Form Hw 14

What is the Form Hw 14

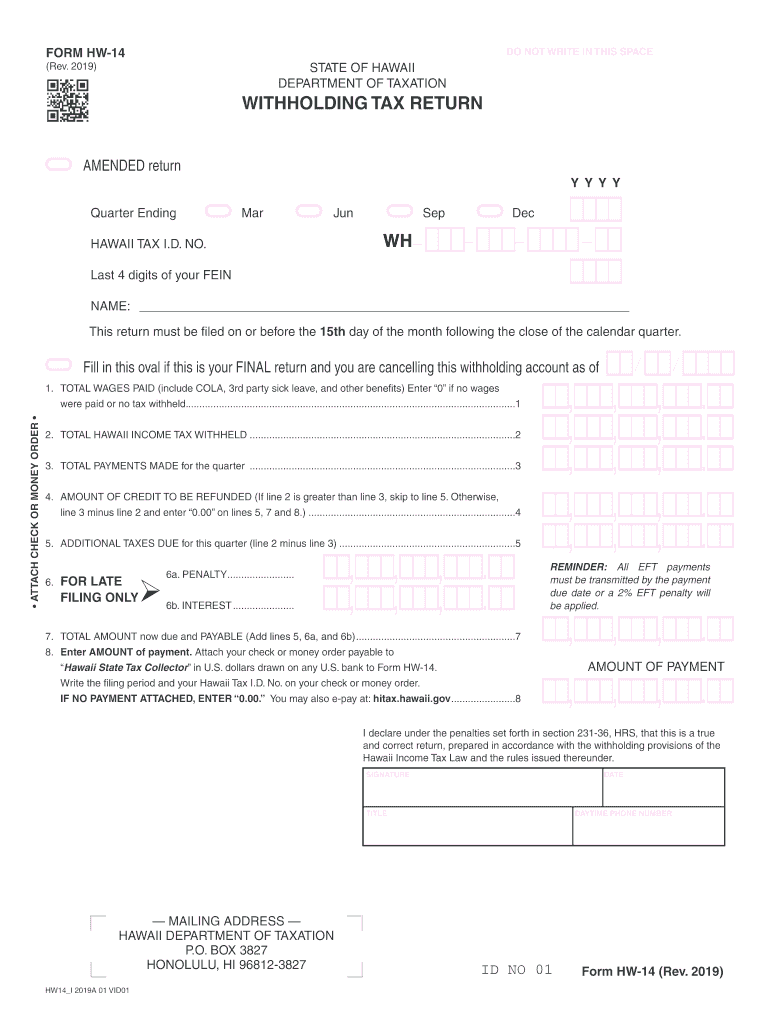

The Form Hw 14 is a tax document used primarily in Hawaii for reporting specific income and tax obligations. This form is essential for individuals and businesses to accurately declare their income and calculate the appropriate state tax liabilities. Understanding the purpose and requirements of the Hw 14 is crucial for compliance with Hawaii's tax laws.

How to use the Form Hw 14

Using the Form Hw 14 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out each section of the form, ensuring that all figures are accurate and reflect your current financial situation. After completing the form, review it for any errors before submission to avoid potential penalties.

Steps to complete the Form Hw 14

Completing the Form Hw 14 requires a systematic approach:

- Obtain the latest version of the Hw 14 form from official sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, detailing all sources of income as required.

- Calculate your tax liability based on the instructions provided with the form.

- Sign and date the form before submission.

Legal use of the Form Hw 14

The Form Hw 14 is legally binding when completed and submitted according to Hawaii's tax regulations. To ensure its validity, it must be filled out with accurate information and submitted by the designated deadlines. Compliance with state tax laws is critical to avoid legal repercussions, including fines and penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form Hw 14 are typically aligned with the state tax calendar. It is important to submit the form by the specified due date to avoid late fees. Generally, the deadline for filing individual tax returns in Hawaii is April 20. However, specific dates may vary, so it is advisable to check the latest updates from the Hawaii Department of Taxation.

Required Documents

To complete the Form Hw 14, certain documents are necessary:

- Income statements, including W-2s and 1099s.

- Previous tax returns for reference.

- Documentation of any deductions or credits you plan to claim.

Form Submission Methods (Online / Mail / In-Person)

The Form Hw 14 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online via the Hawaii Department of Taxation’s e-filing system, which is often the quickest option. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at local tax offices. Each method has its own processing times and requirements, so it is essential to choose the one that best suits your needs.

Quick guide on how to complete form hw 14 rev 2018 withholding tax return forms 2018

Complete Form Hw 14 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without hold-ups. Manage Form Hw 14 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form Hw 14 without effort

- Obtain Form Hw 14 and then click Get Form to begin.

- Use the tools we offer to submit your form.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Form Hw 14 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form hw 14 rev 2018 withholding tax return forms 2018

How to make an eSignature for your Form Hw 14 Rev 2018 Withholding Tax Return Forms 2018 in the online mode

How to generate an eSignature for the Form Hw 14 Rev 2018 Withholding Tax Return Forms 2018 in Google Chrome

How to create an eSignature for putting it on the Form Hw 14 Rev 2018 Withholding Tax Return Forms 2018 in Gmail

How to generate an electronic signature for the Form Hw 14 Rev 2018 Withholding Tax Return Forms 2018 straight from your mobile device

How to generate an electronic signature for the Form Hw 14 Rev 2018 Withholding Tax Return Forms 2018 on iOS

How to create an electronic signature for the Form Hw 14 Rev 2018 Withholding Tax Return Forms 2018 on Android devices

People also ask

-

What is hw14 and how does it work with airSlate SignNow?

hw14 refers to the innovative features offered by airSlate SignNow that streamline the eSigning process. This service allows users to efficiently send, sign, and manage documents electronically, ensuring a smooth workflow for businesses.

-

How much does airSlate SignNow with hw14 integration cost?

The pricing for airSlate SignNow varies based on the features you choose, including the advanced capabilities of hw14. We offer competitive plans suitable for all business sizes, allowing users to select a package that aligns with their document signing needs.

-

What features does hw14 include in airSlate SignNow?

hw14 includes features such as customizable workflows, secure document storage, and real-time tracking of document status. These functionalities make it easier for businesses to manage their eSign processes and enhance overall efficiency.

-

Can hw14 help improve my business’s productivity?

Yes, hw14 is designed to enhance productivity by automating and simplifying the eSigning experience. With its user-friendly interface and quick turnaround times, businesses can focus on what matters most while reducing administrative friction.

-

Is airSlate SignNow with hw14 easy to integrate with other tools?

Absolutely! airSlate SignNow with hw14 seamlessly integrates with various applications and tools, making it easy to incorporate into your existing workflows. This flexibility allows businesses to enhance their operations without extensive changes to current systems.

-

What type of customer support does airSlate SignNow offer for hw14 users?

airSlate SignNow provides comprehensive customer support for hw14 users, including live chat, email support, and detailed online documentation. This ensures that all users can get assistance promptly whenever they encounter issues or have questions.

-

Can I try airSlate SignNow featuring hw14 for free?

Yes, airSlate SignNow offers a free trial period that allows you to explore the features of hw14 thoroughly. This gives you the opportunity to understand how hw14 can meet your business needs before committing to a subscription.

Get more for Form Hw 14

Find out other Form Hw 14

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free