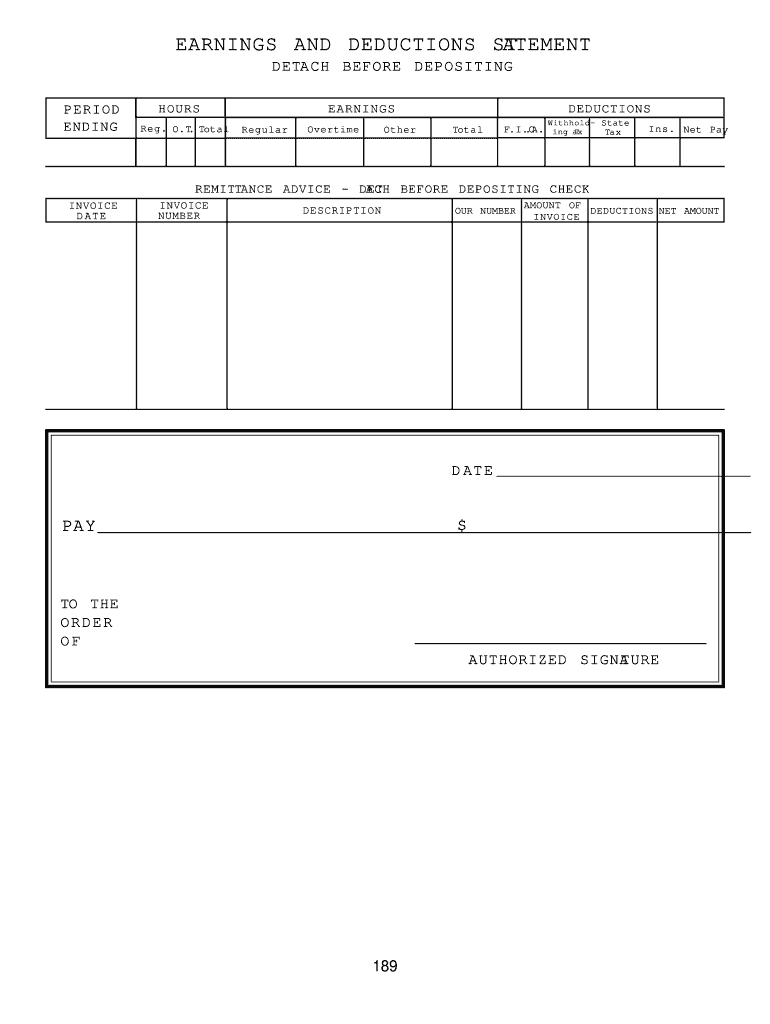

Statement of Earnings Template Form

What is the Statement of Earnings Template

The Statement of Earnings Template, often referred to as the nessie UIC earnings statement, is a formal document that outlines an individual's earnings over a specific period. This template is essential for employees at the University of Illinois Chicago (UIC) and serves as a record of wages, bonuses, and deductions. It provides a clear summary of gross pay, net pay, and year-to-date figures, making it a crucial tool for financial planning and tax preparation.

How to Use the Statement of Earnings Template

Using the Statement of Earnings Template involves several straightforward steps. First, ensure you have the correct version of the template that aligns with your employment status at UIC. Next, fill in your personal information, including your name, employee ID, and relevant dates. After entering your earnings details, review the document for accuracy. Finally, save the completed statement securely, as it may be required for tax filings or loan applications.

Key Elements of the Statement of Earnings Template

The key elements of the Statement of Earnings Template include:

- Employee Information: Name, employee ID, and department.

- Earnings Details: Breakdown of gross pay, bonuses, and overtime.

- Deductions: Taxes withheld, retirement contributions, and other deductions.

- Year-to-Date Totals: Cumulative earnings and deductions for the current year.

These elements ensure that the statement provides a comprehensive overview of an employee's financial status.

Steps to Complete the Statement of Earnings Template

Completing the Statement of Earnings Template involves the following steps:

- Download the official template from the UIC website or your HR portal.

- Enter your personal information accurately at the top of the document.

- Input your earnings details, ensuring all figures are correct.

- Add any applicable deductions, referencing your pay stubs for accuracy.

- Review the completed statement for any errors or omissions.

