Form it 212 Investment Credit Tax Year 2024-2026

Understanding the IT 212 Investment Credit Tax Year

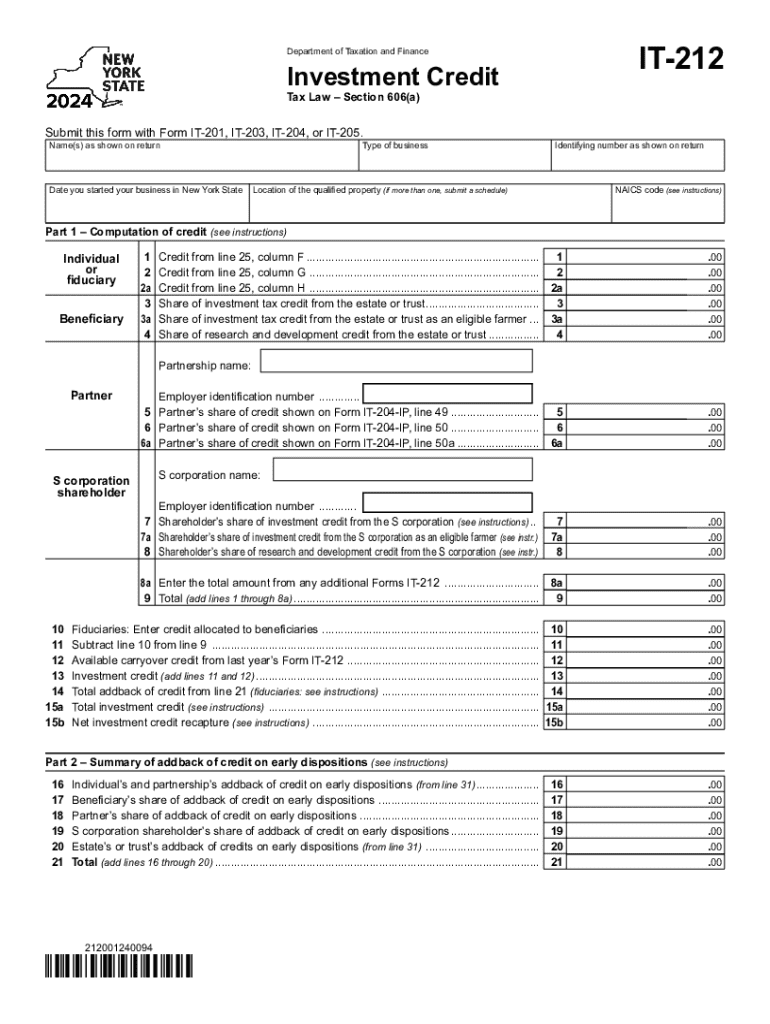

The IT 212 form, also known as the Investment Credit form, is utilized in New York for claiming investment credits against state taxes. This form is specifically designed for taxpayers who have made qualified investments in certain property types during the tax year. The investment credit can significantly reduce tax liability, making it an essential form for eligible taxpayers. It is crucial to understand the specific tax year for which the form is being filed, as this determines the applicable credits and regulations.

Steps to Complete the IT 212 Investment Credit Tax Year

Completing the IT 212 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your investments, including purchase receipts and any relevant financial statements. Next, fill out the form by providing your personal information, detailing the investments made, and calculating the credit amount based on the instructions provided. Finally, review the completed form for any errors before submission. It is advisable to keep copies of all documents for your records.

Eligibility Criteria for the IT 212 Investment Credit Tax Year

To qualify for the IT 212 investment credit, taxpayers must meet specific eligibility criteria. Generally, the investments must be made in qualified property types, such as machinery, equipment, or certain types of real estate. Additionally, the taxpayer must be subject to New York State tax and must have incurred the investment expenses during the tax year for which they are claiming the credit. It is essential to review the detailed eligibility requirements outlined in the form instructions to ensure compliance.

Required Documents for the IT 212 Investment Credit Tax Year

When filing the IT 212 form, certain documents are required to substantiate your claim. These typically include proof of purchase for the qualified investments, such as invoices or receipts, and any relevant financial records that demonstrate the investment's impact on your business. Additionally, if applicable, documentation showing prior year credits or adjustments may also be necessary. Having these documents readily available can streamline the filing process and help avoid delays.

Filing Deadlines for the IT 212 Investment Credit Tax Year

It is important to be aware of the filing deadlines associated with the IT 212 form. Generally, the form must be submitted by the same deadline as your state income tax return. This means that if you are filing your taxes by April 15, your IT 212 form should also be submitted by this date. In some cases, extensions may be available, but it is crucial to check with the New York State Department of Taxation and Finance for the most current deadlines and any potential changes.

Form Submission Methods for the IT 212 Investment Credit Tax Year

The IT 212 form can be submitted through various methods, providing flexibility for taxpayers. Options typically include online submission via the New York State Department of Taxation and Finance website, mailing a paper form, or delivering it in person to a local tax office. Each method has its advantages, such as the speed of online filing or the personal touch of in-person submission. Be sure to choose the method that best suits your needs and ensures timely processing of your claim.

Create this form in 5 minutes or less

Find and fill out the correct form it 212 investment credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 212 investment credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the IT 212 instructions for using airSlate SignNow?

The IT 212 instructions for airSlate SignNow guide users through the process of sending and eSigning documents efficiently. These instructions cover everything from setting up your account to managing your documents securely. By following these steps, you can ensure a smooth experience while utilizing our platform.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for businesses of all sizes. We offer different tiers that cater to various needs, ensuring you get the best value for your investment. For detailed pricing and features, refer to our pricing page.

-

What features does airSlate SignNow offer?

airSlate SignNow includes a range of features designed to streamline document management, including eSigning, document templates, and real-time collaboration. The platform also provides secure storage and tracking capabilities, making it easier to manage your documents. These features are all detailed in the IT 212 instructions for optimal use.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, your business can enhance productivity and reduce turnaround times for document signing. The platform simplifies the eSigning process, allowing you to focus on core business activities. The benefits outlined in the IT 212 instructions highlight how our solution can transform your document workflows.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integrations with various software applications, enhancing its functionality. You can connect it with popular tools like Google Drive, Salesforce, and more to streamline your workflows. The IT 212 instructions provide guidance on how to set up these integrations effectively.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive documents are protected. We implement industry-standard encryption and adhere to regulations to safeguard your data. The IT 212 instructions include information on our security measures and best practices for document handling.

-

Can I customize my documents in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your documents easily using templates and editing tools. This feature enables you to create personalized documents that meet your specific needs. The IT 212 instructions provide detailed steps on how to utilize these customization options effectively.

Get more for Form IT 212 Investment Credit Tax Year

- Leaseagreement02 free alabama conditional waiver on progress payment form to be used to get payment released on a project

- Ohio hunting permission slip form

- Personal property inventory worksheet form

- Data collection form totalsir

- Employability profile form

- Motion for order setting final hearing marion county clerk of courts marioncountyclerk form

- Affidavit terminating life form

- Pharmacy prescription transfer template form

Find out other Form IT 212 Investment Credit Tax Year

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile