Schedule L 2016-2026

What is the Schedule L

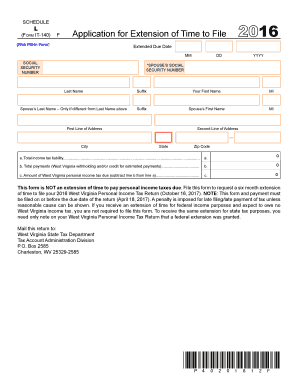

The Schedule L is a supplementary form used in conjunction with the West Virginia IT-140 form, which is the state's individual income tax return. This schedule allows taxpayers to report specific types of income and deductions that may not be included directly on the IT-140. It is essential for individuals who have additional income sources or wish to claim certain deductions that require detailed reporting.

How to use the Schedule L

To use the Schedule L effectively, taxpayers should first gather all relevant financial documents, including W-2s, 1099s, and any other income statements. After completing the IT-140 form, taxpayers will fill out the Schedule L to provide detailed information about their income and deductions. This includes reporting income from self-employment, rental properties, or other sources that require additional explanation. Once completed, the Schedule L should be submitted along with the IT-140 form to ensure accurate processing by the West Virginia State Tax Department.

Steps to complete the Schedule L

Completing the Schedule L involves several key steps:

- Gather necessary documents, including income statements and receipts for deductions.

- Fill out personal information at the top of the form, ensuring accuracy.

- Report all applicable income sources in the designated sections.

- Detail any deductions you are claiming, providing necessary explanations where required.

- Review the completed Schedule L for accuracy before submission.

Key elements of the Schedule L

Important elements of the Schedule L include sections for reporting various types of income, such as self-employment income, interest, dividends, and rental income. Additionally, the form includes areas for claiming deductions related to business expenses, educational expenses, and other specific tax credits. Each section is designed to capture detailed information that supports the amounts reported on the main IT-140 form.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines for the West Virginia IT-140 and Schedule L. The standard deadline for submitting these forms is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to file on time to avoid penalties and interest on any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Schedule L along with the IT-140 form. They can file online through the West Virginia State Tax Department's e-filing system, which is often the quickest method. Alternatively, individuals may choose to print the forms and submit them by mail to the appropriate tax office. In-person submissions are also accepted at designated tax offices, providing another avenue for taxpayers who prefer face-to-face assistance.

Quick guide on how to complete schedule l

Effortlessly Prepare Schedule L on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Schedule L on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The Easiest Way to Modify and eSign Schedule L Stress-Free

- Obtain Schedule L and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Schedule L while ensuring seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule l

Create this form in 5 minutes!

How to create an eSignature for the schedule l

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the West Virginia IT 140 form?

The West Virginia IT 140 form is a state tax return form used by individuals and businesses to report income and calculate tax liabilities in West Virginia. It is essential for ensuring compliance with state tax laws and can be easily completed using airSlate SignNow's user-friendly platform.

-

How can airSlate SignNow help with the West Virginia IT 140 form?

airSlate SignNow streamlines the process of completing and eSigning the West Virginia IT 140 form. Our platform allows users to fill out the form digitally, ensuring accuracy and saving time, while also providing secure storage for your documents.

-

Is there a cost associated with using airSlate SignNow for the West Virginia IT 140 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. Our cost-effective solutions ensure that you can efficiently manage your West Virginia IT 140 form and other documents without breaking the bank.

-

What features does airSlate SignNow offer for the West Virginia IT 140 form?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and document tracking specifically for the West Virginia IT 140 form. These features enhance the user experience and ensure that your tax documents are handled efficiently.

-

Can I integrate airSlate SignNow with other software for the West Virginia IT 140 form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage your West Virginia IT 140 form alongside your other business tools. This seamless integration helps streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for the West Virginia IT 140 form?

Using airSlate SignNow for the West Virginia IT 140 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your sensitive tax information is protected while simplifying the filing process.

-

Is airSlate SignNow secure for handling the West Virginia IT 140 form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the West Virginia IT 140 form. We utilize advanced encryption and security protocols to protect your data and ensure that your documents remain confidential.

Get more for Schedule L

Find out other Schedule L

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form