1099 B Form

What is the 1099 B

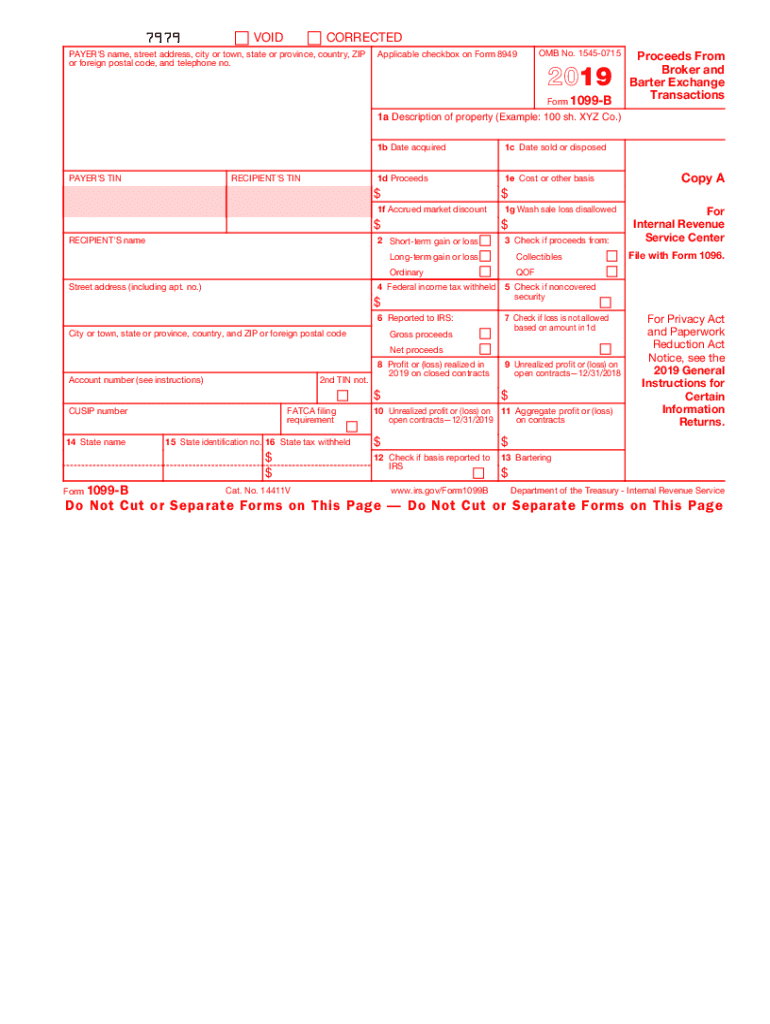

The 1099 B form is a critical document used for reporting proceeds from broker and barter exchange transactions. It is primarily utilized by taxpayers who have engaged in the sale of stocks, bonds, or other securities. The form provides essential details, including the date of the transaction, the type of security sold, and the gross proceeds from the sale. Understanding this form is vital for accurately reporting capital gains or losses on your tax return.

Steps to complete the 1099 B

Completing the 1099 B involves several key steps to ensure accuracy and compliance with IRS guidelines. First, gather all necessary information regarding your transactions, including dates, amounts, and types of securities sold. Next, accurately fill out the form, ensuring that each section reflects the correct data. Pay particular attention to the reporting of short-term versus long-term gains, as this affects tax rates. Finally, review the completed form for any errors before submission.

How to obtain the 1099 B

Taxpayers can obtain the 1099 B form from their brokerage firms or financial institutions. Most brokers provide this form electronically through their online platforms or send it via mail at the beginning of the tax season. If you have not received your form by mid-February, it is advisable to contact your broker to request a copy. Additionally, the IRS website offers downloadable versions of the form for reference.

IRS Guidelines

The IRS has established specific guidelines for the use and submission of the 1099 B form. Taxpayers must ensure that they report all relevant transactions accurately, as failure to do so can result in penalties. The form must be filed by the deadline, typically by the end of February if filing by paper or by the end of March if filing electronically. It is essential to keep a copy of the form for your records, as it will be needed when preparing your tax return.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 1099 B form is crucial for compliance. The form must be submitted to the IRS by February twenty-eighth if filing by mail or by March thirty-first if filing electronically. Additionally, taxpayers should ensure they provide copies to recipients by the same deadlines. Missing these deadlines can lead to penalties, so it is important to mark your calendar and prepare in advance.

Penalties for Non-Compliance

Failure to comply with the reporting requirements of the 1099 B form can result in significant penalties. The IRS imposes fines for late filings, which can accumulate based on how late the form is submitted. Additionally, inaccuracies in reporting can lead to further penalties, including interest on unpaid taxes. It is essential to ensure that the information reported is correct and submitted on time to avoid these financial repercussions.

Quick guide on how to complete 2019 form 1099 b proceeds from broker and barter exchange transactions

Prepare 1099 B effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage 1099 B on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

How to alter and eSign 1099 B with ease

- Locate 1099 B and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you would like to submit your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign 1099 B and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1099 b proceeds from broker and barter exchange transactions

How to create an electronic signature for your 2019 Form 1099 B Proceeds From Broker And Barter Exchange Transactions in the online mode

How to generate an electronic signature for the 2019 Form 1099 B Proceeds From Broker And Barter Exchange Transactions in Chrome

How to make an electronic signature for putting it on the 2019 Form 1099 B Proceeds From Broker And Barter Exchange Transactions in Gmail

How to create an electronic signature for the 2019 Form 1099 B Proceeds From Broker And Barter Exchange Transactions straight from your mobile device

How to make an eSignature for the 2019 Form 1099 B Proceeds From Broker And Barter Exchange Transactions on iOS devices

How to make an eSignature for the 2019 Form 1099 B Proceeds From Broker And Barter Exchange Transactions on Android OS

People also ask

-

What is the significance of the 2019 IRS 1099 B form?

The 2019 IRS 1099 B form reports sales of securities and dividends to the IRS. It's essential for taxpayers to accurately report their capital gains and losses. Understanding the details of the 2019 IRS 1099 B ensures compliance and helps in proper tax filing.

-

How can airSlate SignNow assist with the 2019 IRS 1099 B documentation?

AirSlate SignNow offers an efficient platform for businesses to create, send, and eSign the 2019 IRS 1099 B documents. This integrated solution simplifies the process, ensuring all necessary tax forms are completed correctly and promptly. Streamlining document workflows saves time and reduces errors.

-

Are there any pricing tiers for using airSlate SignNow for handling the 2019 IRS 1099 B?

Yes, airSlate SignNow provides flexible pricing tiers tailored to different business needs. Each tier offers the necessary tools to manage documents like the 2019 IRS 1099 B effectively. It's a cost-effective solution designed to support businesses of all sizes.

-

What features does airSlate SignNow offer for managing the 2019 IRS 1099 B process?

AirSlate SignNow includes features like templates for the 2019 IRS 1099 B, automated workflows, and secure eSigning. These tools ensure that all documentation processes are quick and compliant. Users can easily track the status of their forms for greater peace of mind.

-

Can I integrate airSlate SignNow with other accounting software for the 2019 IRS 1099 B?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting software to streamline the management of the 2019 IRS 1099 B and other tax documents. This integration allows for automatic data syncing, enhancing productivity and accuracy in tax filings.

-

What are some benefits of using airSlate SignNow for the 2019 IRS 1099 B?

Using airSlate SignNow for the 2019 IRS 1099 B ensures faster processing times and improved compliance. The platform is user-friendly, helping users avoid common pitfalls associated with tax documentation. Additionally, the cost-effective design makes it accessible for every business.

-

How secure is airSlate SignNow for managing sensitive documents like the 2019 IRS 1099 B?

AirSlate SignNow prioritizes security with industry-standard encryption and secure document storage. This vigilance ensures that sensitive information, such as details on the 2019 IRS 1099 B, is protected. You can trust that your data remains confidential throughout the eSigning process.

Get more for 1099 B

Find out other 1099 B

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF