Form it 203 TM ATT a Schedule a Group Return for Nonresident Athletic Team Members Tax Year

What is the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year

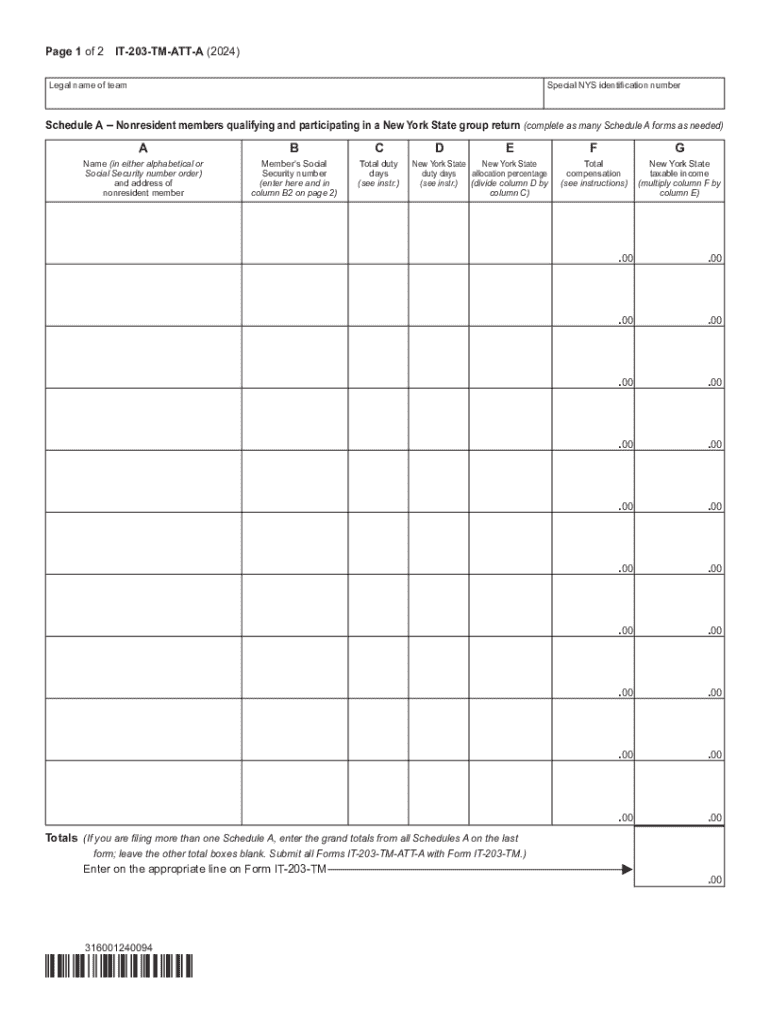

The Form IT 203 TM ATT A Schedule A is a tax document specifically designed for nonresident athletic team members participating in events within the United States. This form allows teams to file a group return, simplifying the tax process for individual members who may not have a permanent tax obligation in the U.S. The form is essential for ensuring compliance with state tax regulations while allowing nonresident athletes to report their income accurately. It is particularly relevant during the tax year when these athletes earn income from competitions or endorsements while in the U.S.

How to use the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year

Using the Form IT 203 TM ATT A involves gathering necessary information about each nonresident athlete and the income they earned during the tax year. Teams must compile details such as names, Social Security numbers or Individual Taxpayer Identification Numbers, and the specific income amounts for each member. Once the information is collected, it can be entered into the form, allowing the team to submit a consolidated return. This process not only streamlines filing but also ensures that all members benefit from the same tax treatment.

Steps to complete the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year

Completing the Form IT 203 TM ATT A involves several key steps:

- Gather all relevant information for each nonresident athlete, including their income and identification details.

- Fill out the form accurately, ensuring that each athlete's information is correctly represented.

- Review the completed form for any errors or missing information before submission.

- Submit the form by the designated filing deadline to avoid penalties.

By following these steps, teams can ensure a smooth filing process and compliance with tax regulations.

Legal use of the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year

The legal use of the Form IT 203 TM ATT A is critical for nonresident athletic teams to fulfill their tax obligations in the U.S. This form is recognized by state tax authorities and must be used in accordance with relevant tax laws. It allows teams to report income earned by nonresident athletes without requiring each member to file separately. Proper use of this form helps prevent legal issues related to tax noncompliance, ensuring that athletes are taxed appropriately for their earnings while participating in U.S. events.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 203 TM ATT A are typically aligned with the general tax filing dates for the tax year. Teams should be aware of the specific deadline for submission, which is usually April fifteenth for the previous tax year. It is important to keep track of any changes in deadlines that may occur due to state regulations or special circumstances. Filing on time helps avoid penalties and ensures that athletes' tax obligations are met promptly.

Required Documents

To complete the Form IT 203 TM ATT A, teams must gather several required documents, including:

- Income statements for each nonresident athlete, such as W-2s or 1099s.

- Identification numbers for each athlete, either Social Security numbers or ITINs.

- Records of any tax withheld during the year for each athlete.

Having these documents ready will facilitate a smoother completion of the form and ensure accurate reporting of income.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 203 tm att a schedule a group return for nonresident athletic team members tax year 772088710

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year?

The Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year is a tax form used by nonresident athletic teams to report income earned in New York State. This form allows teams to file a single return for all members, simplifying the tax process. Understanding this form is crucial for compliance and accurate reporting.

-

How can airSlate SignNow help with the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year?

airSlate SignNow provides an efficient platform for electronically signing and sending the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year. Our solution streamlines the document management process, ensuring that all team members can easily sign and submit the necessary forms. This saves time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year. Our plans are cost-effective and designed to provide maximum value, ensuring you can manage your tax documents without breaking the bank. Contact us for detailed pricing information.

-

What features does airSlate SignNow offer for managing tax documents?

With airSlate SignNow, you gain access to features such as customizable templates, secure eSigning, and document tracking, all essential for managing the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year. These features enhance efficiency and ensure that all documents are handled securely and professionally. Our platform is user-friendly, making it easy for anyone to navigate.

-

Is airSlate SignNow compliant with tax regulations for the Form IT 203 TM ATT A Schedule A?

Yes, airSlate SignNow is designed to comply with all relevant tax regulations, including those pertaining to the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year. We prioritize security and compliance, ensuring that your documents are handled according to legal standards. This gives you peace of mind when managing sensitive tax information.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax preparation software, making it easier to manage the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year. This integration allows for a smoother workflow, enabling you to sync data and documents effortlessly. Check our integration options to find the best fit for your needs.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for managing the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, allowing for quick turnaround times. Additionally, you can track document status in real-time, ensuring nothing falls through the cracks.

Get more for Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year

- Childcarelicensingutahgovformsallhealth and safety plan child care licensing

- Office of enrollment management lsuedu form

- Exchange transfer number plates form

- Wwwmbleorgada accommodations requestmissouri board of law examiners ada accommodations request form

- Oregon lottery winner form

- Graduate legal intern agreement indiana board of law form

- Alabama packet 575713498 form

- Ohio motion record form

Find out other Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online