Form it 641 Manufacturer's Real Property Tax Credit Tax Year 2024-2026

What is the Form IT 641 Manufacturer's Real Property Tax Credit?

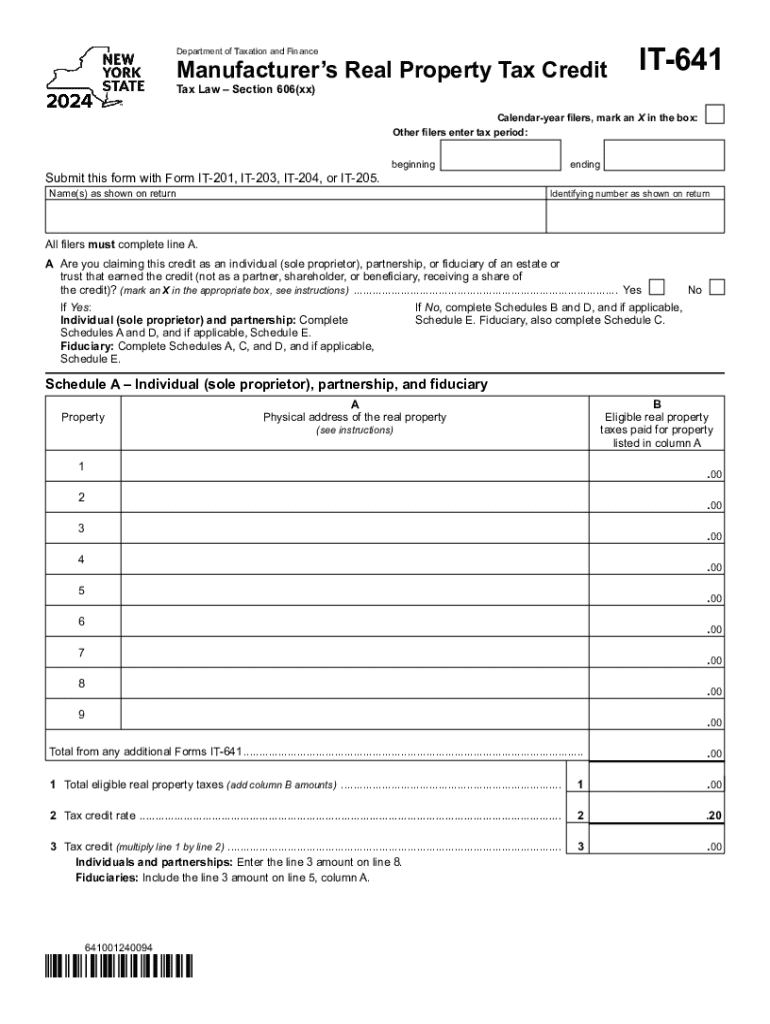

The Form IT 641 is a tax document used in the United States, specifically designed for claiming the Manufacturer's Real Property Tax Credit. This form allows manufacturers to receive a credit against their property taxes, which can significantly reduce their overall tax burden. The credit is applicable for real property used in manufacturing activities, promoting investment and growth within the manufacturing sector. Understanding the specifics of this form is essential for eligible businesses to maximize their tax benefits.

Eligibility Criteria for the Form IT 641

To qualify for the Manufacturer's Real Property Tax Credit using the IT 641 form, businesses must meet specific eligibility criteria. Generally, the property must be used primarily for manufacturing purposes. Additionally, the business must be registered and operating within the state that provides this tax credit. It is crucial for applicants to review the detailed requirements set forth by their state’s tax authority to ensure compliance and eligibility.

Steps to Complete the Form IT 641

Completing the Form IT 641 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including property assessments and previous tax returns. Next, fill out the form with precise information regarding the property and the manufacturing activities conducted. It's important to double-check all entries for errors before submission. Once completed, the form can be submitted according to the guidelines provided by the state tax authority, either electronically or by mail.

Filing Deadlines for the Form IT 641

Filing deadlines for the Form IT 641 vary by state, and it is important to adhere to these dates to avoid penalties. Typically, forms must be submitted by a specific date each year, often aligned with the annual tax filing period. Businesses should consult their state’s tax authority for the exact deadlines and ensure timely submission to maintain eligibility for the tax credit.

Form Submission Methods

The Form IT 641 can be submitted through various methods, depending on state regulations. Common submission options include online filing via the state’s tax portal, mailing a physical copy of the form to the appropriate tax office, or in-person submission at designated tax offices. Each method has its own guidelines and requirements, so businesses should choose the option that best suits their needs while ensuring compliance with submission protocols.

Key Elements of the Form IT 641

Understanding the key elements of the Form IT 641 is essential for accurate completion. The form typically includes sections for taxpayer information, property details, and the calculation of the tax credit. Additionally, it may require supporting documentation to substantiate the claims made. Familiarity with these components can streamline the filing process and help avoid common mistakes.

Legal Use of the Form IT 641

The legal use of the Form IT 641 is governed by state tax laws, which outline the parameters for claiming the Manufacturer's Real Property Tax Credit. Businesses must ensure that they are using the form in accordance with these laws, as improper use can lead to penalties or denial of the credit. Consulting with a tax professional can provide clarity on the legal implications and ensure compliance with all regulations.

Create this form in 5 minutes or less

Find and fill out the correct form it 641 manufacturers real property tax credit tax year 772088714

Create this form in 5 minutes!

How to create an eSignature for the form it 641 manufacturers real property tax credit tax year 772088714

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 641 tax form and who needs to file it?

The 641 tax form is used by certain businesses and individuals to report specific income and expenses related to their operations. Typically, those who have income from sources such as partnerships or S corporations may need to file this form. Understanding the requirements for the 641 tax form is crucial for compliance and accurate reporting.

-

How can airSlate SignNow help with the 641 tax form?

airSlate SignNow simplifies the process of preparing and signing the 641 tax form by providing an easy-to-use platform for document management. Users can quickly upload, edit, and eSign their forms, ensuring that all necessary information is accurately captured. This streamlines the filing process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the 641 tax form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that enhance the efficiency of managing documents like the 641 tax form. Investing in this solution can save time and resources in the long run.

-

What features does airSlate SignNow offer for managing the 641 tax form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing the 641 tax form. These tools help ensure that all parties can easily access and sign the document, making the filing process more efficient. Additionally, the platform supports collaboration among team members.

-

Can I integrate airSlate SignNow with other software for the 641 tax form?

Absolutely! airSlate SignNow offers integrations with various accounting and financial software, making it easier to manage the 641 tax form alongside your other business processes. This seamless integration helps streamline workflows and ensures that all necessary data is readily available for filing.

-

What are the benefits of using airSlate SignNow for the 641 tax form?

Using airSlate SignNow for the 641 tax form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document sharing, which can signNowly speed up the filing process. Additionally, it helps maintain compliance with tax regulations.

-

How secure is airSlate SignNow when handling the 641 tax form?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect sensitive information related to the 641 tax form. Users can trust that their documents are safe and secure throughout the signing process. This commitment to security helps businesses comply with data protection regulations.

Get more for Form IT 641 Manufacturer's Real Property Tax Credit Tax Year

- Hcmc release of information

- Duplicate title form ca

- Statement of claim for short term recovery ebview form

- Ups poa form

- Chdp program letter 01 11 california department of health care dhcs ca form

- Employee training record template form

- 5 paragraph essay outline form

- Wti program application template 1520 from form

Find out other Form IT 641 Manufacturer's Real Property Tax Credit Tax Year

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer