Section a Section B Comptroller of Maryland Form

What is the Section A Section B Comptroller Of Maryland

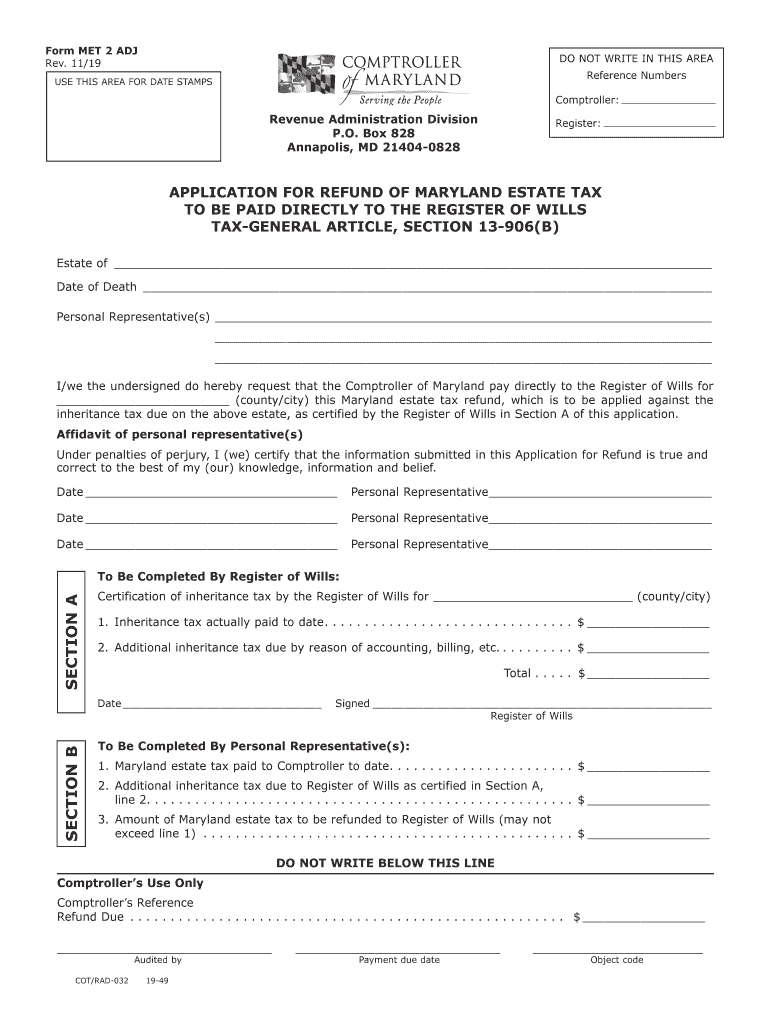

The Section A Section B Comptroller of Maryland form is a crucial document used for various tax-related purposes in the state of Maryland. It is primarily utilized by individuals and businesses to report income, deductions, and other financial information to the Maryland Comptroller's office. This form helps ensure compliance with state tax regulations and facilitates accurate tax assessments. Understanding the specific requirements and purposes of this form is essential for proper filing and to avoid potential penalties.

Steps to complete the Section A Section B Comptroller Of Maryland

Completing the Section A Section B Comptroller of Maryland form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, begin filling out the form by providing your personal information, such as your name, address, and Social Security number. It is important to accurately report your income sources and any applicable deductions or credits. After completing the form, review it carefully for any errors or omissions before submission. Finally, submit the form according to the specified guidelines, whether online, by mail, or in person.

Legal use of the Section A Section B Comptroller Of Maryland

The legal use of the Section A Section B Comptroller of Maryland form is governed by state tax laws and regulations. To be considered valid, the form must be completed accurately and submitted within the designated time frame. It is essential to adhere to the guidelines set forth by the Maryland Comptroller’s office to ensure that the form is legally binding. Failure to comply with these regulations may result in penalties, including fines or legal action. Therefore, understanding the legal implications of this form is vital for all taxpayers in Maryland.

Form Submission Methods (Online / Mail / In-Person)

The Section A Section B Comptroller of Maryland form can be submitted through various methods, providing flexibility for taxpayers. Submissions can be made online through the Maryland Comptroller's website, which offers a streamlined process for electronic filing. Alternatively, taxpayers may choose to mail the completed form to the appropriate address provided by the Comptroller’s office. For those who prefer face-to-face interactions, in-person submissions are also accepted at designated locations. Each method has its own guidelines and timelines, so it is important to choose the one that best suits your needs.

