Irs Form 990 Ez Schedule a

What is the IRS Form 990 EZ Schedule A

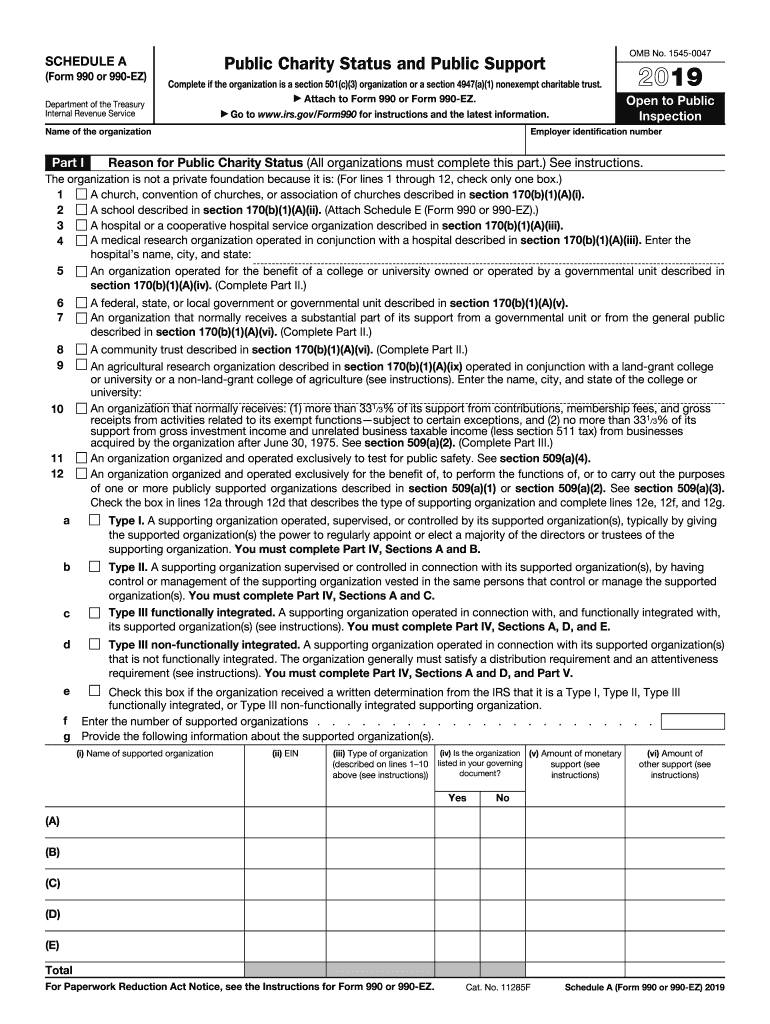

The IRS Form 990 EZ Schedule A is a supplementary document used by organizations that are classified as tax-exempt under section 501(c)(3) of the Internal Revenue Code. This form provides detailed information about the organization’s public charity status and helps determine its eligibility for tax-exempt status. It includes information on the organization’s revenue sources, expenditures, and activities, which are essential for compliance with federal regulations. The 2019 Form 990 EZ Schedule A specifically pertains to the tax year ending in 2019 and is crucial for organizations to maintain transparency and accountability in their financial reporting.

Steps to complete the IRS Form 990 EZ Schedule A

Completing the IRS Form 990 EZ Schedule A involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form by providing information about your organization’s revenue, expenses, and activities. Be sure to clearly indicate the sources of your funding and any public support received. After completing the form, review it for accuracy and completeness. Finally, submit the form electronically or by mail, ensuring that it is filed by the appropriate deadline.

Legal use of the IRS Form 990 EZ Schedule A

The legal use of the IRS Form 990 EZ Schedule A is essential for organizations seeking to maintain their tax-exempt status. This form must be completed accurately and submitted in compliance with IRS regulations. Failure to do so may result in penalties, including the loss of tax-exempt status. Organizations must ensure that all information provided is truthful and reflective of their operations. Additionally, maintaining proper records and documentation to support the information on the form is crucial for legal compliance and future audits.

Filing Deadlines / Important Dates

The filing deadlines for the IRS Form 990 EZ Schedule A are critical for organizations to adhere to in order to avoid penalties. Generally, the form must be filed by the 15th day of the fifth month after the end of the organization’s fiscal year. For organizations with a fiscal year ending on December 31, the deadline would be May 15 of the following year. It is important to monitor these dates closely, as extensions may be available but must be requested in advance. Missing the deadline can lead to significant consequences, including fines and potential loss of tax-exempt status.

