2290 Form

What is the 2290 Form

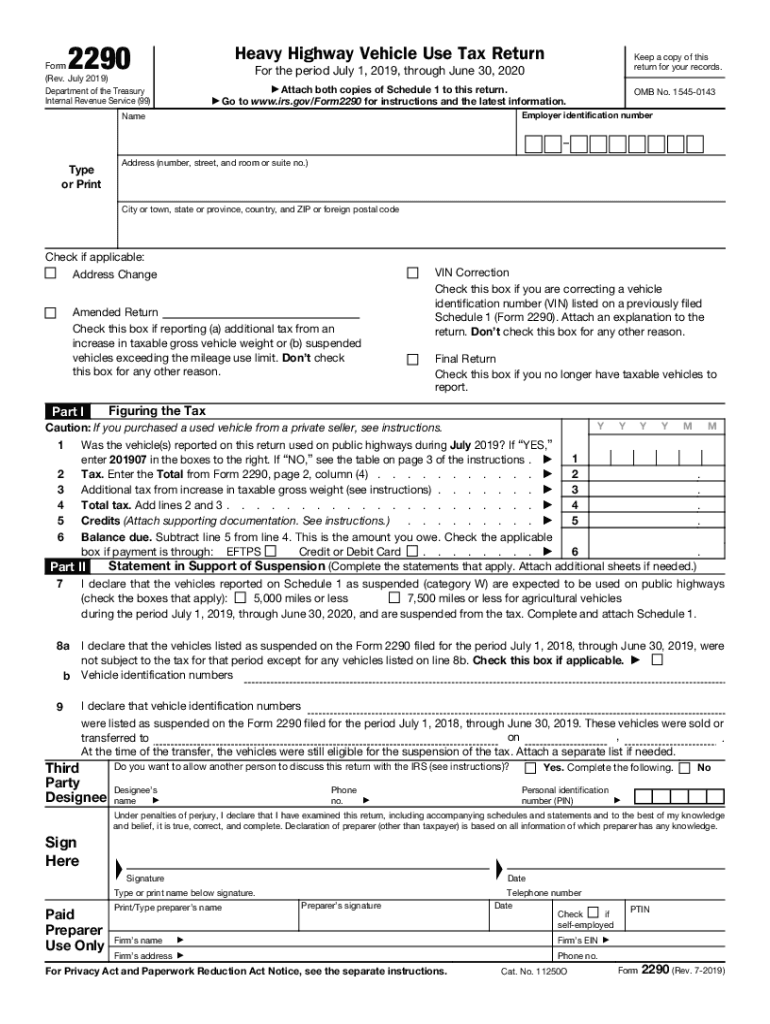

The 2290 form, officially known as the IRS Form 2290, is a federal tax document used by businesses and individuals to report and pay the Heavy Highway Vehicle Use Tax. This tax applies to vehicles that have a gross weight of 55,000 pounds or more and are used on public highways. The form must be filed annually, and it helps the IRS determine the tax liability associated with the operation of heavy vehicles. Understanding the purpose of the 2290 form is crucial for compliance with federal tax regulations.

Steps to complete the 2290 Form

Completing the 2290 form involves several key steps to ensure accuracy and compliance. First, gather necessary information such as your Employer Identification Number (EIN), vehicle details, and mileage information. Next, download the form from the IRS website or use an e-filing service. Fill out the form by providing details about each vehicle subject to the tax. After completing the form, review it for any errors, and submit it either electronically or via mail. Ensure that you keep a copy for your records.

Filing Deadlines / Important Dates

The filing deadline for the 2290 form is typically the last day of the month following the end of the tax period. For example, if you are filing for the tax year that begins on July first, the form must be filed by August 31. It is essential to be aware of these deadlines to avoid penalties and interest on late payments. Additionally, if you acquire a new vehicle during the tax year, you must file the form within a specific timeframe to report that vehicle.

Legal use of the 2290 Form

The 2290 form is legally binding when completed correctly and submitted to the IRS. It serves as proof of payment for the Heavy Highway Vehicle Use Tax and must be kept on file for at least three years. Electronic signatures are accepted, provided that the e-signature solution complies with the ESIGN Act and other relevant regulations. Using a reputable e-signature platform can enhance the legal validity of your submission, ensuring that it meets all necessary requirements.

How to obtain the 2290 Form

The 2290 form can be obtained directly from the IRS website, where it is available for download in PDF format. Alternatively, you can use authorized e-filing services that streamline the process and allow for electronic submission. These services often provide step-by-step guidance to help you complete the form accurately. It is advisable to use the most current version of the form to ensure compliance with any updates in tax regulations.

Examples of using the 2290 Form

There are various scenarios in which the 2290 form is used. For instance, a trucking company operating multiple heavy vehicles must file the form annually to report the use of each vehicle. Additionally, an individual who purchases a heavy vehicle for personal use must also file the form to comply with tax regulations. These examples illustrate the importance of understanding the 2290 form and its application in different contexts.

Quick guide on how to complete form 2290 rev july 2019 heavy highway vehicle use tax return

Complete 2290 Form with ease on any device

Online document organization has become increasingly popular among companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage 2290 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and electronically sign 2290 Form effortlessly

- Locate 2290 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight signNow sections of your documents or conceal sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method of sending your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Alter and electronically sign 2290 Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2290 rev july 2019 heavy highway vehicle use tax return

How to generate an electronic signature for your Form 2290 Rev July 2019 Heavy Highway Vehicle Use Tax Return in the online mode

How to make an electronic signature for your Form 2290 Rev July 2019 Heavy Highway Vehicle Use Tax Return in Google Chrome

How to make an electronic signature for signing the Form 2290 Rev July 2019 Heavy Highway Vehicle Use Tax Return in Gmail

How to create an electronic signature for the Form 2290 Rev July 2019 Heavy Highway Vehicle Use Tax Return right from your mobile device

How to create an electronic signature for the Form 2290 Rev July 2019 Heavy Highway Vehicle Use Tax Return on iOS

How to generate an eSignature for the Form 2290 Rev July 2019 Heavy Highway Vehicle Use Tax Return on Android

People also ask

-

What is the 2290 form 2019?

The 2290 form 2019 is a federal tax form used by heavy vehicle operators to report their vehicle usage to the IRS. It must be filed annually and is essential for anyone operating a vehicle with a gross weight of 55,000 pounds or more. Ensuring timely and accurate submission of the 2290 form 2019 can prevent penalties.

-

How can I e-sign the 2290 form 2019 with airSlate SignNow?

With airSlate SignNow, you can easily upload and e-sign the 2290 form 2019 in a secure online environment. The platform's user-friendly interface allows you to add signatures, dates, and text fields quickly. This ensures a smooth and efficient process for submitting your 2290 form 2019.

-

Is there a cost associated with using airSlate SignNow for the 2290 form 2019?

Yes, airSlate SignNow offers several pricing plans that cater to different business needs. Generally, the cost is affordable, providing excellent value for the features offered, especially for those frequently handling documents like the 2290 form 2019. A trial version is often available to test the service before committing.

-

What are the benefits of using airSlate SignNow for the 2290 form 2019?

Using airSlate SignNow for the 2290 form 2019 streamlines your filing process, allowing for faster submissions and easier amendments. The platform enhances security by providing encrypted storage and audit trails for all documents. With a focus on efficiency, it helps reduce the risk of submission errors.

-

Can I integrate airSlate SignNow with other applications for filing the 2290 form 2019?

Absolutely! airSlate SignNow offers seamless integrations with various applications, improving your overall workflow when filing the 2290 form 2019. Whether you are using accounting software or CRM systems, integrating SignNow allows for a smoother document management experience.

-

How secure is airSlate SignNow when handling the 2290 form 2019?

airSlate SignNow prioritizes security, utilizing SSL encryption and secure storage to protect your documents, including the 2290 form 2019. The platform complies with leading industry standards to ensure that sensitive information remains confidential and secure at all times.

-

What features does airSlate SignNow offer for managing the 2290 form 2019?

airSlate SignNow provides various features for managing the 2290 form 2019, including document templates, customizable fields, and automated reminders for deadlines. These tools help simplify the filing process and keep you organized, ensuring that you never miss an important date.

Get more for 2290 Form

- Hsbc download name change foam form

- Hsbc online deposit slip form

- Hsbc deposit slip form

- Hsbc direct deposit form

- Medallion signature guarantee hsbc form

- Blank letter of credit form

- Us bank fleet card form

- Ic 831 form 4466w wisconsin corporation or pass through entity application for quick refund of overpayment of estimated tax 794907800

Find out other 2290 Form

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe