Form 457

What is the Form 457

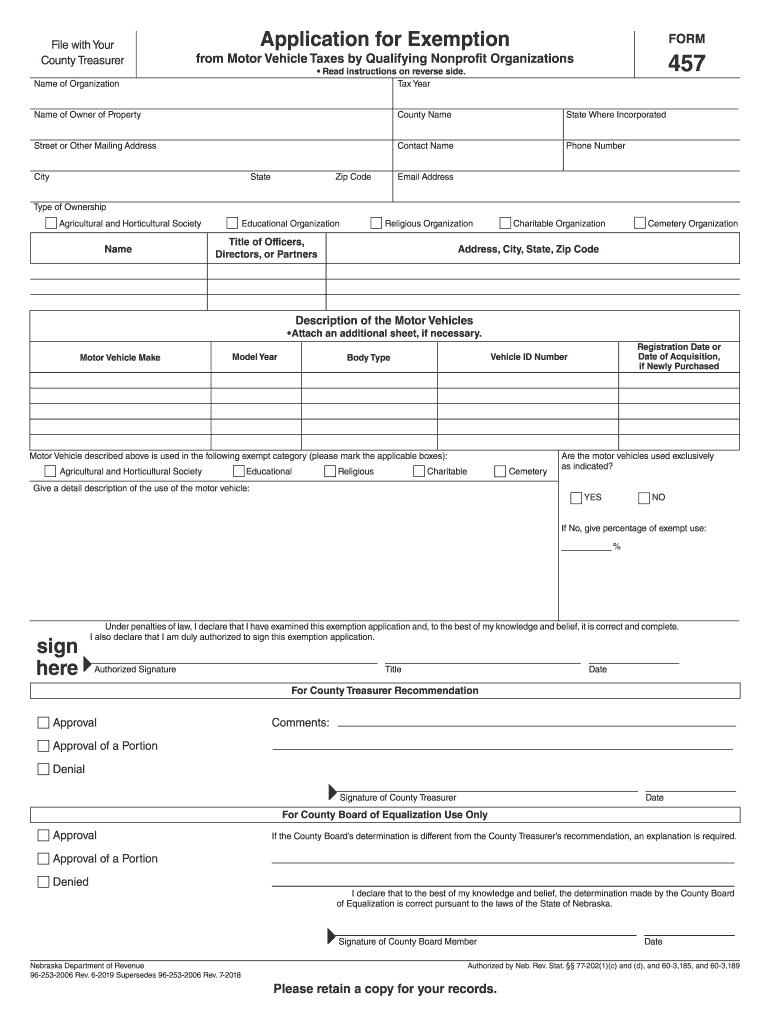

The Form 457 is a specific document used primarily for applying for a homestead exemption in Nebraska. This exemption can significantly reduce property taxes for eligible homeowners. The form is designed to collect necessary information about the applicant's property and personal circumstances to determine eligibility for tax relief. Understanding the purpose and requirements of the Form 457 is essential for homeowners seeking to benefit from this exemption.

How to use the Form 457

Using the Form 457 involves several steps to ensure proper completion and submission. First, gather all required information, including personal identification and property details. Next, fill out the form accurately, ensuring that all sections are completed. Once the form is filled, review it for any errors or missing information. Finally, submit the form through the appropriate channels, which may include online submission, mailing it to the local tax office, or delivering it in person.

Steps to complete the Form 457

Completing the Form 457 requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documentation, such as proof of residency and property ownership.

- Fill out personal information, including your name, address, and contact details.

- Provide information about the property, including its address and tax identification number.

- Indicate your eligibility for the homestead exemption by answering specific questions on the form.

- Review the form for accuracy before submission.

Legal use of the Form 457

The Form 457 must be used in compliance with state regulations governing property tax exemptions. It is essential to ensure that the form is filled out correctly and submitted within the designated time frame to maintain its legal validity. The form serves as an official request for tax relief, and any inaccuracies or late submissions may result in denial of the exemption. Understanding the legal implications of using the Form 457 helps protect the applicant's rights and benefits.

Eligibility Criteria

To qualify for the homestead exemption using the Form 457, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Being the owner of the property for which the exemption is being requested.

- Occupying the property as a primary residence.

- Meeting income limits established by state guidelines.

- Filing the form within the set deadlines.

Reviewing these criteria before applying ensures that applicants are prepared and meet all necessary conditions for approval.

Form Submission Methods

The Form 457 can be submitted through various methods, providing flexibility for applicants. Options typically include:

- Online submission through the state’s tax department website, if available.

- Mailing the completed form to the local tax assessor's office.

- Delivering the form in person to the appropriate office.

Choosing the right submission method can streamline the process and ensure timely consideration of the exemption application.

Quick guide on how to complete file with your

Effortlessly Prepare Form 457 on Any Device

The management of online documents has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without delays. Handle Form 457 on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The Easiest Way to Edit and eSign Form 457 with Ease

- Find Form 457 and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes a few seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 457 and guarantee outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the file with your

How to generate an electronic signature for the File With Your in the online mode

How to make an electronic signature for the File With Your in Chrome

How to create an electronic signature for putting it on the File With Your in Gmail

How to make an eSignature for the File With Your right from your mobile device

How to make an eSignature for the File With Your on iOS devices

How to create an eSignature for the File With Your on Android devices

People also ask

-

What is Form 457 and how can airSlate SignNow help with it?

Form 457 is a tax form used by certain employees to manage their deferred compensation plans. With airSlate SignNow, you can easily create, send, and eSign your Form 457 documents securely and efficiently, ensuring compliance and accuracy in your submissions.

-

What features does airSlate SignNow offer for managing Form 457?

airSlate SignNow provides a variety of features for managing Form 457, including customizable templates, secure eSigning, and automated workflows. These features streamline the process of filling out and submitting your Form 457, saving you time and reducing the chance of errors.

-

Is there a cost associated with using airSlate SignNow for Form 457?

Yes, airSlate SignNow offers various pricing plans to meet your needs, starting from a free trial to affordable subscriptions. These plans allow you to access essential features for managing your Form 457, making it a cost-effective solution for individuals and businesses alike.

-

Can I integrate airSlate SignNow with other software for Form 457 management?

Absolutely! airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Dropbox, and Microsoft Office. This allows you to manage your Form 457 alongside your existing tools, enhancing your productivity and ensuring a smooth workflow.

-

How does eSigning work for Form 457 on airSlate SignNow?

eSigning your Form 457 on airSlate SignNow is fast and secure. Simply upload your document, add the necessary fields for signatures, and send it out for signing. Recipients can eSign from any device, making it easy to collect signatures quickly.

-

What are the benefits of using airSlate SignNow for Form 457 submissions?

Using airSlate SignNow for your Form 457 submissions offers several benefits, including enhanced security, faster processing times, and improved document tracking. This ensures that your submissions are handled efficiently while maintaining compliance with necessary regulations.

-

Is airSlate SignNow user-friendly for completing Form 457?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete their Form 457 without technical expertise. With intuitive navigation and helpful support resources, you can get your forms done quickly and accurately.

Get more for Form 457

- Affidavit of change of denomination form

- Department of fish and game alaska department of fish adfg alaska form

- Checklist oil spill dispersant form

- Esd ark 501 form

- Child care assistance arkansas form

- Reset formformmo2220department use only mmddyy 794728297

- Champion for children tax creditmissouri department of form

- 25126010001 missouri department of revenue mo gov form

Find out other Form 457

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format