Form 940 Schedule a

What is the Form 940 Schedule A

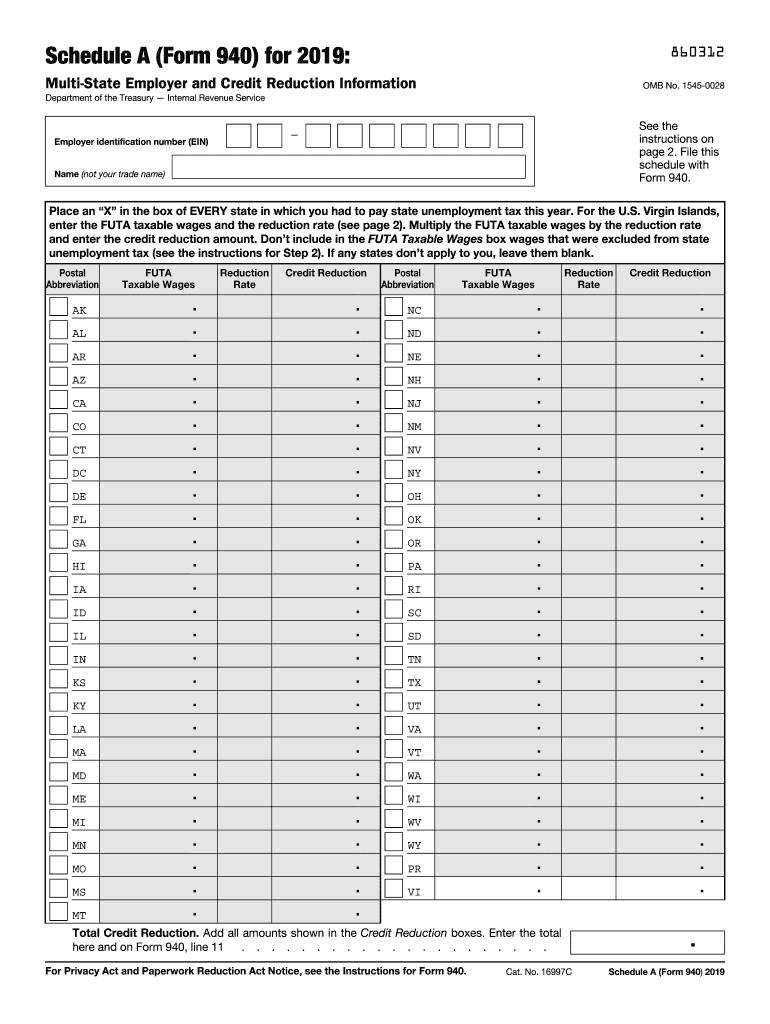

The Form 940 Schedule A is a supplementary document that accompanies the IRS Form 940, which is used by employers to report annual Federal Unemployment Tax Act (FUTA) taxes. The Schedule A specifically allows employers to calculate any adjustments in their FUTA tax liability based on state unemployment taxes paid. This form is crucial for ensuring compliance with federal tax regulations and accurately reflecting any credits or reductions applicable to the employer's tax obligations.

How to use the Form 940 Schedule A

To use the Form 940 Schedule A, employers first need to complete the main Form 940. Once the primary form is filled out, they can proceed to Schedule A to determine any applicable credits for state unemployment taxes. This involves entering the total state unemployment taxes paid and calculating the credit based on the guidelines provided by the IRS. The completed Schedule A is then submitted alongside the Form 940 to the IRS, ensuring that all relevant tax information is accurately reported.

Steps to complete the Form 940 Schedule A

Completing the Form 940 Schedule A involves several key steps:

- Gather necessary information about state unemployment taxes paid during the tax year.

- Fill out the main Form 940, ensuring all employer information is accurate.

- Access the Form 940 Schedule A and enter the total amount of state unemployment taxes paid.

- Calculate the credit based on the IRS guidelines, ensuring to follow the specific instructions for your state.

- Review the completed Schedule A for accuracy before submitting it with the Form 940.

Legal use of the Form 940 Schedule A

The legal use of the Form 940 Schedule A is governed by IRS regulations, which stipulate that employers must accurately report their FUTA tax liabilities. Proper completion of this schedule is essential for compliance, as it affects the overall tax liability. Failure to use the form correctly can result in penalties or interest charges. Employers should ensure they are familiar with the legal requirements and guidelines set forth by the IRS to avoid any compliance issues.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Form 940 and its Schedule A. The annual FUTA tax return is due by January 31 of the following year. If employers deposit their FUTA taxes on time, they may have until February 10 to file the form. It is important to keep track of these deadlines to avoid late fees and penalties. Employers should also be aware of any changes in deadlines announced by the IRS, especially during tax season.

