Form 1098

What is the Form 1098

The Form 1098 is a tax document used in the United States to report mortgage interest paid by individuals during the tax year. This form is essential for taxpayers who have taken out a mortgage, as it provides a summary of the interest paid, which can be deducted from taxable income. The 1098 form is issued by lenders to borrowers, detailing the amount of interest and any points paid on a mortgage, making it a crucial component for filing taxes accurately. It is also referred to as the 1098 e form when discussing electronic submissions.

How to use the Form 1098

Using the Form 1098 is straightforward. Taxpayers should receive this form from their mortgage lender, typically by the end of January each year. The information on the form must be reported on the taxpayer's annual income tax return, specifically on the IRS Form 1040. The interest reported can be deducted from taxable income, which may lower the overall tax liability. It is important to ensure that the amounts reported on the 1098 align with personal records to avoid discrepancies during tax filing.

Steps to complete the Form 1098

Completing the Form 1098 involves several key steps:

- Gather relevant documents, including mortgage statements and payment records.

- Fill in the lender's information, including name, address, and taxpayer identification number.

- Enter the borrower's information accurately, ensuring that names and Social Security numbers are correct.

- Report the total interest paid during the tax year in the designated section.

- Include any points paid on the mortgage, if applicable.

- Provide any other required information, such as the property address.

After completing the form, it should be submitted to the IRS along with the taxpayer's income tax return.

Legal use of the Form 1098

The legal use of the Form 1098 hinges on its accuracy and compliance with IRS regulations. The information reported must be truthful and reflect actual payments made during the tax year. Misreporting can lead to penalties or audits by the IRS. The form serves as an official record for both the taxpayer and the IRS, ensuring that mortgage interest deductions are properly documented. Electronic submissions of the 1098 form must also adhere to the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant regulations.

Who Issues the Form

The Form 1098 is issued by mortgage lenders, which may include banks, credit unions, or other financial institutions that provide loans for purchasing real estate. These lenders are responsible for sending the form to borrowers by January thirty-first of each year, ensuring that the information is accurate and complete. If a borrower does not receive a Form 1098, they should contact their lender to obtain the necessary documentation for their tax filing.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1098 are crucial for taxpayers to keep in mind. Lenders must send out the Form 1098 to borrowers by January thirty-first each year. Taxpayers should ensure they have received their form in time to file their annual tax returns, which are typically due by April fifteenth unless an extension is filed. It is advisable to keep track of these dates to avoid any penalties or late fees associated with tax filings.

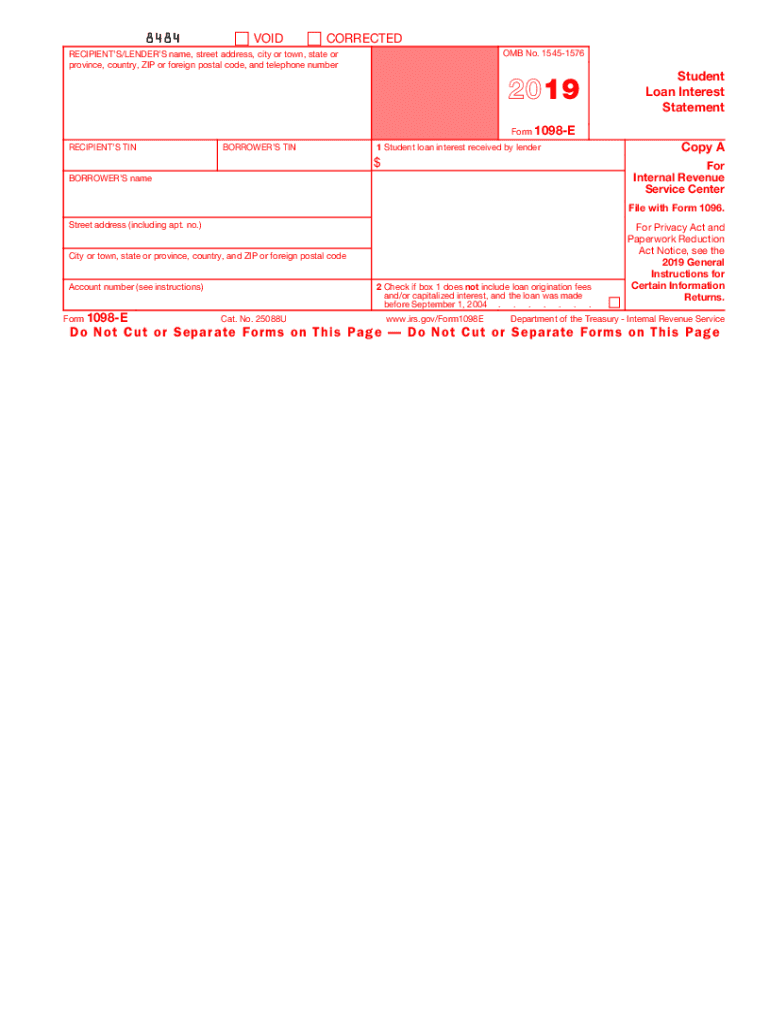

Quick guide on how to complete 2019 form 1098 e student loan interest statement

Complete Form 1098 effortlessly on any device

Managing documents online has become increasingly favored by both organizations and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the features you require to create, edit, and electronically sign your documents quickly without any holdups. Manage Form 1098 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest way to edit and eSign Form 1098 without stress

- Find Form 1098 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to share your form, via email, text message (SMS), an invitation link, or download it to your computer.

Forget about lost or mislaid documents, cumbersome form navigation, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and eSign Form 1098 and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1098 e student loan interest statement

How to make an electronic signature for the 2019 Form 1098 E Student Loan Interest Statement in the online mode

How to create an eSignature for your 2019 Form 1098 E Student Loan Interest Statement in Chrome

How to make an electronic signature for signing the 2019 Form 1098 E Student Loan Interest Statement in Gmail

How to make an electronic signature for the 2019 Form 1098 E Student Loan Interest Statement straight from your mobile device

How to make an electronic signature for the 2019 Form 1098 E Student Loan Interest Statement on iOS

How to make an eSignature for the 2019 Form 1098 E Student Loan Interest Statement on Android OS

People also ask

-

What is a 1098 e form and why is it important?

The 1098 e form is used for reporting interest payments on student loans. It helps borrowers track their payments and qualify for potential tax deductions, making it crucial for financial management and tax preparation.

-

How can airSlate SignNow help me with my 1098 e process?

airSlate SignNow streamlines the 1098 e document process by allowing you to send, sign, and manage your forms electronically. This saves time and reduces the risk of errors associated with manual processing, enhancing your workflow efficiency.

-

What are the pricing options for using airSlate SignNow for 1098 e documentation?

AirSlate SignNow offers flexible pricing plans tailored to various business needs. You can choose from individual, small business, or enterprise plans, all designed to provide cost-effective solutions for managing your 1098 e forms.

-

Can I integrate airSlate SignNow with other software for my 1098 e documents?

Yes, airSlate SignNow seamlessly integrates with several popular software tools, such as Salesforce and Google Drive. This allows you to enhance your workflow and efficiently manage your 1098 e documents within your existing systems.

-

What features does airSlate SignNow offer for automating the 1098 e process?

AirSlate SignNow includes features like auto-fill, templates, and bulk sending to help automate the 1098 e document process. These tools minimize manual entry time and streamline the signing experience for all parties involved.

-

Is airSlate SignNow compliant with regulations for handling 1098 e forms?

Absolutely! airSlate SignNow adheres to stringent security and compliance standards, ensuring that all your 1098 e documents are handled securely and in line with applicable regulations, such as e-signature laws.

-

What benefits can I expect from using airSlate SignNow for 1098 e documentation?

By using airSlate SignNow for your 1098 e forms, you can expect improved efficiency, reduced processing time, and enhanced accuracy. Plus, the secure electronic signing process enhances document management and compliance.

Get more for Form 1098

- Forcible entry and detainer petition pdf form

- You are hereby summoned in the name of the state of louisiana and of the 24th judicial district court for form

- Louisiana answer petition 495579056 form

- Louisiana assumed name certificate form

- Parish courtjefferson parish district attorneys office form

- Epworth sleepiness scale spanish pdf 273955278 form

- Medicare advantage out of plan reimbursement form

- Compas house connecticut mental health services form

Find out other Form 1098

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free