- Save the document in a secure location for future reference.

Legal Use of the Statement of Earnings Template

The Statement of Earnings Template is legally recognized as a valid document when it is completed accurately and signed by the appropriate parties. It complies with U.S. regulations regarding employment records and can be used for various purposes, including tax filings and loan applications. Ensuring that the document meets all legal requirements is essential for its acceptance by institutions and authorities.

How to Obtain the Statement of Earnings Template

To obtain the Statement of Earnings Template, employees should visit the UIC human resources website or contact their HR department directly. The template is typically available for download in a user-friendly format, such as PDF or Word. Employees may also request a physical copy if needed, ensuring they have the most current version for their records.

Quick guide on how to complete statement of earning and deduction form

Complete Statement Of Earnings Template effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to acquire the right form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Handle Statement Of Earnings Template on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Statement Of Earnings Template with ease

- Locate Statement Of Earnings Template and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Statement Of Earnings Template and ensure clear communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Do I need to fill out a financial statement form if I get a full tuition waiver and RA/TA?

If that is necessary, the university or the faculty will inform you of that. These things can vary from university to university. Your best option would be to check your university website, financial services office or the Bursar office in your university.

-

I’ve been staying out of India for 2 years. I have an NRI/NRO account in India and my form showed TDS deduction of Rs. 1 lakh. Which form should I fill out to claim that?

The nature of your income on which TDS has been deducted will decide the type of ITR to be furnished by you for claiming refund of excess TDS. ITR for FY 2017–18 only can be filed now with a penalty of Rs. 5000/- till 31.12.2018 and Rs. 10,000/- from 01.01.2019 to 31.03.2019. So if your TDS relates to any previous year, then just forget the refund.

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

What is the ITR 3 form?

Income Tax Return Form-3ITR 3 form can be used by an individual or a Hindu Undivided Family (HUF) earning income from a business or a profession. ITR-3 is also required to be filed by a person whose income is chargeable to tax under “profits and gains of business or profession” in the nature of interest, salary, bonus, commission or remuneration.Form ITR 3 can’t be used by any person other than an individual or a HUF. Also, an individual or a HUF not earning any income from business or profession can’t use ITR.It is a type of Income Tax Return form to be used by individuals or HUF’s deriving income from proprietary business or profession. It is to be used for Assessment Year 2018–19 by the groups mentioned below to file their returns.ITR 3 is applicable for those Individuals and HUFs who have income from proprietary business or are carrying on any profession.The persons having income from following sources are eligible to file ITR 3:Carrying on a business or professionReturn may include income from House property, Salary/Pension and Income from other sourcesWho can file their income tax return on ITR-3?Income Tax Return is prepared on ITR-3 when:an individual or an HUF is a partner in a firm ANDwhere income chargeable to income-tax under the head “Profits or gains of business or profession” does not include any income except the income by way of any interest, salary, bonus, commission or remuneration, due to, or received by him from such firm.In case a partner in the firm does not have any income from the firm by way of interest, salary, etc. and has only exempt income by way of share in the profit of the firm, the assessee shall use this form only; not Form ITR-2.When to file ITR 3?ITR-3 form is to be used when the assessee has income that falls into the below category:Income from carrying on a professionIncome from Proprietary BusinessAlong with income from a profession or proprietary business, return may also include income from House property, Salary/Pension and Income from other sourcesStructure of the ITR-3 Form for AY 2018–19:ITR-3 is divided into:Part APart A-GEN: General information and Nature of BusinessPart A-BS: Balance Sheet as of March 31, 2018, of the Proprietary Business or ProfessionPart A-P&L: Profit and Loss for the Financial Year 2017–18Part A-OI: Other Information (optional in a case not liable for audit under Section 44AB)Part A-QD: Quantitative Details (optional in a case not liable for audit under Section 44AB)Part B: Outline of the total income and tax computation in respect of income chargeable total tax.VerificationTax Payments: Details of advance tax, TDS, self-assessment taxAfter this, there are the following schedules.Schedule-S: Computation of income under the head Salaries.Schedule-HP: Computation of income under the head Income from House PropertySchedule BP: Computation of income from business or professionSchedule-DPM: Computation of depreciation on plant and machinery under the Income-tax ActSchedule DOA: Computation of depreciation on other assets under the Income-tax ActSchedule DEP: Summary of depreciation on all the assets under the Income-tax ActSchedule DCG: Computation of deemed capital gains on the sale of depreciable assetsSchedule ESR: Deduction under section 35 (expenditure on scientific research)Schedule-CG: Computation of income under the head Capital gains.Schedule-OS: Computation of income under the head Income from other sources.Schedule-CYLA: Statement of income after set off of current year’s lossesSchedule BFLA: Statement of income after set off of unabsorbed loss brought forward from earlier years.Schedule CFL: Statement of losses to be carried forward to future years.Schedule- UD: Statement of unabsorbed depreciation.Schedule ICDS — Effect of Income Computation Disclosure Standards on ProfitSchedule- 10AA: Computation of deduction under section 10AA.Schedule 80G: Statement of donations entitled for deduction under section 80G.Schedule- 80IA: Computation of deduction under section 80IA.Schedule- 80IB: Computation of deduction under section 80IB.Schedule- 80IC/ 80-IE: Computation of deduction under section 80IC/ 80-IE.Schedule VIA: Statement of deductions (from total income) under Chapter VIA.Schedule AMT: Computation of Alternate Minimum Tax Payable under Section 115JCSchedule AMTC: Computation of tax credit under section 115JDSchedule SPI: Statement of income arising to spouse/ minor child/ son’s wife or any other person or association of persons to be included in the income of the assessee in Schedules-HP, BP, CG and OS.Schedule SI: Statement of income which is chargeable to tax at special ratesSchedule-IF: Information regarding partnership firms in which assessee is a partner.Schedule EI: Statement of Income not included in total income (exempt incomes)Schedule PTI: Pass through income details from a business trust or investment fund as per section 115UA, 115UBSchedule FSI: Details of income from outside India and tax reliefSchedule TR: Statement of tax relief claimed under section 90 or section 90A or section 91.Schedule FA: Statement of Foreign Assets.Schedule 5A: Information regarding apportionment of income between spouses governed by Portuguese Civil CodeSchedule AL: Asset and Liability at the end of the year(applicable where the total income exceeds Rs 50 lakhsHow to fill ITR-3 Form?Instructions for filling out ITR-3:If any schedule is not applicable score across as “ — NA — “.If any item is inapplicable, write “NA” against that item.Write “Nil” to denote nil figures.Except as provided in the form, for a negative figure/ figure of loss, write “-“ before such figure.All figures should be rounded off to the nearest one rupee. However, the figures for total income/ loss and tax payable be finally rounded off to the nearest multiple of ten rupees.Sequence for filling out parts and schedules:The Income Tax Department advises assesses to follow the sequence mentioned below while filling out the income tax return.1. Part A- General on page 12. Schedules3. Part B-TI and Part B-TTI4. VerificationMajor Changes in ITR 3Aadhaar NumberIt is necessary to quote the Aadhaar number in the return of income. If any person does not have the Aadhaar Number but he had applied so, then he can quote the Enrollment ID of Aadhaar Application Form in the ITR.Declaration of value of assets and liabilitiesIn 2016 taxpayers have to declare the value of assets and liabilities if the total income is more than Rs.50 lakhs but from now they have to declare also the description of movable assets and disclose the address of the immovable property.Disclosure of Cash deposits during DemonetisationIt is necessary to fill this new column which introduced in all ITR forms if the taxpayer has deposited Rs 2 lakh or more during the demonetization period.Disclosure of unexplained income and Dividend IncomeNew fields inserted in Schedule ‘OS’ to declare unexplained credit or investment and dividend received from domestic companies above Rs 10 lakhs. Such persons cannot opt for ITR 1 (Sahaj).Registration number of Chartered Accountant FirmIt is mandatory to mention the registration number of the firm of Chartered Accountant which has done the audit in ITR forms.Who is not eligible to file ITR 3?As, ITR-3 form is used for business returns, any individual filing his/her personal income tax return, i.e. Salaried employee or filing using ITR 1 form does not have to file ITR3.You can apply for an attractive offer with best possible Rate of Interest and Terms for Personal, Business and Home Loan.FundsTiger is an Online Lending Marketplace where you can avail fast and easy Home, Business and Personal Loans via 30+ Banks and NBFCs at best possible rates. We will also help you to improve your Credit Score. We have dedicated Relationship Managers who assist you at every step of the process. We can also help you in Balance Transfers that will help you reduce your Interest Outgo.

-

What is the ITR form 5?

ITR-5 Form can be used by Firms, Limited Liability Partnerships(LLPs), Association of persons(AOPs) and Body of Individuals(BOIs), Artificial Juridical Person, Cooperative society and Local authority, provided they are not required to file the return of income under section 139(4A) or 139(4B) or 139(4C) or 139(4D) (i.e Trusts, Political party, Institutions, Colleges, etc)Who can use ITR Form – 5?FirmLLP – Limited Liability PartnershipAOP – Association of PersonsBOI – Body of IndividualsArtificial juridical person (section 2 (21)(vi)Cooperative/registered societyLocal AuthorityPersons as per section 160(1)(iii)(iv)What is the structure of the ITR-5 Form?The Form has been divided into two parts and several schedules:Part A: General informationPart B: Outline of the total income and tax computation with respect to income chargeable to tax.There are 30 schedules details of which are as under:Schedule-HP: Computation of income under the head Income from House PropertySchedule-BP: Computation of income under the head “profit and gains from business or profession”Schedule-DPM: Computation of depreciation on plant and machinery under the Income Tax ActSchedule DOA: Computation of depreciation on other assets under the Income Tax ActSchedule DEP: Summary of depreciation on all the assets under the Income-tax ActSchedule DCG: Computation of deemed capital gains on sale of depreciable assetsSchedule ESR: Deduction under section 35 (expenditure on scientific research)Schedule-CG: Computation of income under the head Capital gains.Schedule-OS: Computation of income under the head Income from other sources.Schedule-CYLA: Statement of income after set off of current year’s lossesSchedule-BFLA: Statement of income after set off of unabsorbed loss brought forward from earlier years.Schedule- CFL: Statement of losses to be carried forward to future years.Schedule –UD: Unabsorbed DepreciationSchedule- 10A: Computation of deduction under section 10ASchedule- 10AA: Computation of deduction under section 10AASchedule- 80G: Details of donation entitled for deduction under section 80GSchedule- 80IA: Computation of deduction under section 80IASchedule- 80IB: Computation of deduction under section 80IBSchedule- 80IC/ 80-IE: Computation of deduction under section 80IC/ 80-IE.Schedule-VIA: Statement of deductions (from total income) under Chapter VIA.Schedule –AMT: Computation of Alternate Minimum Tax payable under section 115JCSchedule AMTC: Computation of tax credit under section 115JDSchedule-SI: Statement of income which is chargeable to tax at special ratesSchedule-EI: Statement of Income not included in total income (exempt incomes)Schedule-IT: Statement of payment of advance-tax and tax on self-assessment.Schedule-TDS: Statement of tax deducted at source on income other than salary.Schedule-TCS: Statement of tax collected at sourceSchedule FSI: Details of income accruing or arising outside IndiaSchedule TR: Details of Taxes paid outside IndiaSchedule FA: Details of Foreign AssetsMode of filing ITR 5Taxpayers can use either online or offline option to submit the ITR 5 Form for the AY 2017-18 and all the taxpayers who are paying tax and earned an income more than 5 lakhs shall furnish their ITR by offline and online mode. It is mandatory to file the return electronically under the digital signature whose accounts are liable to audit under section 44AB.When the returns filed by the online mode so the taxpayer should print out the two copies of ITR V Form and one copy of that form has duly signed by the taxpayer and send it to the Income Tax Department-CPC Office within 120 days of e-filing.When the return filed by the offline mode so the acknowledgment slip provided by the Income Tax Department should be duly filled with the return form.Common guidelines while filling ITR 5If any schedule is not applicable score across as “—NA—“Write “NA” against that item which is inapplicableWrite “Nil” to denote nil figures.Write “-” before for a negative figure/ figure of lossAll figures should be rounded off to the nearest one rupeeSequence to fill ITR-5 FormPart ASchedulesPart BPart CVerificationChances 1st April, 2018 (ITR 5 FY 2017-18 or AY 2018-2019)Late fee if IT returns not filled on time.The taxpayers now need to provide more details in the form if they are claiming capital gains exemption.New columns have been introduced in the ITR forms to report the details of GST paid and refundedA new field has been added to facilitate the claim for TDS credit where the TDS was deducted in the name of another person or from a common pool or other similar situations.A new field has been added to report disallowance of expenses in case of TDS default.Cess levied on your tax liability has been hiked by 1 per cent from the current 3 per cent to 4 per cent. ( For FY 2018-19)How to file ITR5 Form?ITR 5 needs to be e-filed by persons:Whose books of accounts are audited u/s 44AB. The verification must be completed by using digital signatureWhose books of accounts are not required to be audited u/s 44AB, then the verification can be done by:Digital signatureElectronic Verification CodeUsing ITR-V – print and signed by principal contact and postPenalty on late filing of ITR:Starting from April 1, if you file your ITR post the deadline of July 31, 2018 (unless the tax department extends it), you will be liable to pay a maximum penalty of Rs.10K.w.e.f. assessment year 2018-19, if assesse failed to furnish return of income within due date as prescribed under section 139(1) then as per section 234F, he will be required to penalty of:5000 if return is furnished on or before 31 December of assessment year.10,000 in any other case.Total income of the person does not exceed Rs. 5 lakh then Rs. 1000.If Income is not taxable then NIL (Not required to pay penalty as per income tax provisions)You can apply for an attractive offer with best possible Rate of Interest and Terms for Personal, Business and Home Loan.FundsTiger is an Online Lending Marketplace where you can avail fast and easy Home, Business and Personal Loans via 30+ Banks and NBFCs at best possible rates. We will also help you to improve your Credit Score. We have dedicated Relationship Managers who assist you at every step of the process. We can also help you in Balance Transfers that will help you reduce your Interest Outgo.

Create this form in 5 minutes!

How to create an eSignature for the statement of earning and deduction form

How to generate an eSignature for the Statement Of Earning And Deduction Form in the online mode

How to make an electronic signature for the Statement Of Earning And Deduction Form in Chrome

How to generate an electronic signature for putting it on the Statement Of Earning And Deduction Form in Gmail

How to make an electronic signature for the Statement Of Earning And Deduction Form from your smart phone

How to make an eSignature for the Statement Of Earning And Deduction Form on iOS devices

How to make an eSignature for the Statement Of Earning And Deduction Form on Android OS

People also ask

-

What is a UIC earning statement?

A UIC earning statement is a document that outlines an individual’s earnings and deductions within a specified period, often used for income verification and financial planning. By utilizing airSlate SignNow, you can easily eSign and manage your UIC earning statement securely and efficiently.

-

How can airSlate SignNow help with managing UIC earning statements?

With airSlate SignNow, you can create, send, and eSign your UIC earning statement effortlessly. Our user-friendly platform ensures that you can track the status of your documents and keep all parties informed throughout the signing process.

-

Is airSlate SignNow cost-effective for businesses needing UIC earning statements?

Yes, airSlate SignNow offers a cost-effective solution for businesses that require UIC earning statements. Our competitive pricing plans allow organizations of all sizes to access premium features while effectively managing their document workflows.

-

What features does airSlate SignNow offer for UIC earning statements?

airSlate SignNow provides a range of features including customizable templates, real-time tracking, and secure eSigning options specifically for UIC earning statements. These features enhance document management efficiency and ensure compliance with industry standards.

-

Can I integrate airSlate SignNow with other tools for UIC earning statements?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, making it easy to manage your UIC earning statements. Integration options include CRM systems, cloud storage solutions, and productivity tools, enhancing your document workflow.

-

How secure is the process of eSigning a UIC earning statement with airSlate SignNow?

The security of your UIC earning statement is paramount at airSlate SignNow. We employ advanced encryption, authentication, and secure storage practices to ensure that your signed documents remain confidential and protected from unauthorized access.

-

What benefits does airSlate SignNow provide for businesses handling UIC earning statements?

By using airSlate SignNow for your UIC earning statements, businesses benefit from streamlined workflows, reduced paperwork, and faster processing times. Our platform enhances collaboration and provides real-time updates, which can improve overall operational efficiency.

Get more for Statement Of Earnings Template

Find out other Statement Of Earnings Template

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile