Alaska DOR Tax Programs Tax Revenue Collections and 2017-2026

What is the Alaska DOR Tax Programs Tax Revenue Collections And

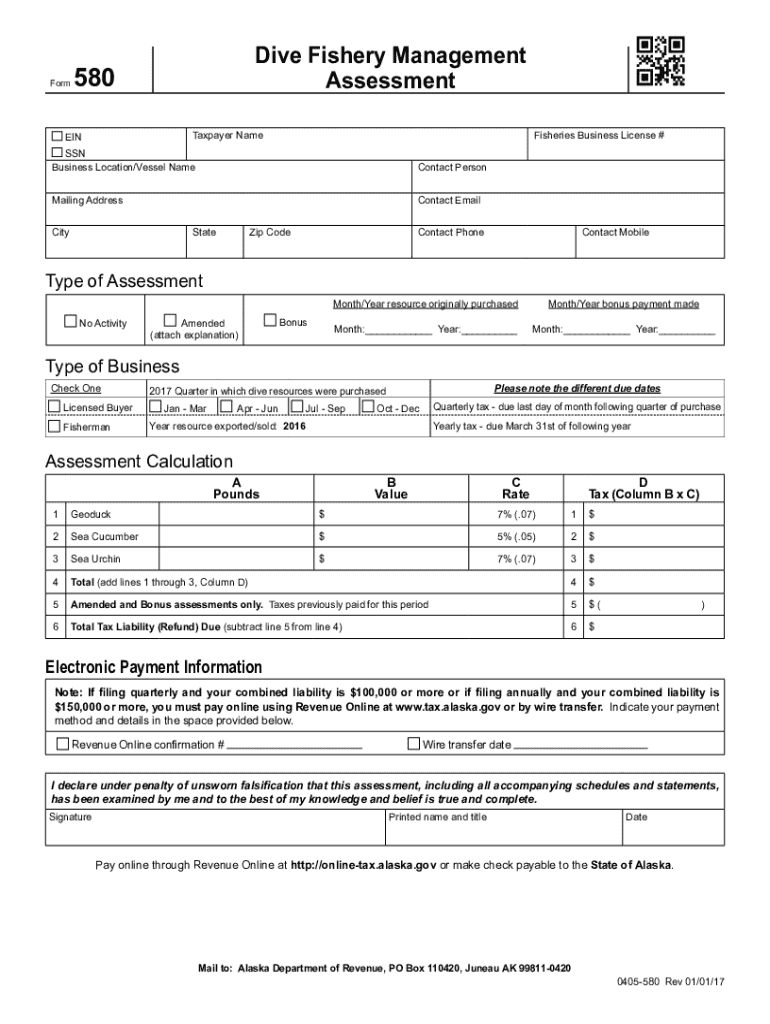

The Alaska DOR Tax Programs Tax Revenue Collections And refers to the various tax initiatives managed by the Alaska Department of Revenue (DOR) aimed at collecting state revenue. This program encompasses multiple tax categories, including corporate income tax, individual income tax, and various excise taxes. The DOR plays a crucial role in ensuring compliance with state tax laws and facilitating the collection of taxes necessary for funding state services and programs.

How to use the Alaska DOR Tax Programs Tax Revenue Collections And

To effectively utilize the Alaska DOR Tax Programs Tax Revenue Collections And, taxpayers must first understand the specific tax obligations that apply to them. This involves reviewing the relevant tax forms and guidelines provided by the DOR. Users can access these resources online, where they can find detailed instructions on completing tax forms, understanding tax rates, and determining applicable deductions. It is essential to keep accurate records of income and expenses to ensure compliance and facilitate the filing process.

Steps to complete the Alaska DOR Tax Programs Tax Revenue Collections And

Completing the Alaska DOR Tax Programs Tax Revenue Collections And involves several key steps:

- Identify the specific tax form required for your situation, such as corporate or individual income tax forms.

- Gather all necessary documentation, including income statements, expense records, and previous tax returns.

- Fill out the tax form accurately, ensuring all information is complete and correct.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the designated method, whether online, by mail, or in person, as outlined by the DOR.

Required Documents

When engaging with the Alaska DOR Tax Programs Tax Revenue Collections And, certain documents are needed to ensure a smooth filing process. Common required documents include:

- W-2 forms for wage earners, detailing annual earnings and taxes withheld.

- 1099 forms for independent contractors and other non-employee compensation.

- Receipts and records of deductible expenses related to business or personal tax filings.

- Previous tax returns to provide context and assist in accurate reporting.

Penalties for Non-Compliance

Failure to comply with the Alaska DOR Tax Programs Tax Revenue Collections And can result in significant penalties. These penalties may include:

- Late filing penalties, which are assessed for not submitting tax forms by the due date.

- Late payment penalties for taxes owed that are not paid on time.

- Interest on unpaid taxes, which accrues over time until the balance is settled.

Eligibility Criteria

Eligibility for participation in the Alaska DOR Tax Programs Tax Revenue Collections And varies based on the type of tax being filed. Generally, individuals and businesses must meet specific income thresholds and residency requirements. For example, individuals may need to demonstrate residency in Alaska for a certain period, while businesses must register with the state and comply with local regulations. Understanding these criteria is essential for accurate tax reporting and compliance.

Quick guide on how to complete alaska dor tax programs tax revenue collections and

Complete Alaska DOR Tax Programs Tax Revenue Collections And seamlessly on any device

Online document management has gained traction with companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents rapidly without delays. Manage Alaska DOR Tax Programs Tax Revenue Collections And on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Alaska DOR Tax Programs Tax Revenue Collections And effortlessly

- Obtain Alaska DOR Tax Programs Tax Revenue Collections And and click on Get Form to initiate.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Alaska DOR Tax Programs Tax Revenue Collections And and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska dor tax programs tax revenue collections and

Create this form in 5 minutes!

How to create an eSignature for the alaska dor tax programs tax revenue collections and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of Alaska DOR Tax Programs Tax Revenue Collections And?

Alaska DOR Tax Programs Tax Revenue Collections And offers a range of features designed to streamline tax collection processes. These include automated document generation, eSignature capabilities, and real-time tracking of tax submissions. This ensures that businesses can manage their tax obligations efficiently and effectively.

-

How does airSlate SignNow integrate with Alaska DOR Tax Programs Tax Revenue Collections And?

airSlate SignNow seamlessly integrates with Alaska DOR Tax Programs Tax Revenue Collections And, allowing users to eSign and send documents directly within the tax program. This integration enhances workflow efficiency by reducing the time spent on document management. Users can easily access their signed documents and maintain compliance with state regulations.

-

What is the pricing structure for Alaska DOR Tax Programs Tax Revenue Collections And?

The pricing for Alaska DOR Tax Programs Tax Revenue Collections And is competitive and designed to accommodate businesses of all sizes. Various subscription plans are available, allowing users to choose the one that best fits their needs. Additionally, airSlate SignNow offers a free trial, enabling prospective customers to explore the features before committing.

-

What benefits does using Alaska DOR Tax Programs Tax Revenue Collections And provide?

Using Alaska DOR Tax Programs Tax Revenue Collections And provides numerous benefits, including improved accuracy in tax filings and reduced processing times. The platform's user-friendly interface simplifies the tax collection process, making it accessible for all users. Furthermore, it helps businesses stay compliant with state tax regulations.

-

Can I customize documents within Alaska DOR Tax Programs Tax Revenue Collections And?

Yes, Alaska DOR Tax Programs Tax Revenue Collections And allows users to customize documents to meet their specific needs. This includes adding company logos, adjusting templates, and modifying fields to capture necessary information. Customization ensures that all documents align with your business branding and requirements.

-

Is training available for new users of Alaska DOR Tax Programs Tax Revenue Collections And?

Absolutely! airSlate SignNow provides comprehensive training resources for new users of Alaska DOR Tax Programs Tax Revenue Collections And. This includes tutorials, webinars, and customer support to help users navigate the platform effectively. The goal is to ensure that all users can maximize the benefits of the tax program.

-

How secure is the data within Alaska DOR Tax Programs Tax Revenue Collections And?

Data security is a top priority for Alaska DOR Tax Programs Tax Revenue Collections And. The platform employs advanced encryption and security protocols to protect sensitive information. Users can trust that their tax data is safe and secure while using airSlate SignNow's services.

Get more for Alaska DOR Tax Programs Tax Revenue Collections And

- Painting contractor package ohio form

- Framing contractor package ohio form

- Foundation contractor package ohio form

- Plumbing contractor package ohio form

- Brick mason contractor package ohio form

- Roofing contractor package ohio form

- Electrical contractor package ohio form

- Sheetrock drywall contractor package ohio form

Find out other Alaska DOR Tax Programs Tax Revenue Collections And

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe