Form 1099 Q

What is the Form 1099 Q

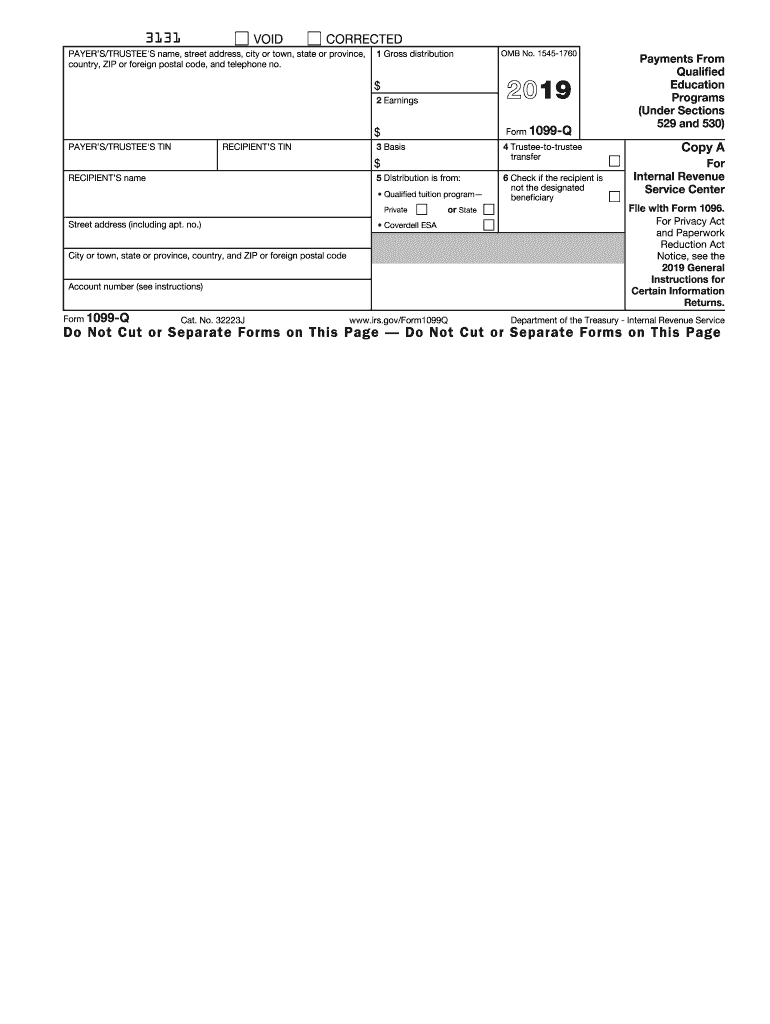

The Form 1099 Q is a tax document used in the United States to report distributions from qualified tuition programs, commonly known as 529 plans. This form is essential for both the account holder and the beneficiary, as it provides necessary information regarding the amounts withdrawn for educational expenses. The IRS requires this form to ensure that the distributions are used for qualified education costs, which can include tuition, fees, and other related expenses.

How to use the Form 1099 Q

To effectively use the Form 1099 Q, individuals must first understand the information it contains. The form details the total amount distributed from the 529 plan during the tax year, as well as the portion that is considered taxable. It is crucial for recipients to report this information accurately on their tax returns. The form also helps in determining if any distributions were used for non-qualified expenses, which may incur tax penalties.

Steps to complete the Form 1099 Q

Completing the Form 1099 Q involves several steps:

- Gather necessary information, including the account number, beneficiary details, and distribution amounts.

- Fill in the payer information, which is typically the financial institution managing the 529 plan.

- Report the total distributions made during the year in the appropriate sections of the form.

- Indicate the portion of the distribution that is taxable, if applicable.

- Ensure all information is accurate and complete before submitting the form to the IRS and providing a copy to the beneficiary.

Legal use of the Form 1099 Q

The legal use of the Form 1099 Q is governed by IRS regulations. It must be filled out correctly to comply with tax laws and avoid penalties. The form serves as a record of distributions and is essential for tax reporting purposes. Both the payer and the recipient must retain copies for their records, as they may be required to provide documentation in case of an audit.

Who Issues the Form

The Form 1099 Q is issued by the financial institution or entity managing the qualified tuition program. This could be a bank, credit union, or investment firm that administers the 529 plan. It is their responsibility to provide the form to both the IRS and the account holder by the required deadlines, ensuring that all necessary information is reported accurately.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 Q are crucial for compliance. Typically, the form must be sent to the IRS by the end of February if filed by paper, or by the end of March if filed electronically. Recipients should also receive their copies by these deadlines to ensure timely reporting on their tax returns. Keeping track of these dates helps avoid potential penalties for late filing.

Quick guide on how to complete 2019 form 1099 q payments from qualified education programs under sections 529 and 530

Handle Form 1099 Q effortlessly on any device

Managing documents online has become increasingly favored by companies and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any hold-ups. Administer Form 1099 Q on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign Form 1099 Q with ease

- Locate Form 1099 Q and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs within a few clicks from any device of your choice. Edit and electronically sign Form 1099 Q to ensure effective communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1099 q payments from qualified education programs under sections 529 and 530

How to generate an electronic signature for the 2019 Form 1099 Q Payments From Qualified Education Programs Under Sections 529 And 530 in the online mode

How to create an electronic signature for your 2019 Form 1099 Q Payments From Qualified Education Programs Under Sections 529 And 530 in Google Chrome

How to create an eSignature for putting it on the 2019 Form 1099 Q Payments From Qualified Education Programs Under Sections 529 And 530 in Gmail

How to generate an electronic signature for the 2019 Form 1099 Q Payments From Qualified Education Programs Under Sections 529 And 530 from your mobile device

How to make an electronic signature for the 2019 Form 1099 Q Payments From Qualified Education Programs Under Sections 529 And 530 on iOS

How to generate an eSignature for the 2019 Form 1099 Q Payments From Qualified Education Programs Under Sections 529 And 530 on Android devices

People also ask

-

What is Form 1099 Q?

Form 1099 Q is a tax document used to report distributions from qualified tuition programs, including 529 plans. This form provides critical information for individuals receiving funds for education expenses, ensuring accurate tax reporting on financial aid.

-

How can airSlate SignNow help me manage Form 1099 Q?

airSlate SignNow simplifies the process of sending and eSigning Form 1099 Q by providing a user-friendly platform for document management. With our solution, you can quickly prepare and send Form 1099 Q electronically, reducing paperwork and improving efficiency.

-

What features does airSlate SignNow offer for Form 1099 Q processing?

airSlate SignNow offers features like secure eSigning, document templates, and automated workflows for Form 1099 Q processing. These features help streamline your workflow, ensuring that you can manage important tax documents without hassle.

-

Is there a cost associated with eSigning Form 1099 Q using airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but our pricing is competitive and offers excellent value for those needing to handle Form 1099 Q efficiently. Choose from various affordable plans that cater to businesses of all sizes, ensuring you can find one that fits your budget.

-

Can I integrate airSlate SignNow with my existing accounting software for Form 1099 Q?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easy to manage Form 1099 Q alongside your financial data. This seamless integration ensures that your workflow remains efficient and organized.

-

What are the benefits of using airSlate SignNow for Form 1099 Q?

Using airSlate SignNow for Form 1099 Q provides numerous benefits, including faster processing, reduced paper waste, and improved compliance. Our platform enhances collaboration by allowing multiple parties to review and sign documents securely.

-

Is airSlate SignNow compliant with tax regulations for Form 1099 Q?

Yes, airSlate SignNow is compliant with tax regulations and ensures that your Form 1099 Q meets all necessary requirements. Our platform adheres to industry standards for security and compliance, providing peace of mind as you manage sensitive tax documents.

Get more for Form 1099 Q

Find out other Form 1099 Q

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online