Irs Govschedule F Form 1040

What is the IRS Schedule F Form 1040?

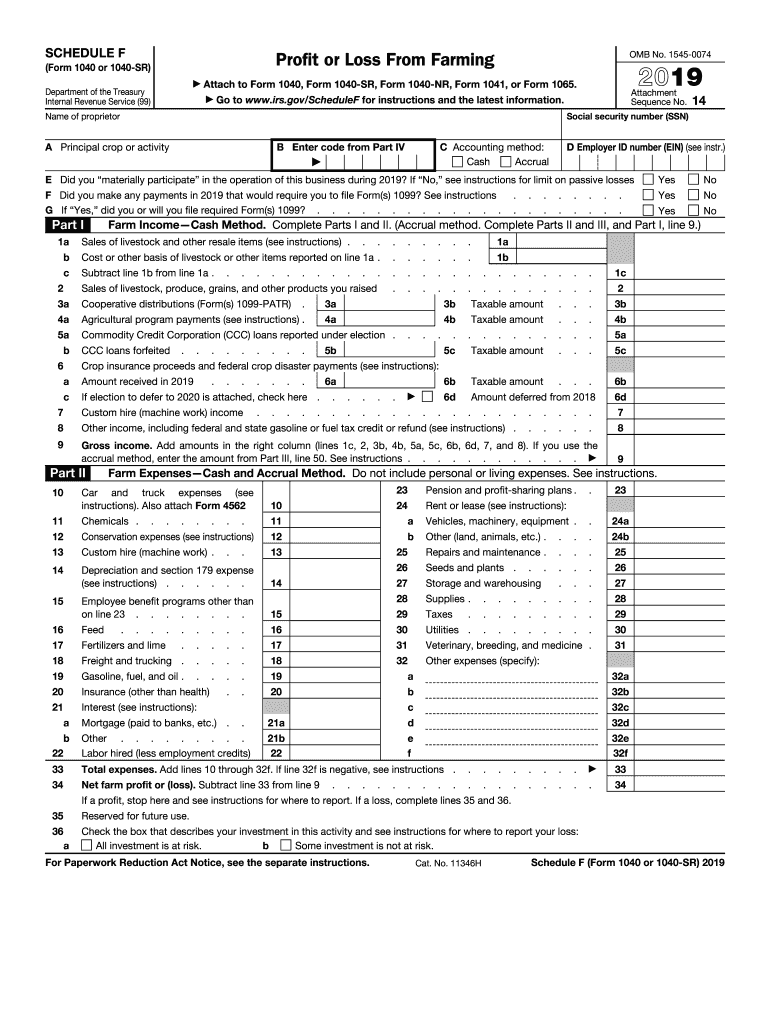

The IRS Schedule F Form 1040 is a tax form used by farmers to report income and expenses related to farming activities. This form is essential for individuals who operate a farm as a sole proprietorship, allowing them to detail their profit or loss from farming operations. It is an attachment to the standard Form 1040, which is the individual income tax return used in the United States. The information provided on Schedule F is crucial for calculating the overall taxable income and ensuring compliance with IRS regulations.

How to Use the IRS Schedule F Form 1040

Using the IRS Schedule F Form 1040 involves several key steps. First, gather all relevant financial records related to your farming activities, including income from sales, expenses for supplies, and any other costs incurred. Next, complete the form by entering your gross income from farming on the designated lines, followed by detailing your expenses in the appropriate sections. It is important to categorize expenses accurately, as this can affect your overall tax liability. Once completed, Schedule F should be attached to your Form 1040 when filing your taxes.

Steps to Complete the IRS Schedule F Form 1040

Completing the IRS Schedule F Form 1040 can be broken down into a series of steps:

- Begin by entering your name and Social Security number at the top of the form.

- Report your total income from farming activities in Part I, which includes sales of livestock, produce, and other farm products.

- In Part II, list all allowable expenses, such as feed, fertilizer, and labor costs. Be sure to keep accurate records to substantiate these expenses.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Transfer the net profit or loss amount to your Form 1040 to finalize your tax return.

Key Elements of the IRS Schedule F Form 1040

Several key elements define the IRS Schedule F Form 1040:

- Income Reporting: Farmers must report all sources of income from their farming operations.

- Expense Categories: The form includes specific categories for various expenses, such as operating costs and depreciation.

- Net Profit or Loss Calculation: This is a critical figure that affects overall tax liability and is essential for tax planning.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the IRS Schedule F Form 1040 is crucial for compliance. Typically, the deadline for filing individual tax returns, including Schedule F, is April 15. However, if you request an extension, you may have until October 15 to file. It is important to keep track of these dates to avoid penalties and interest on any unpaid taxes.

Penalties for Non-Compliance

Failure to file the IRS Schedule F Form 1040 accurately and on time can result in various penalties. The IRS may impose fines for late filing, which can accumulate over time. Additionally, inaccuracies in reporting income or expenses may lead to audits, further penalties, and interest on any unpaid tax liabilities. It is essential to ensure that the form is filled out correctly and submitted by the deadline to avoid these consequences.

Quick guide on how to complete 2018 schedule f form 1040 internal revenue service

Complete Irs Govschedule F Form 1040 effortlessly on any device

Digital document management has gained traction among both businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly without delays. Handle Irs Govschedule F Form 1040 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and eSign Irs Govschedule F Form 1040 with ease

- Obtain Irs Govschedule F Form 1040 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Choose your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Irs Govschedule F Form 1040 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2018 schedule f form 1040 internal revenue service

How to generate an electronic signature for your 2018 Schedule F Form 1040 Internal Revenue Service online

How to make an eSignature for your 2018 Schedule F Form 1040 Internal Revenue Service in Google Chrome

How to create an electronic signature for signing the 2018 Schedule F Form 1040 Internal Revenue Service in Gmail

How to generate an eSignature for the 2018 Schedule F Form 1040 Internal Revenue Service from your mobile device

How to make an electronic signature for the 2018 Schedule F Form 1040 Internal Revenue Service on iOS

How to create an electronic signature for the 2018 Schedule F Form 1040 Internal Revenue Service on Android

People also ask

-

What is the 2019 Schedule F and how is it used?

The 2019 Schedule F is a tax form used by farmers to report their income and expenses. It is essential for anyone in the agricultural sector to accurately document their financial performance to ensure compliance with IRS regulations.

-

How can airSlate SignNow help with the 2019 Schedule F?

AirSlate SignNow streamlines the process of signing and sending documents related to the 2019 Schedule F. This easy-to-use platform allows users to manage their documentation securely, ensuring that all necessary forms are signed and submitted on time.

-

What are the pricing plans for airSlate SignNow tailored for farmers handling the 2019 Schedule F?

AirSlate SignNow offers various pricing plans that cater to businesses seeking to manage their 2019 Schedule F submissions effectively. Start with a free trial, and explore affordable monthly or annual subscriptions that suit your business needs, ensuring you remain cost-effective.

-

What features does airSlate SignNow offer for managing the 2019 Schedule F?

AirSlate SignNow includes features like eSignature capabilities, document templates, and secure cloud storage, which are essential for managing the 2019 Schedule F. Additionally, users can collaborate in real time, making it easier to gather signatures and information quickly.

-

Can I integrate airSlate SignNow with my existing accounting software for the 2019 Schedule F?

Yes, airSlate SignNow offers seamless integration with popular accounting software, which can simplify managing your 2019 Schedule F. By connecting your tools, you can streamline workflows and reduce the risk of errors in your documentation.

-

What security measures does airSlate SignNow implement for documents like the 2019 Schedule F?

AirSlate SignNow employs robust security measures such as encryption, secure access controls, and compliance with industry standards to protect documents like the 2019 Schedule F. Your sensitive information remains safe, giving you peace of mind while handling important tax documents.

-

Is airSlate SignNow compliant with IRS requirements for the 2019 Schedule F?

Yes, airSlate SignNow is compliant with IRS requirements for electronic signatures and document submissions related to the 2019 Schedule F. This compliance ensures your electronically signed documents are valid and recognized by tax authorities.

Get more for Irs Govschedule F Form 1040

- Itd3170 form

- Idl land exchange form

- Be application idaho state bar isb idaho form

- Idaho transportation department policy and procedure special events on the state highway system form

- Idaho fish and game application for temporary employment fishandgame idaho form

- Idwr driller licensing forms 238 2

- Southafrica newyorknethomeaffairsformsbi84pdf

- Homeowneramp039s tax credit utah state tax commission form

Find out other Irs Govschedule F Form 1040

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later