Penalties for Non-Compliance

Non-compliance with the requirements related to the Form 940 Schedule A can lead to significant penalties. The IRS may impose fines for late filing, underpayment of taxes, or failure to accurately report state unemployment taxes. These penalties can accumulate over time, resulting in increased financial liability for employers. It is crucial for businesses to understand these risks and ensure timely and accurate submissions to maintain compliance with federal tax laws.

Quick guide on how to complete 2019 schedule a form 940 internal revenue service

Effortlessly Prepare Form 940 Schedule A on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary format and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without interruptions. Manage Form 940 Schedule A on any device with the airSlate SignNow apps for Android or iOS and enhance any document-oriented process today.

The simplest way to modify and eSign Form 940 Schedule A effortlessly

- Obtain Form 940 Schedule A and click Get Form to initiate.

- Use the tools we offer to fill out your form.

- Emphasize key parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes a few seconds and has the same legal validity as a traditional handwritten signature.

- Review all the information and then click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 940 Schedule A and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule a form 940 internal revenue service

How to make an eSignature for your 2019 Schedule A Form 940 Internal Revenue Service in the online mode

How to create an electronic signature for the 2019 Schedule A Form 940 Internal Revenue Service in Google Chrome

How to create an electronic signature for putting it on the 2019 Schedule A Form 940 Internal Revenue Service in Gmail

How to generate an eSignature for the 2019 Schedule A Form 940 Internal Revenue Service from your smart phone

How to generate an eSignature for the 2019 Schedule A Form 940 Internal Revenue Service on iOS

How to generate an eSignature for the 2019 Schedule A Form 940 Internal Revenue Service on Android OS

People also ask

-

What is the IRS 2019 940 form, and why is it important?

The IRS 2019 940 form is used by employers to report annual unemployment taxes. It is essential for businesses to file this form to remain compliant with federal regulations and avoid penalties. Understanding how to correctly complete the IRS 2019 940 ensures that businesses can effectively manage their unemployment tax responsibilities.

-

How can airSlate SignNow assist with filing the IRS 2019 940?

AirSlate SignNow simplifies the process of completing and signing the IRS 2019 940 form electronically. Our platform allows users to eSign documents securely, reducing the time it takes to gather necessary signatures. This ensures you can submit your IRS 2019 940 form promptly without the hassle of traditional paperwork.

-

What features does airSlate SignNow offer for completing the IRS 2019 940?

AirSlate SignNow provides a user-friendly interface that allows you to fill out the IRS 2019 940 form with ease. Features like template creation, secure cloud storage, and automated reminders enhance your efficiency. Additionally, the ability to track document status ensures you can manage submissions effectively.

-

Is airSlate SignNow a cost-effective solution for managing IRS 2019 940 submissions?

Yes, airSlate SignNow is designed to be a cost-effective solution for handling IRS 2019 940 submissions. Our pricing plans cater to businesses of all sizes, allowing you to choose a plan that fits your budget while ensuring seamless document management. Investing in our platform can save you both time and resources in the long run.

-

Can I integrate airSlate SignNow with my existing accounting software for IRS 2019 940 filings?

Absolutely! AirSlate SignNow integrates with various accounting software solutions, enhancing your workflow for completing the IRS 2019 940 form. This integration allows for seamless data transfer and document management, streamlining the entire process of tax filing for your business.

-

What are the benefits of using airSlate SignNow for IRS 2019 940?

Using airSlate SignNow for IRS 2019 940 submissions offers numerous benefits, including enhanced security, increased speed, and ease of use. Our platform ensures your documents are safely stored and easily accessible when needed. Plus, the electronic signing feature accelerates the approval process, allowing for timely filings.

-

Do I need any technical skills to use airSlate SignNow for IRS 2019 940?

No, you do not need any technical skills to use airSlate SignNow for managing IRS 2019 940 forms. Our intuitive platform is designed for users of all skill levels, making it easy to create, edit, and eSign documents. With just a few clicks, you can efficiently complete your IRS 2019 940 submissions.

Get more for Form 940 Schedule A

- Performance management d3 puget sound partnership

- Mshp 455 form

- Verification of education experience form the mississippi

- General work contract template form

- Generator maintenance contract template form

- Generic construction contract template form

- Generic contract template form

- Generic consult contract template form

Find out other Form 940 Schedule A

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe