HEALTH CARE EXPENSE WORKSHEET Form 1200

What is the HEALTH CARE EXPENSE WORKSHEET form 1200

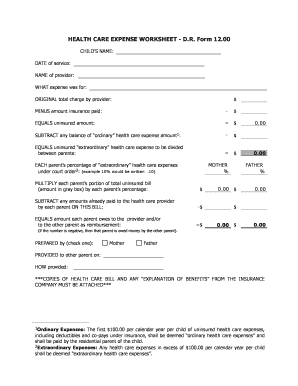

The HEALTH CARE EXPENSE WORKSHEET form 1200 is a document designed to help individuals and families track their medical expenses throughout the year. This form is particularly useful for those who wish to itemize their deductions on their tax returns. It provides a structured way to record various health care costs, including doctor visits, hospital stays, prescriptions, and other related expenses. By maintaining accurate records, users can ensure they maximize their eligible deductions and comply with IRS regulations.

How to use the HEALTH CARE EXPENSE WORKSHEET form 1200

Using the HEALTH CARE EXPENSE WORKSHEET form 1200 involves a few straightforward steps. First, gather all relevant receipts and documentation of your health care expenses. Next, fill out the form by entering each expense in the designated fields, including the date, type of service, and amount paid. Be sure to categorize expenses correctly to facilitate easier reporting during tax preparation. Once completed, keep a copy for your records, as you may need to refer to it when filing your taxes or if requested by the IRS.

Key elements of the HEALTH CARE EXPENSE WORKSHEET form 1200

The HEALTH CARE EXPENSE WORKSHEET form 1200 includes several key elements that are essential for effective tracking of medical expenses. These elements typically consist of:

- Date of Service: The date when the medical service was provided.

- Description of Service: A brief explanation of the type of medical service received.

- Provider Information: The name and contact details of the health care provider.

- Amount Paid: The total cost incurred for the service.

- Insurance Reimbursement: Any amounts reimbursed by insurance, if applicable.

These elements help ensure that all necessary information is captured, making it easier to report expenses accurately on tax returns.

Steps to complete the HEALTH CARE EXPENSE WORKSHEET form 1200

Completing the HEALTH CARE EXPENSE WORKSHEET form 1200 involves several clear steps:

- Collect Documentation: Gather all receipts and statements related to health care expenses.

- Fill Out the Form: Enter each expense in the appropriate fields, ensuring accuracy.

- Review Entries: Double-check all information for completeness and correctness.

- Save a Copy: Keep a digital or printed copy of the completed form for your records.

Following these steps will help ensure that you have a comprehensive record of your health care expenses.

How to obtain the HEALTH CARE EXPENSE WORKSHEET form 1200

The HEALTH CARE EXPENSE WORKSHEET form 1200 can be obtained through various means. Many individuals find it convenient to download the form directly from official websites that provide tax resources. Additionally, local tax preparation offices may have physical copies available. It is important to ensure that you are using the most current version of the form to comply with IRS requirements.

Legal use of the HEALTH CARE EXPENSE WORKSHEET form 1200

The HEALTH CARE EXPENSE WORKSHEET form 1200 serves a legal purpose in the context of tax reporting. It is used to substantiate claims for medical expense deductions on tax returns. By accurately completing and maintaining this form, individuals can demonstrate compliance with IRS guidelines regarding allowable deductions. It is advisable to retain this form and any supporting documentation for at least three years, as the IRS may request verification of expenses during audits.

Quick guide on how to complete health care expense worksheet form 1200

Complete HEALTH CARE EXPENSE WORKSHEET form 1200 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, alter, and eSign your documents quickly without any delays. Handle HEALTH CARE EXPENSE WORKSHEET form 1200 on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to adjust and eSign HEALTH CARE EXPENSE WORKSHEET form 1200 with ease

- Locate HEALTH CARE EXPENSE WORKSHEET form 1200 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure confidential information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign HEALTH CARE EXPENSE WORKSHEET form 1200 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the health care expense worksheet form 1200

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the HEALTH CARE EXPENSE WORKSHEET form 1200?

The HEALTH CARE EXPENSE WORKSHEET form 1200 is a document designed to help individuals and businesses track and manage their healthcare expenses effectively. It provides a structured format for recording various healthcare costs, ensuring that users can easily reference and analyze their spending. Utilizing this form can lead to better financial planning and budgeting for healthcare needs.

-

How can I access the HEALTH CARE EXPENSE WORKSHEET form 1200?

You can easily access the HEALTH CARE EXPENSE WORKSHEET form 1200 through the airSlate SignNow platform. Simply sign up for an account, and you will have the ability to download and customize the form to suit your specific needs. Our user-friendly interface makes it simple to get started.

-

Is there a cost associated with using the HEALTH CARE EXPENSE WORKSHEET form 1200?

While the HEALTH CARE EXPENSE WORKSHEET form 1200 itself is free to download, airSlate SignNow offers various pricing plans for additional features and services. These plans are designed to be cost-effective, allowing you to choose the level of service that best fits your budget and requirements. Explore our pricing options to find the right fit for you.

-

What features does the HEALTH CARE EXPENSE WORKSHEET form 1200 offer?

The HEALTH CARE EXPENSE WORKSHEET form 1200 includes features such as customizable fields, easy data entry, and the ability to track multiple expenses over time. Additionally, it integrates seamlessly with other airSlate SignNow tools, allowing for efficient document management and eSigning. This makes it a comprehensive solution for managing healthcare expenses.

-

How can the HEALTH CARE EXPENSE WORKSHEET form 1200 benefit my business?

Using the HEALTH CARE EXPENSE WORKSHEET form 1200 can signNowly benefit your business by providing a clear overview of healthcare expenditures. This transparency helps in budgeting and financial planning, ultimately leading to cost savings. Moreover, it simplifies the process of preparing for tax deductions related to healthcare expenses.

-

Can I integrate the HEALTH CARE EXPENSE WORKSHEET form 1200 with other software?

Yes, the HEALTH CARE EXPENSE WORKSHEET form 1200 can be integrated with various software applications through airSlate SignNow's API. This allows for seamless data transfer and enhances your overall workflow. By integrating with your existing systems, you can streamline the management of healthcare expenses.

-

Is the HEALTH CARE EXPENSE WORKSHEET form 1200 compliant with regulations?

The HEALTH CARE EXPENSE WORKSHEET form 1200 is designed to comply with relevant healthcare regulations and standards. By using this form, you can ensure that your documentation meets necessary compliance requirements, which is crucial for both individuals and businesses. Always consult with a professional for specific compliance needs.

Get more for HEALTH CARE EXPENSE WORKSHEET form 1200

- Letter to lienholder to notify of trust oklahoma form

- Timber sale contract oklahoma form

- Forest products sale contract timber oklahoma form

- Easement 497323256 form

- Oklahoma easement form

- Ok easement form

- Oklahoma easement 497323259 form

- Assumption agreement of mortgage and release of original mortgagors oklahoma form

Find out other HEALTH CARE EXPENSE WORKSHEET form 1200

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter