W3 Pr Form

What is the W-3PR?

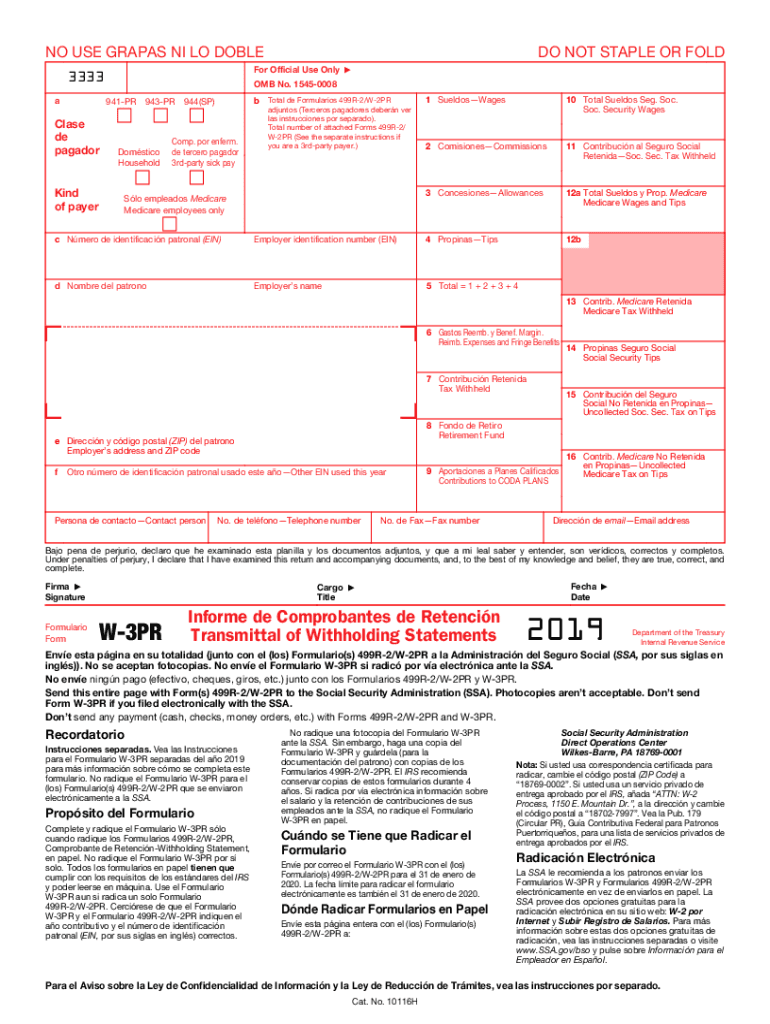

The W-3PR is a transmittal form used by employers in Puerto Rico to report annual wage and tax information to the Internal Revenue Service (IRS). This form summarizes the information reported on various W-2 forms, specifically for employees who worked in Puerto Rico. It is essential for ensuring accurate reporting of income and tax withholdings for residents and employees in Puerto Rico.

Steps to Complete the W-3PR

Completing the W-3PR involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all relevant W-2 forms for your employees. Next, ensure that the information on the W-2 forms matches the details you will report on the W-3PR. Fill out the W-3PR with the total number of W-2 forms submitted, total wages paid, and total taxes withheld. Finally, review the form for any errors before submission.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the W-3PR. Employers must ensure that the form is filled out accurately, with all required fields completed. The IRS requires that the W-3PR be submitted alongside the W-2 forms by the designated filing deadline. It is also important to keep copies of the submitted forms for your records, as they may be needed for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the W-3PR are critical to avoid penalties. Typically, the form must be submitted by January thirty-first of the year following the tax year being reported. For example, the W-3PR for the tax year 2019 must be filed by January thirty-first, 2020. Employers should also be aware of any changes in deadlines that may occur due to holidays or other factors.

Required Documents

To complete the W-3PR, employers need several documents. Primarily, you will need all W-2 forms for employees who worked in Puerto Rico during the tax year. Additionally, you may need records of wages paid and taxes withheld to ensure accurate reporting. Having these documents organized will facilitate a smoother completion process.

Form Submission Methods

The W-3PR can be submitted through various methods. Employers can file electronically using the IRS e-file system, which is often the most efficient option. Alternatively, the form can be mailed to the appropriate IRS address. It is important to follow the guidelines for each submission method to ensure that your forms are processed correctly and on time.

Penalties for Non-Compliance

Failure to file the W-3PR on time or inaccuracies in the form can result in penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, incorrect information may lead to issues with employee tax records, which can cause complications for both employers and employees. It is crucial to ensure compliance to avoid these potential penalties.

Quick guide on how to complete 2019 form w 3pr transmittal of withholding statements puerto rico

Effortlessly Prepare W3 Pr on Any Device

Managing documents online has gained popularity among companies and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and safely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage W3 Pr on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Easiest Way to Alter and eSign W3 Pr with Ease

- Locate W3 Pr and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact confidential information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your modifications.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns regarding lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your device of choice. Edit and eSign W3 Pr and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form w 3pr transmittal of withholding statements puerto rico

How to create an eSignature for the 2019 Form W 3pr Transmittal Of Withholding Statements Puerto Rico online

How to create an eSignature for the 2019 Form W 3pr Transmittal Of Withholding Statements Puerto Rico in Chrome

How to create an eSignature for signing the 2019 Form W 3pr Transmittal Of Withholding Statements Puerto Rico in Gmail

How to create an eSignature for the 2019 Form W 3pr Transmittal Of Withholding Statements Puerto Rico from your mobile device

How to generate an electronic signature for the 2019 Form W 3pr Transmittal Of Withholding Statements Puerto Rico on iOS devices

How to generate an eSignature for the 2019 Form W 3pr Transmittal Of Withholding Statements Puerto Rico on Android devices

People also ask

-

What is the 2019 499r 2 w 2pr form, and why is it important?

The 2019 499r 2 w 2pr form is a critical document used for reporting tax information related to contributions made to retirement plans. Understanding this form is essential for businesses to ensure compliance with IRS regulations while optimizing tax benefits for employees.

-

How can airSlate SignNow help with completing the 2019 499r 2 w 2pr form?

airSlate SignNow provides a user-friendly platform to easily complete and eSign the 2019 499r 2 w 2pr form. With customizable templates and easy document management, it simplifies the process, allowing you to focus more on your core business activities.

-

What are the costs associated with using airSlate SignNow for the 2019 499r 2 w 2pr?

airSlate SignNow offers various pricing plans suitable for businesses of different sizes, starting from a competitive rate that provides access to all features necessary for managing the 2019 499r 2 w 2pr form. You can choose a plan that fits your budget while benefiting from unlimited eSigning capabilities.

-

What features does airSlate SignNow provide for managing forms like the 2019 499r 2 w 2pr?

AirSlate SignNow offers features such as customizable templates, real-time tracking, and secure cloud storage which are particularly beneficial for managing forms like the 2019 499r 2 w 2pr. These features streamline your workflow and enhance the efficiency of document handling.

-

Can airSlate SignNow integrate with other software for managing the 2019 499r 2 w 2pr?

Yes, airSlate SignNow seamlessly integrates with various software applications, allowing for enhanced workflows when dealing with the 2019 499r 2 w 2pr. Whether you use CRM systems or accounting software, our integrations make it easy to manage your documents across platforms.

-

Is airSlate SignNow secure for handling sensitive documents like the 2019 499r 2 w 2pr?

Absolutely, airSlate SignNow takes security seriously with advanced encryption and compliance with industry standards, ensuring that sensitive documents like the 2019 499r 2 w 2pr are protected. You can trust us to keep your data secure while you handle important documentation.

-

What are the benefits of using airSlate SignNow for the 2019 499r 2 w 2pr form?

Using airSlate SignNow for the 2019 499r 2 w 2pr form allows you to speed up the signing process, enhance collaboration, and reduce paper usage signNowly. The platform’s efficiency enables businesses to manage their documents faster while maintaining compliance with regulatory requirements.

Get more for W3 Pr

Find out other W3 Pr

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now