Form 8962

What is the Form 8962

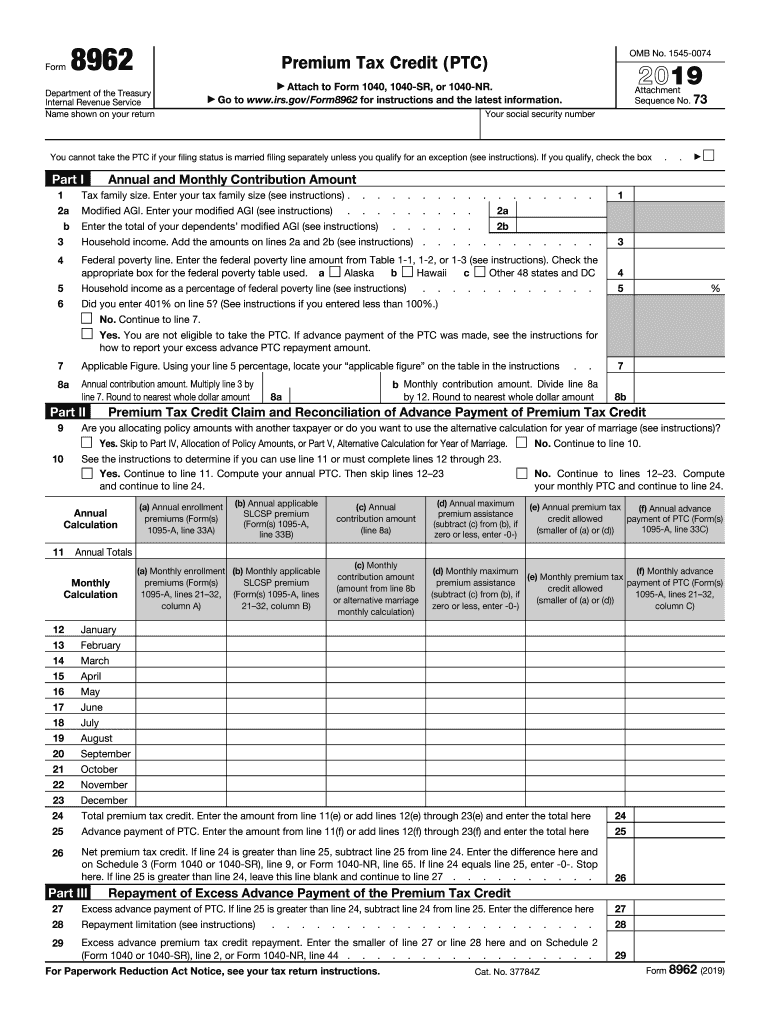

The Form 8962, also known as the Premium Tax Credit form, is used by taxpayers to calculate their eligibility for the premium tax credit under the Affordable Care Act (ACA). This form helps determine the amount of premium tax credit a taxpayer is entitled to based on their household income and the size of their family. It is essential for individuals who have purchased health insurance through the Health Insurance Marketplace and wish to reconcile any advance payments of the premium tax credit made on their behalf.

How to use the Form 8962

To effectively use the Form 8962, taxpayers must gather relevant information regarding their health insurance coverage, household income, and family size. The form requires details about the taxpayer’s coverage months, the amount of premium tax credit received, and the actual premium costs. By accurately completing this form, individuals can reconcile their advance premium tax credits with their actual eligibility, ensuring compliance with IRS regulations.

Steps to complete the Form 8962

Completing the Form 8962 involves several key steps:

- Gather necessary documents, including Form 1095-A, which provides information about health coverage.

- Fill out the personal information section, including your name, Social Security number, and filing status.

- Report the monthly coverage amounts and any advance payment of the premium tax credit received.

- Calculate the premium tax credit based on your household income and family size.

- Sign and date the form before submission.

Legal use of the Form 8962

The legal use of the Form 8962 is crucial for ensuring compliance with the IRS. This form must be filed with your federal tax return if you received advance premium tax credits. Failure to file or inaccuracies may result in penalties or the requirement to repay any excess credits received. It is important to understand the legal implications of the information provided on the form, as it impacts your tax obligations and eligibility for future credits.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the Form 8962. Typically, the deadline for submitting your federal tax return, including Form 8962, is April fifteenth of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website for any updates regarding filing deadlines and to ensure timely submission to avoid penalties.

Required Documents

When completing the Form 8962, certain documents are necessary to provide accurate information. Key documents include:

- Form 1095-A, Health Insurance Marketplace Statement, which outlines your health coverage details.

- Your tax return from the previous year for reference on income and filing status.

- Any additional documentation that supports your household income and family size.

IRS Guidelines

IRS guidelines for the Form 8962 are essential for ensuring compliance and accuracy. Taxpayers must follow the instructions provided by the IRS for completing the form, including how to calculate the premium tax credit and reconcile any advance payments. It is recommended to consult the IRS website or a tax professional for guidance on specific situations, especially if there are changes in income or family size that may affect eligibility.

Quick guide on how to complete 2019 form 8962 premium tax credit ptc

Effortlessly Prepare Form 8962 on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Form 8962 across any platform with airSlate SignNow's Android or iOS applications and streamline any document-driven procedure today.

Modification and Electronic Signing of Form 8962 Made Easy

- Locate Form 8962 and click on Get Form to begin.

- Utilize the provided tools to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your document, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or mislaid documents, tedious form searches, or mistakes necessitating new document prints. airSlate SignNow manages all your document-related needs in just a few clicks from your preferred device. Modify and electronically sign Form 8962 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 8962 premium tax credit ptc

How to generate an electronic signature for your 2019 Form 8962 Premium Tax Credit Ptc in the online mode

How to generate an eSignature for the 2019 Form 8962 Premium Tax Credit Ptc in Chrome

How to make an eSignature for signing the 2019 Form 8962 Premium Tax Credit Ptc in Gmail

How to generate an eSignature for the 2019 Form 8962 Premium Tax Credit Ptc straight from your mobile device

How to generate an electronic signature for the 2019 Form 8962 Premium Tax Credit Ptc on iOS devices

How to generate an eSignature for the 2019 Form 8962 Premium Tax Credit Ptc on Android OS

People also ask

-

What is the purpose of the 2019 for 8962 form?

The 2019 for 8962 form is used to reconcile premium tax credits for health insurance coverage. It helps taxpayers determine their eligibility for premium tax credits based on their household income and family size in 2019. Properly using this form can prevent any discrepancies with the IRS.

-

How can airSlate SignNow help with the 2019 for 8962 form?

airSlate SignNow simplifies the process of completing and submitting the 2019 for 8962 form by providing an easy-to-use eSignature platform. With user-friendly templates and secure document handling, businesses can efficiently gather and manage all necessary documentation required for filing. This streamlines the filing process and enhances compliance.

-

What features does airSlate SignNow offer for handling the 2019 for 8962 form?

airSlate SignNow offers features such as customizable templates, secure electronic signatures, and automated workflows that facilitate the completion of the 2019 for 8962 form. Users can track the status of documents and ensure that all necessary parties have signed efficiently. Additionally, our platform offers integrations that simplify workflows.

-

Is there a cost associated with using airSlate SignNow for the 2019 for 8962 form?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs when using it for the 2019 for 8962 form. The plans are designed to be cost-effective while providing essential features necessary for efficient document management and compliance. Businesses can choose a plan that best fits their volume and complexity of signatures.

-

Can I integrate airSlate SignNow with other tools for the 2019 for 8962 form process?

Absolutely! airSlate SignNow offers seamless integrations with various tools and software to enhance your workflow when completing the 2019 for 8962 form. You can connect it with CRM platforms, cloud storage services, and other applications to create a more efficient document management process. This ensures that all your data remains organized and easily accessible.

-

What are the benefits of using airSlate SignNow for my 2019 for 8962 submissions?

Using airSlate SignNow for your 2019 for 8962 submissions provides numerous benefits, including increased efficiency and improved compliance. The ability to eSign documents remotely reduces the time needed for approvals, allowing for quicker submissions. Additionally, the secure platform ensures your information is protected during the entire process.

-

Is airSlate SignNow user-friendly for first-time users of the 2019 for 8962 form?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for first-time users to navigate through the process of completing the 2019 for 8962 form. The intuitive interface allows users to quickly become familiar with the platform and utilize its features effectively. Comprehensive resources and support are also available for assistance.

Get more for Form 8962

Find out other Form 8962

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form