS Form 4506-T is legally binding when completed correctly. It allows the IRS to release your tax information to third parties, such as lenders or financial institutions, provided you have authorized this disclosure. Ensuring that all information is accurate and that you have signed the form is crucial for it to be considered valid.

Required Documents

When submitting the IRS Form 4506-T, no additional documents are typically required. However, it is advisable to have your tax identification information readily available. This includes your Social Security number and any previous addresses if you have changed your residence since filing your tax returns.

Form Submission Methods

The IRS Form 4506-T can be submitted in multiple ways:

- By mail: Send the completed form to the address specified in the instructions.

- Electronically: Some tax software programs allow for electronic submission of the form.

Each method has its processing times, so taxpayers should choose the one that best fits their needs.

Quick guide on how to complete f4506tpdf form 4506 tjune 2019 department of the

Complete Irs Form 4506t effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect environmentally-friendly alternative to traditional printed and signed documents, as you can easily locate the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without hassle. Manage Irs Form 4506t on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to edit and eSign Irs Form 4506t without hassle

- Locate Irs Form 4506t and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information carefully and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form hunts, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Irs Form 4506t and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f4506tpdf form 4506 tjune 2019 department of the

How to make an eSignature for your F4506tpdf Form 4506 Tjune 2019 Department Of The online

How to make an electronic signature for the F4506tpdf Form 4506 Tjune 2019 Department Of The in Chrome

How to generate an electronic signature for signing the F4506tpdf Form 4506 Tjune 2019 Department Of The in Gmail

How to make an electronic signature for the F4506tpdf Form 4506 Tjune 2019 Department Of The right from your smart phone

How to make an electronic signature for the F4506tpdf Form 4506 Tjune 2019 Department Of The on iOS devices

How to create an eSignature for the F4506tpdf Form 4506 Tjune 2019 Department Of The on Android

People also ask

-

What is the 2019 IRS Form 4506-T used for?

The 2019 IRS Form 4506-T allows taxpayers to request a transcript of their tax return information from the IRS. This is often required for loan applications, financial aid, and other verification processes. Having easy access to this form ensures you can swiftly provide necessary information when needed.

-

How can airSlate SignNow help with the 2019 IRS Form 4506-T?

With airSlate SignNow, you can conveniently eSign and send the 2019 IRS Form 4506-T electronically. This streamlines the process, making it faster and more efficient for users who need to handle tax transcripts. Our platform ensures that you can securely submit your documents with ease.

-

Are there any fees for using airSlate SignNow to eSign the 2019 IRS Form 4506-T?

airSlate SignNow offers flexible pricing plans to cater to various business needs, including options for eSigning the 2019 IRS Form 4506-T. Users can choose a plan that fits their budget, ensuring cost-effective document management. Sign up today to explore our pricing options and choose the best plan for you.

-

Can I integrate airSlate SignNow with other applications to manage the 2019 IRS Form 4506-T?

Yes, airSlate SignNow integrates seamlessly with a variety of applications, allowing you to manage the 2019 IRS Form 4506-T alongside other documents. Our integrations enable a smooth workflow for businesses, making it easier to track and manage all your forms. This enhances productivity and ensures everything is in one place.

-

What are the benefits of using airSlate SignNow for the 2019 IRS Form 4506-T?

Using airSlate SignNow for the 2019 IRS Form 4506-T provides numerous benefits, including time-saving eSigning capabilities and secure document handling. Our platform also offers templates and workflows that can simplify the process, making it user-friendly. Streamline your paperwork and enhance efficiency with our powerful features.

-

Is the process of eSigning the 2019 IRS Form 4506-T simple to follow?

Absolutely! The process of eSigning the 2019 IRS Form 4506-T with airSlate SignNow is designed to be straightforward. Users can upload the form, add necessary fields, and eSign within minutes, ensuring a hassle-free experience. Our intuitive interface guides you every step of the way.

-

What security measures are in place when using airSlate SignNow for the 2019 IRS Form 4506-T?

airSlate SignNow prioritizes your security and privacy when handling sensitive documents like the 2019 IRS Form 4506-T. We employ advanced encryption protocols and secure access controls to protect your data. You can confidently eSign knowing your personal information is safe with us.

Get more for Irs Form 4506t

Find out other Irs Form 4506t

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form