Florida Dept of Revenue Enroll to EFile and Pay 2024-2026

What is the Florida Dept Of Revenue Enroll To EFile And Pay

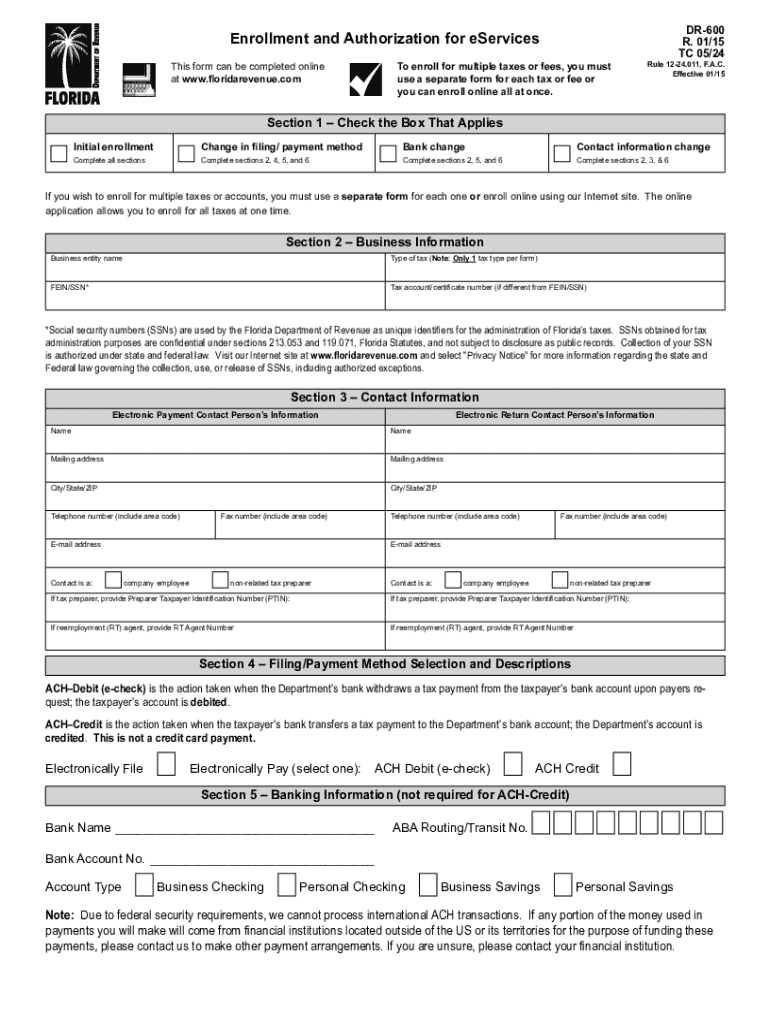

The Florida Dept Of Revenue Enroll To EFile And Pay is a program designed for taxpayers to electronically file their tax returns and make payments online. This initiative simplifies the tax filing process, allowing individuals and businesses to manage their tax obligations efficiently. By enrolling in this program, users can access various services, including filing sales tax, corporate income tax, and other state tax returns electronically.

Steps to complete the Florida Dept Of Revenue Enroll To EFile And Pay

Completing the enrollment process for the Florida Dept Of Revenue Enroll To EFile And Pay involves several key steps:

- Visit the Florida Department of Revenue's official website.

- Locate the eFile and Pay enrollment section.

- Provide the required personal or business information, including your tax identification number.

- Set up a secure online account by creating a username and password.

- Review and accept the terms and conditions of the program.

- Submit your enrollment application for processing.

Once your application is approved, you will receive confirmation and can start using the eFile and Pay services.

Required Documents for Enrollment

To successfully enroll in the Florida Dept Of Revenue Enroll To EFile And Pay, certain documents are necessary. These may include:

- Your Social Security number or Employer Identification Number (EIN).

- Proof of identity, such as a driver's license or state ID.

- Business registration documents, if applicable.

- Any previous tax returns or financial statements that may be required for verification.

Having these documents ready can streamline the enrollment process and ensure compliance with state regulations.

Legal Use of the Florida Dept Of Revenue Enroll To EFile And Pay

The Florida Dept Of Revenue Enroll To EFile And Pay is legally recognized for the electronic submission of tax documents and payments. By using this service, taxpayers fulfill their obligations under Florida tax law. It is important to ensure that all information submitted is accurate and complies with state regulations to avoid penalties or legal issues.

Eligibility Criteria for Enrollment

Eligibility for the Florida Dept Of Revenue Enroll To EFile And Pay typically includes:

- Individuals or businesses registered in Florida.

- Taxpayers who have a valid Social Security number or EIN.

- Those who are current on their tax obligations.

- Users must have access to a computer and the internet to utilize the online services.

Meeting these criteria ensures that users can effectively participate in the eFile and Pay program.

Examples of Using the Florida Dept Of Revenue Enroll To EFile And Pay

Examples of how taxpayers can utilize the Florida Dept Of Revenue Enroll To EFile And Pay include:

- Filing monthly sales tax returns for retail businesses.

- Submitting corporate income tax returns electronically.

- Making estimated tax payments throughout the year.

- Accessing payment history and filing records for personal or business use.

These examples highlight the versatility and convenience of the eFile and Pay system for various tax-related needs.

Quick guide on how to complete florida dept of revenue enroll to efile and pay

Effortlessly Prepare Florida Dept Of Revenue Enroll To EFile And Pay on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Handle Florida Dept Of Revenue Enroll To EFile And Pay on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Simplest Way to Modify and eSign Florida Dept Of Revenue Enroll To EFile And Pay with Ease

- Find Florida Dept Of Revenue Enroll To EFile And Pay and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or redact sensitive information using the tools provided by airSlate SignNow, specifically designed for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to finalize your changes.

- Choose how you want to share your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors requiring you to print new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Florida Dept Of Revenue Enroll To EFile And Pay and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida dept of revenue enroll to efile and pay

Create this form in 5 minutes!

How to create an eSignature for the florida dept of revenue enroll to efile and pay

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Florida Dept Of Revenue Enroll To EFile And Pay?

To Florida Dept Of Revenue Enroll To EFile And Pay, you need to visit the official Florida Department of Revenue website. There, you can find detailed instructions on how to register for e-filing and payment services. Completing the enrollment process will allow you to manage your tax obligations efficiently.

-

What are the benefits of Florida Dept Of Revenue Enroll To EFile And Pay?

Enrolling to e-file and pay with the Florida Dept Of Revenue offers numerous benefits, including faster processing times and reduced paperwork. It also allows for easier tracking of your payments and filings. Overall, it streamlines your tax management process.

-

Are there any fees associated with Florida Dept Of Revenue Enroll To EFile And Pay?

Generally, there are no fees for enrolling to e-file and pay with the Florida Dept Of Revenue. However, certain payment methods may incur transaction fees. It's best to check the Florida Department of Revenue's website for the most current information regarding any potential costs.

-

Can I integrate airSlate SignNow with Florida Dept Of Revenue Enroll To EFile And Pay?

Yes, airSlate SignNow can be integrated with the Florida Dept Of Revenue Enroll To EFile And Pay process. This integration allows you to easily e-sign and send necessary documents directly related to your tax filings. It enhances your workflow and ensures compliance with state regulations.

-

What features does airSlate SignNow offer for Florida Dept Of Revenue Enroll To EFile And Pay?

airSlate SignNow provides features such as document templates, secure e-signatures, and real-time tracking for your submissions. These tools are designed to simplify the Florida Dept Of Revenue Enroll To EFile And Pay process, making it more efficient and user-friendly.

-

How does airSlate SignNow ensure the security of my information during Florida Dept Of Revenue Enroll To EFile And Pay?

airSlate SignNow employs advanced encryption and security protocols to protect your information during the Florida Dept Of Revenue Enroll To EFile And Pay process. Your data is safeguarded against unauthorized access, ensuring that your sensitive tax information remains confidential.

-

Is customer support available for Florida Dept Of Revenue Enroll To EFile And Pay?

Yes, airSlate SignNow offers customer support to assist you with the Florida Dept Of Revenue Enroll To EFile And Pay process. Whether you have questions about the enrollment or need help with document management, our support team is here to help you navigate the system effectively.

Get more for Florida Dept Of Revenue Enroll To EFile And Pay

- Quitclaim deed limited liability company to limited liability company oklahoma form

- Oklahoma mineral deed form

- Quitclaim deed one individual to four individuals oklahoma form

- Oklahoma warranty deed 497322820 form

- Oklahoma life estate form

- Special warranty deed limited liability company to limited liability company oklahoma form

- Transfer of deed on death oklahoma form

- Child support in oklahoma form

Find out other Florida Dept Of Revenue Enroll To EFile And Pay

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation