Irs Gov Forms1040v

What is the IRS Form 1040-V?

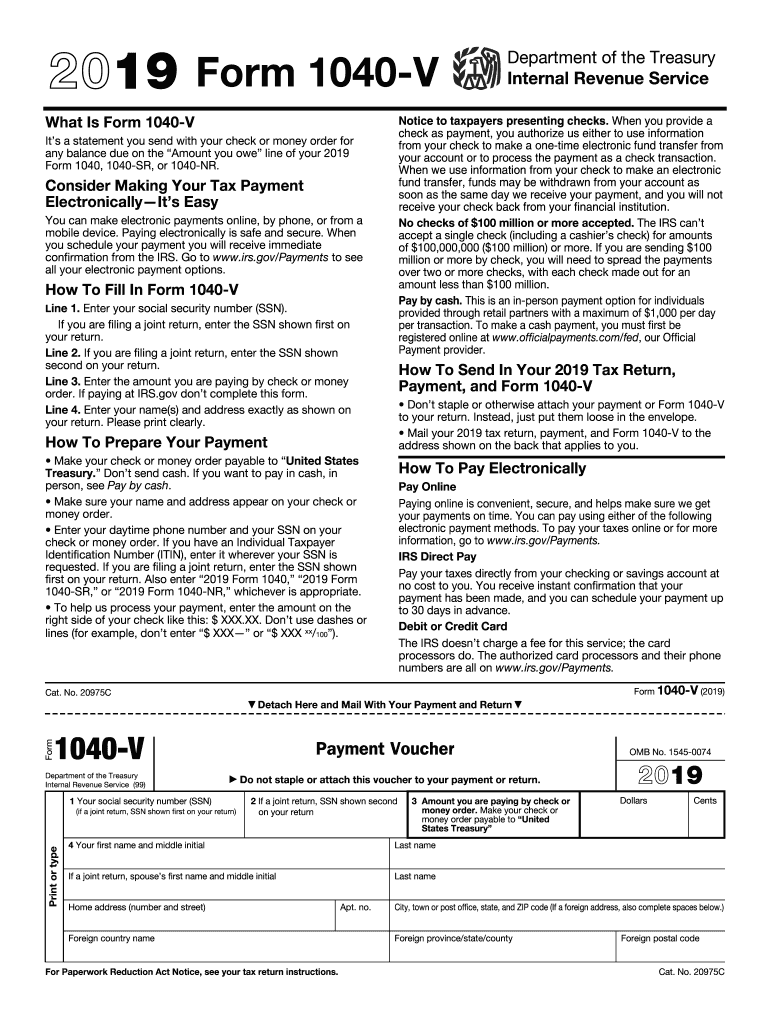

The IRS Form 1040-V is a payment voucher used by taxpayers in the United States to submit payments along with their individual income tax returns. This form is specifically designed for those who are filing Form 1040, 1040-SR, or 1040-NR and need to make a payment. The 1040-V ensures that the IRS can accurately apply the payment to the correct account and tax year. It is important to include this voucher with your payment to avoid any delays in processing.

How to Use the IRS Form 1040-V

Using the IRS Form 1040-V is straightforward. First, download and print the form from the IRS website or obtain a copy from a tax professional. Fill in your personal information, including your name, address, and Social Security number. Indicate the amount you are paying and attach your payment, which can be a check or money order made out to the "United States Treasury." Finally, mail the completed form along with your payment to the address specified for your state on the form.

Steps to Complete the IRS Form 1040-V

Completing the IRS Form 1040-V involves several key steps:

- Download the form from the IRS website or request a physical copy.

- Provide your personal details, including your name and Social Security number.

- Enter the payment amount you are submitting.

- Attach your payment, ensuring it is made out to the "United States Treasury."

- Mail the form and payment to the appropriate IRS address for your state.

Legal Use of the IRS Form 1040-V

The IRS Form 1040-V is legally recognized as a valid method for submitting tax payments. By using this form, taxpayers can ensure that their payments are properly recorded and allocated to their tax liabilities. It is crucial to follow the IRS guidelines when completing and submitting the form to maintain compliance with tax laws. Failure to use the form correctly may result in processing delays or misapplied payments.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the IRS Form 1040-V. Typically, individual income tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to submit your payment voucher and payment by this deadline to avoid penalties and interest on unpaid taxes.

Form Submission Methods

The IRS Form 1040-V can be submitted via mail along with your payment. Ensure that you send the form to the correct address based on your state, as indicated on the form itself. While electronic payment options are available through the IRS website, the 1040-V is specifically for those who prefer to submit their payments by mail. Always keep a copy of the completed form and payment for your records.

Quick guide on how to complete about form 1040 v payment voucherinternal revenue

Effortlessly prepare Irs Gov Forms1040v on any device

Managing documents online has become increasingly favored by both businesses and individuals. It serves as a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Irs Gov Forms1040v on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Irs Gov Forms1040v with ease

- Find Irs Gov Forms1040v and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you select. Modify and eSign Irs Gov Forms1040v to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 1040 v payment voucherinternal revenue

How to create an eSignature for your About Form 1040 V Payment Voucherinternal Revenue online

How to make an eSignature for the About Form 1040 V Payment Voucherinternal Revenue in Google Chrome

How to make an eSignature for putting it on the About Form 1040 V Payment Voucherinternal Revenue in Gmail

How to generate an electronic signature for the About Form 1040 V Payment Voucherinternal Revenue straight from your smart phone

How to make an electronic signature for the About Form 1040 V Payment Voucherinternal Revenue on iOS devices

How to make an electronic signature for the About Form 1040 V Payment Voucherinternal Revenue on Android OS

People also ask

-

What is the IRS Form 1040V and how can airSlate SignNow assist with it?

The IRS Form 1040V is a payment voucher that taxpayers use to submit their taxes along with payments. airSlate SignNow simplifies this process by allowing users to securely eSign and send the form electronically, ensuring timely submission and compliance.

-

Is there a cost associated with using airSlate SignNow for filing IRS Form 1040V?

Yes, while airSlate SignNow offers competitive pricing, the cost varies based on the subscription plan you choose. Regardless of your plan, you'll benefit from an easy-to-use solution for managing IRS Form 1040V without the hassle of physical paperwork.

-

What features does airSlate SignNow offer for managing IRS Form 1040V?

airSlate SignNow provides several features such as document templates, eSigning, and secure storage to help you manage IRS Form 1040V efficiently. These features reduce errors and streamline the process of tax submission, making it easier for users.

-

How does airSlate SignNow ensure the security of IRS Form 1040V submissions?

Security is a top priority for airSlate SignNow. All submissions, including IRS Form 1040V, are encrypted with advanced security protocols, ensuring that your sensitive information remains safe and confidential throughout the eSigning process.

-

Can I integrate airSlate SignNow with other software for IRS Form 1040V processing?

Absolutely! airSlate SignNow offers a variety of integrations with popular software solutions, which can enhance your workflow when processing IRS Form 1040V. This means you can link your existing tools for a seamless experience.

-

What are the benefits of using airSlate SignNow for IRS Form 1040V?

Using airSlate SignNow for IRS Form 1040V offers numerous benefits, including increased efficiency, reduced paper waste, and enhanced tracking of document status. With our platform, you can submit your tax payments quickly and conveniently, ensuring peace of mind.

-

Is it easy to eSign IRS Form 1040V with airSlate SignNow?

Yes, eSigning IRS Form 1040V with airSlate SignNow is incredibly easy. Our user-friendly interface allows you to quickly add your signature to the form, making the process straightforward for any user, regardless of tech-savviness.

Get more for Irs Gov Forms1040v

Find out other Irs Gov Forms1040v

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later

- Can I Sign Texas Life-Insurance Quote Form