Form 8888

What is the Form 8888

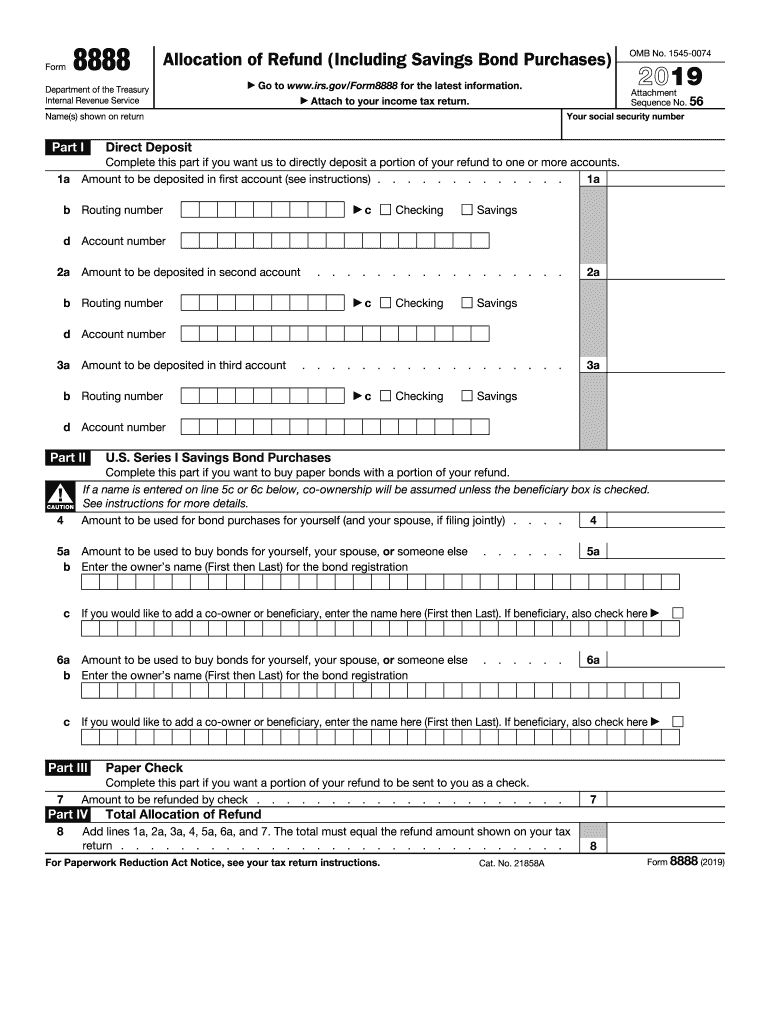

The IRS Form 8888 is used by taxpayers to allocate their federal tax refund to multiple accounts. This form allows individuals to direct their refunds into up to three different bank accounts, making it easier to manage finances. By using this form, taxpayers can ensure that their refunds are distributed according to their preferences, whether for savings, checking, or other accounts.

How to use the Form 8888

To use the IRS Form 8888, taxpayers must complete the form as part of their tax return process. After filling out their Form 1040, individuals can attach Form 8888 to specify how they want their refund divided. Each account must be listed with the correct routing and account numbers to ensure proper allocation. It is important to double-check these numbers to avoid delays in receiving the refund.

Steps to complete the Form 8888

Completing the IRS Form 8888 involves several straightforward steps:

- Begin by entering your personal information, including your name and Social Security number.

- Indicate the amount of your total refund on the form.

- List the bank account details for each allocation, including the bank's routing number and your account number.

- Specify the amount to be deposited into each account, ensuring the total matches your refund amount.

- Sign and date the form before submitting it with your tax return.

Legal use of the Form 8888

The IRS Form 8888 is legally binding when completed accurately and submitted with a valid tax return. To ensure compliance, it is essential that taxpayers follow IRS guidelines regarding the use of the form. This includes providing accurate bank account information and ensuring that the total refund amount is correctly allocated among the specified accounts.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with Form 8888. Typically, the deadline for submitting your federal tax return, along with Form 8888, is April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to file on time to avoid penalties and ensure timely receipt of your refund.

Form Submission Methods (Online / Mail / In-Person)

IRS Form 8888 can be submitted through various methods. Taxpayers can file their tax return electronically using tax software that supports Form 8888, which is a quick and efficient method. Alternatively, individuals can print the form and submit it by mail along with their tax return. In some cases, it may also be possible to file in person at designated IRS offices, though this is less common.

Quick guide on how to complete 2015 form 8888 internal revenue service

Complete Form 8888 seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documentation, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to generate, adjust, and electronically sign your documents quickly without delays. Handle Form 8888 on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to modify and eSign Form 8888 effortlessly

- Access Form 8888 and then click Get Form to begin.

- Utilize the tools available to fill out your form.

- Identify important sections of the documents or obscure sensitive details with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to store your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget the hassle of lost or mislaid documents, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 8888 to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 8888 internal revenue service

How to generate an eSignature for your 2015 Form 8888 Internal Revenue Service online

How to create an electronic signature for the 2015 Form 8888 Internal Revenue Service in Google Chrome

How to generate an electronic signature for signing the 2015 Form 8888 Internal Revenue Service in Gmail

How to generate an eSignature for the 2015 Form 8888 Internal Revenue Service right from your smartphone

How to make an eSignature for the 2015 Form 8888 Internal Revenue Service on iOS

How to create an electronic signature for the 2015 Form 8888 Internal Revenue Service on Android

People also ask

-

What is the 2019 Form 8888 used for?

The 2019 Form 8888 is used by taxpayers to request their tax refund to be deposited into one or more accounts. This form facilitates the direct deposit of your refund, ensuring a quicker and safer receipt of your money compared to a paper check.

-

How can airSlate SignNow assist with the 2019 Form 8888?

AirSlate SignNow simplifies the process of completing and signing the 2019 Form 8888 by providing a seamless e-signature solution. Users can easily fill out the form and securely sign it online, speeding up their tax filing and refund process.

-

Is there a cost associated with using airSlate SignNow for the 2019 Form 8888?

Yes, airSlate SignNow offers various pricing plans, including a free trial to test the features. With competitive pricing, you can efficiently handle documents like the 2019 Form 8888, maximizing your savings while ensuring compliance.

-

What features does airSlate SignNow offer for managing the 2019 Form 8888?

AirSlate SignNow provides features such as template creation, document sharing, and audit trails for the 2019 Form 8888. These tools make it easy to track your forms and ensure that every document is completed correctly.

-

Can I integrate airSlate SignNow with other applications for the 2019 Form 8888?

Absolutely! AirSlate SignNow supports integrations with popular applications such as Google Drive and Dropbox. This means you can easily upload and manage your 2019 Form 8888 alongside your other essential documents.

-

How secure is my information when using airSlate SignNow for the 2019 Form 8888?

Security is a top priority at airSlate SignNow. All data transmitted through our platform for the 2019 Form 8888 is encrypted, and we adhere to stringent security protocols to protect your sensitive information.

-

What are the benefits of using airSlate SignNow for submitting the 2019 Form 8888?

Using airSlate SignNow to submit the 2019 Form 8888 streamlines your tax filing process, allowing for faster submission and easier management of your documents. The platform also helps reduce paper waste and improve accuracy in completing forms.

Get more for Form 8888

Find out other Form 8888

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word