Required Documents

To successfully complete the Section A Section B Comptroller of Maryland form, certain documents are required. These typically include proof of income, such as W-2 forms or 1099 statements, as well as documentation for any deductions or credits claimed. Additional documents may include receipts for business expenses, tax returns from previous years, and identification verification. Having all necessary documents on hand will facilitate a smoother filing process and help ensure compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Section A Section B Comptroller of Maryland form are critical to avoid penalties. Typically, the deadline aligns with the federal tax filing deadline, which is April 15 each year. However, it is essential to verify specific dates with the Maryland Comptroller’s office, as they may vary based on circumstances such as weekends or holidays. Being aware of these important dates will help ensure timely submission and compliance with state tax laws.

Eligibility Criteria

Eligibility criteria for filing the Section A Section B Comptroller of Maryland form depend on various factors, including income level, residency status, and the type of income being reported. Generally, all residents and non-residents earning income in Maryland must file this form if their income exceeds a certain threshold. Additionally, businesses operating within the state may also be required to submit this form. Understanding the eligibility criteria is essential to ensure compliance and avoid potential issues with the Maryland Comptroller’s office.

Quick guide on how to complete section a section b comptroller of maryland

Finalize Section A Section B Comptroller Of Maryland effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the right form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without interruptions. Handle Section A Section B Comptroller Of Maryland on any device using the airSlate SignNow Android or iOS applications and simplify any document-centric process today.

Ways to modify and electronically sign Section A Section B Comptroller Of Maryland with ease

- Obtain Section A Section B Comptroller Of Maryland and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Section A Section B Comptroller Of Maryland and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the section a section b comptroller of maryland

How to generate an electronic signature for your Section A Section B Comptroller Of Maryland in the online mode

How to generate an eSignature for the Section A Section B Comptroller Of Maryland in Google Chrome

How to generate an electronic signature for putting it on the Section A Section B Comptroller Of Maryland in Gmail

How to generate an electronic signature for the Section A Section B Comptroller Of Maryland from your smart phone

How to create an eSignature for the Section A Section B Comptroller Of Maryland on iOS devices

How to make an eSignature for the Section A Section B Comptroller Of Maryland on Android devices

People also ask

-

What is met 2 maryland and how does it relate to airSlate SignNow?

Met 2 Maryland refers to the specific legal regulations in Maryland regarding electronic signatures. airSlate SignNow complies with these regulations, ensuring that all eSigning functions are recognized and enforceable under Maryland law.

-

How does airSlate SignNow's pricing structure accommodate businesses in Maryland?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes in Maryland. Each plan provides essential features at competitive rates, ensuring that companies can efficiently manage their document signing process without breaking the bank.

-

What features does airSlate SignNow provide that cater to Maryland businesses?

airSlate SignNow provides multiple features tailored for Maryland businesses, including customizable templates, secure document storage, and comprehensive audit trails. These tools enable companies to streamline their document workflows while maintaining legal compliance in accordance with met 2 Maryland.

-

Can airSlate SignNow integrate with other tools that businesses in Maryland use?

Yes, airSlate SignNow supports seamless integration with various tools commonly used by Maryland businesses, such as CRM systems, project management software, and cloud storage solutions. This enhances productivity and ensures a smoother workflow for all document-related tasks.

-

What are the benefits of using airSlate SignNow in line with met 2 maryland requirements?

Using airSlate SignNow aligns with met 2 Maryland requirements, granting businesses the peace of mind that their electronic signatures are legally binding. Moreover, it boosts efficiency by eliminating the need for physical document handling, thereby reducing turnaround times.

-

Is airSlate SignNow user-friendly for businesses in Maryland?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for businesses in Maryland to adopt the platform. The intuitive interface allows users to quickly learn how to send and eSign documents without extensive training.

-

How can airSlate SignNow improve the document workflow for Maryland businesses?

airSlate SignNow streamlines the document workflow for Maryland businesses by allowing users to send, sign, and manage documents electronically. This not only speeds up processes but also reduces paperwork and improves overall operational efficiency.

Get more for Section A Section B Comptroller Of Maryland

- Pacific power medical or life support equipment certificate form

- Consent form to search the fire scene nfa plateau com

- Hillhouse capital pdf form

- Aircraft specification sheet form

- Research permit application the nature conservancy in nature form

- Ab 115wisconsin liquor wine permit application form

- Scra letter template form

- Answer amp objection to writ of possession form

Find out other Section A Section B Comptroller Of Maryland

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT