Instructions 1099 Form

What is the Instructions 1099

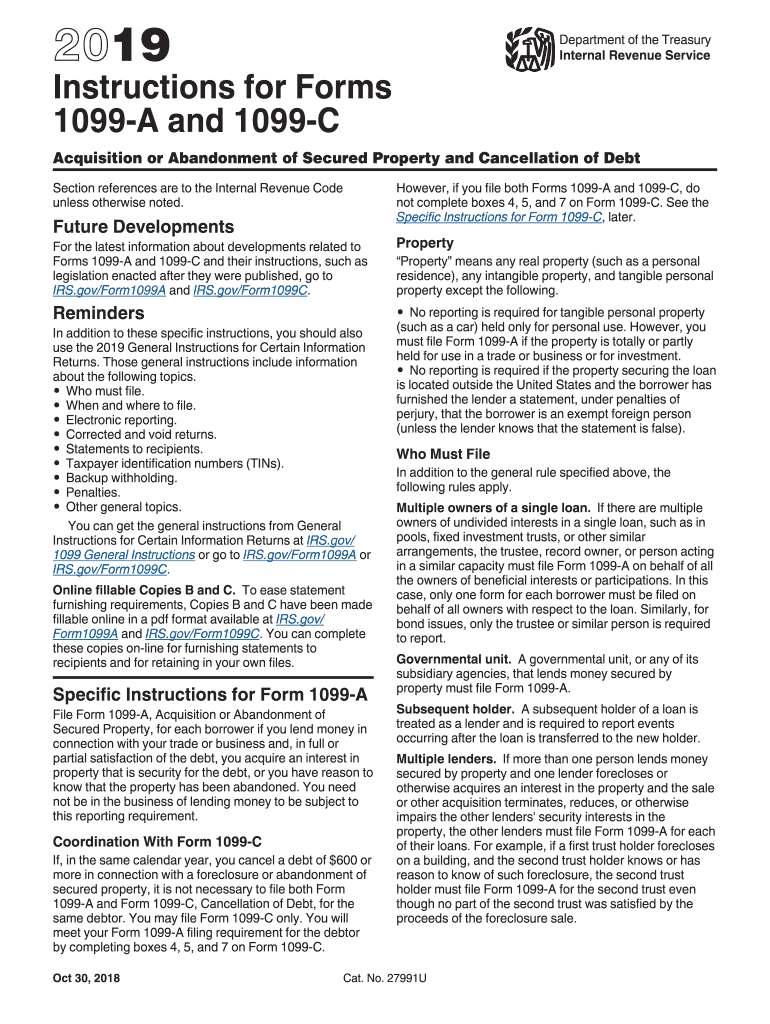

The 2019 Instructions 1099 provide guidance on how to complete the 1099-C form, which is used to report cancellation of debt. This form is essential for both creditors and debtors, as it helps to document the amount of debt forgiven, which may be taxable income for the debtor. Understanding these instructions is crucial for accurate reporting and compliance with IRS regulations.

Steps to complete the Instructions 1099

Completing the 2019 Instructions 1099 involves several key steps:

- Gather necessary information, including the debtor's name, address, and taxpayer identification number (TIN).

- Determine the amount of debt that has been canceled.

- Fill out the form accurately, ensuring that all fields are completed as per the instructions.

- Review the form for accuracy before submission.

- Submit the completed form to the IRS and provide a copy to the debtor.

IRS Guidelines

The IRS has specific guidelines regarding the completion and submission of the 1099-C form. It is important to follow these guidelines to avoid penalties. The instructions detail the requirements for reporting canceled debts, including what constitutes a cancellation and the reporting thresholds. Familiarizing yourself with these guidelines ensures compliance and helps prevent issues with the IRS.

Filing Deadlines / Important Dates

For the 2019 tax year, the deadline for filing the 1099-C form is typically January thirty-first of the following year. It is important to adhere to this deadline to avoid potential penalties. If the deadline falls on a weekend or holiday, the due date may be extended to the next business day. Keeping track of these important dates is essential for timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The 1099-C form can be submitted to the IRS through various methods. These include:

- Online filing through the IRS e-File system, which is often the fastest method.

- Mailing a paper form to the appropriate IRS address, which can vary based on the state of the filer.

- In-person submission at designated IRS offices, although this method is less common.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the 1099-C form can result in significant penalties. The IRS imposes fines for late filings, incorrect information, or failure to provide a copy to the debtor. Understanding these penalties is crucial for creditors to ensure they meet all obligations and avoid unnecessary financial repercussions.

Quick guide on how to complete 2019 instructions for forms 1099 a and 1099 c irsgov

Complete Instructions 1099 seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents swiftly without hold-ups. Manage Instructions 1099 on any gadget with airSlate SignNow Android or iOS applications and simplify any document-driven task today.

The easiest way to alter and eSign Instructions 1099 effortlessly

- Obtain Instructions 1099 and select Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight key sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Edit and eSign Instructions 1099 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for forms 1099 a and 1099 c irsgov

How to make an eSignature for the 2019 Instructions For Forms 1099 A And 1099 C Irsgov in the online mode

How to create an eSignature for your 2019 Instructions For Forms 1099 A And 1099 C Irsgov in Chrome

How to make an eSignature for putting it on the 2019 Instructions For Forms 1099 A And 1099 C Irsgov in Gmail

How to generate an eSignature for the 2019 Instructions For Forms 1099 A And 1099 C Irsgov right from your smartphone

How to generate an eSignature for the 2019 Instructions For Forms 1099 A And 1099 C Irsgov on iOS

How to make an eSignature for the 2019 Instructions For Forms 1099 A And 1099 C Irsgov on Android devices

People also ask

-

What is airSlate SignNow and how does it work?

airSlate SignNow is a digital signature software that empowers businesses to send and eSign documents efficiently. With its user-friendly interface, users can easily prepare and manage documents online, making the process streamlined and cost-effective, especially crucial for those looking for solutions since c 2019.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers various pricing tiers to accommodate different business needs, ensuring that teams can access effective eSigning solutions without overspending. The pricing models introduced since c 2019 have been designed to be flexible and cost-effective, making it budget-friendly for businesses of all sizes.

-

What are the key features of airSlate SignNow?

Some standout features of airSlate SignNow include customizable templates, team collaboration tools, and secure cloud storage. Since c 2019, these features have been continuously enhanced to provide a seamless experience for users who require a reliable electronic signature solution.

-

How can airSlate SignNow improve workflow efficiency?

By utilizing airSlate SignNow, businesses can automate their document workflows, signNowly reducing the time spent on paperwork. The efficiency improvements have been evident for users since c 2019, as they can now quickly send, sign, and store documents all in one place.

-

Is airSlate SignNow compliant with legal standards?

Yes, airSlate SignNow complies with major legal standards for e-signatures, such as ESIGN and UETA, ensuring that your documents are legally binding. This compliance has been a top priority for airSlate since c 2019, assuring users that their electronic signatures are secure and accepted.

-

What integrations does airSlate SignNow offer?

airSlate SignNow integrates seamlessly with various applications, including Google Drive, Salesforce, and Microsoft Office. Since c 2019, the platform has expanded its integration capabilities to enhance productivity by connecting with tools that businesses already use.

-

Can I access airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow provides a mobile-friendly platform that allows you to send and sign documents on-the-go. This mobile accessibility has been optimized since c 2019, ensuring that users have the flexibility to manage their documents anywhere they are.

Get more for Instructions 1099

- Revised complaint form 10 16 08 doc

- Application for certified copy of an arizona birth certificate form

- Medical assistant job application form 474180402

- Endoassocaz net 65516841 form

- Authorization to use or disclose protected health information phi sonora quest

- In witness whereof the parties enter into this contract mihs form

- Direct consolidation loan additional loan listing sheet form

- Complaint form french pdf ed gov

Find out other Instructions 1099

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online