Key elements of the IRS Form 990 EZ Schedule A

The key elements of the IRS Form 990 EZ Schedule A include sections that require detailed information about the organization’s public support, revenue sources, and operational activities. Organizations must disclose their total revenue, including contributions, grants, and program service revenue. Additionally, the form requires organizations to report their expenses, including program services, management, and fundraising costs. Providing accurate and comprehensive information in these sections is vital for demonstrating compliance with IRS guidelines and maintaining tax-exempt status.

Examples of using the IRS Form 990 EZ Schedule A

Examples of using the IRS Form 990 EZ Schedule A can help clarify its practical application. For instance, a nonprofit organization that receives funding from various sources, such as donations, grants, and fundraising events, would use this form to report its total revenue and demonstrate its public support. Another example could involve an organization that has specific programs aimed at community service; it would detail the expenses associated with these programs to illustrate its operational effectiveness. These examples highlight the importance of accurately reflecting an organization’s financial activities to uphold transparency and compliance.

Quick guide on how to complete 2019 schedule a form 990 or 990 ez public charity status and public support

Complete Irs Form 990 Ez Schedule A effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Irs Form 990 Ez Schedule A on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Irs Form 990 Ez Schedule A with ease

- Obtain Irs Form 990 Ez Schedule A and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Irs Form 990 Ez Schedule A and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule a form 990 or 990 ez public charity status and public support

How to make an electronic signature for the 2019 Schedule A Form 990 Or 990 Ez Public Charity Status And Public Support online

How to generate an eSignature for your 2019 Schedule A Form 990 Or 990 Ez Public Charity Status And Public Support in Chrome

How to create an eSignature for signing the 2019 Schedule A Form 990 Or 990 Ez Public Charity Status And Public Support in Gmail

How to create an eSignature for the 2019 Schedule A Form 990 Or 990 Ez Public Charity Status And Public Support from your smart phone

How to create an eSignature for the 2019 Schedule A Form 990 Or 990 Ez Public Charity Status And Public Support on iOS

How to generate an electronic signature for the 2019 Schedule A Form 990 Or 990 Ez Public Charity Status And Public Support on Android

People also ask

-

What is the IRS 2019 Schedule A Form?

The IRS 2019 Schedule A Form is used to report itemized deductions for the tax year. Taxpayers can use this form to detail deductions such as medical expenses, mortgage interest, and charitable contributions. Understanding this form can help simplify the filing process and maximize your tax return.

-

How can airSlate SignNow assist with the IRS 2019 Schedule A Form?

airSlate SignNow provides a user-friendly platform to create, send, and eSign documents like the IRS 2019 Schedule A Form. With our service, you can easily share the form with clients or colleagues and obtain electronic signatures securely. This streamlines the process and ensures that your forms are completed efficiently.

-

Is there a cost associated with using airSlate SignNow for the IRS 2019 Schedule A Form?

airSlate SignNow offers various pricing plans to accommodate different business needs, which can include conditions for using the IRS 2019 Schedule A Form. Our plans are designed to be cost-effective, allowing businesses of all sizes to access the features they need without breaking the bank. You can choose a plan that best suits your requirements.

-

What features does airSlate SignNow offer for document management, including the IRS 2019 Schedule A Form?

AirSlate SignNow provides features such as customizable templates, reusable signing workflows, and secure storage for documents like the IRS 2019 Schedule A Form. These tools enhance productivity and make document management seamless. You can also track the signing status of your forms in real-time to ensure timely completion.

-

Can I integrate airSlate SignNow with other software for managing the IRS 2019 Schedule A Form?

Yes, airSlate SignNow offers integrations with various widely used applications, helping you manage the IRS 2019 Schedule A Form alongside other tools seamlessly. You can connect with popular software like CRM systems, email platforms, and cloud storage services to enhance your workflow. These integrations make it easier to manage your documents efficiently.

-

What are the benefits of using airSlate SignNow for the IRS 2019 Schedule A Form?

Using airSlate SignNow for the IRS 2019 Schedule A Form streamlines the signing process, saving time and reducing paperwork. You benefit from a secure method to eSign and manage your documents, which is compliant with legal eSignature standards. Additionally, our intuitive interface ensures you can quickly navigate the platform.

-

How secure is my data when using airSlate SignNow for the IRS 2019 Schedule A Form?

Security is a top priority at airSlate SignNow. When using our platform for the IRS 2019 Schedule A Form, your data is protected by encryption and stringent security measures. This helps ensure that your sensitive information is safe, allowing you to focus on what matters most without worrying about data bsignNowes.

Get more for Irs Form 990 Ez Schedule A

Find out other Irs Form 990 Ez Schedule A

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement