Form 500 Authorization to Disclose Tax Information & Designation 2023-2026

Understanding the Form 500: Authorization to Disclose Tax Information

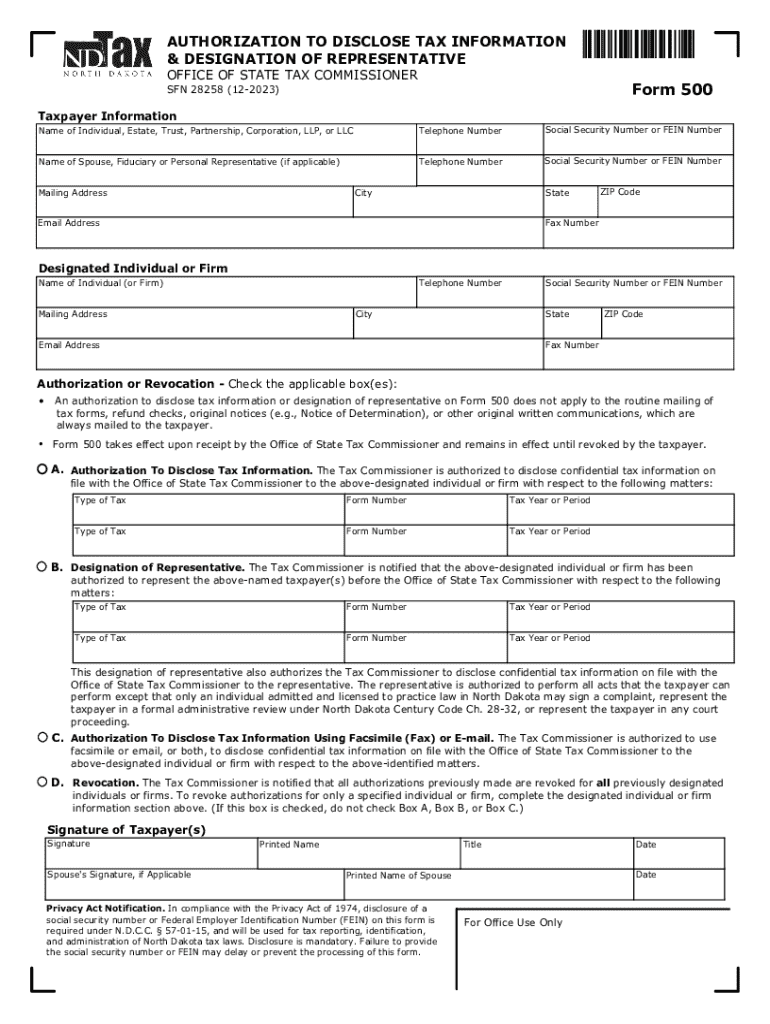

The Form 500, known as the Authorization to Disclose Tax Information, is a crucial document used by taxpayers in the United States to grant permission for the disclosure of their tax information. This form allows individuals to designate specific individuals or entities to receive their tax information from the Internal Revenue Service (IRS) or state tax authorities. The authorization can be vital for various situations, such as when a taxpayer requires assistance from a tax professional or needs to share information with a financial institution.

Steps to Complete the Form 500

Completing the Form 500 involves several straightforward steps:

- Gather necessary information: Collect your personal identification details, including your name, address, and Social Security number.

- Identify the recipient: Clearly specify the individual or entity you are authorizing to receive your tax information.

- Provide the scope of disclosure: Indicate the specific tax years and types of information you wish to disclose.

- Sign and date the form: Ensure that you sign and date the form to validate your authorization.

Once completed, the form can be submitted to the appropriate tax authority as instructed.

Legal Use of the Form 500

The Form 500 serves legal purposes by ensuring that taxpayer information is shared only with authorized individuals or entities. By using this form, taxpayers comply with privacy laws and regulations that protect sensitive tax information. It is essential to understand that unauthorized disclosure of tax information can lead to legal consequences, making the proper use of Form 500 critical for maintaining confidentiality and compliance.

Obtaining the Form 500

Taxpayers can easily obtain the Form 500 from various sources. The form is typically available on the official IRS website or through state tax authority websites. Additionally, tax professionals and accountants often provide the form to their clients as part of their services. Ensuring you have the most current version of the form is vital, as tax regulations can change.

Examples of Using the Form 500

The Form 500 can be utilized in various scenarios, including:

- When a taxpayer seeks assistance from a tax preparer or accountant who needs access to their tax records.

- For individuals applying for loans or financial aid that require verification of income or tax status.

- In situations where a taxpayer needs to authorize a family member to handle their tax matters.

These examples illustrate the form's versatility in facilitating the authorized sharing of tax information.

Filing Deadlines and Important Dates

While the Form 500 itself does not have a specific filing deadline, it is important to submit it timely to ensure that the authorized recipient can access the necessary tax information when needed. Taxpayers should be aware of relevant tax deadlines, such as filing their annual tax returns, to avoid complications. Keeping track of these dates helps ensure compliance and efficient processing of tax-related matters.

Eligibility Criteria for Using the Form 500

Eligibility to use the Form 500 generally includes any individual or entity that has filed a tax return and wishes to authorize the disclosure of their tax information. This includes:

- Individual taxpayers.

- Business entities, such as corporations or partnerships.

- Representatives or agents acting on behalf of the taxpayer.

Understanding the eligibility criteria ensures that the form is used appropriately and effectively.

Quick guide on how to complete form 500 authorization to disclose tax information designation

Effortlessly prepare Form 500 Authorization To Disclose Tax Information & Designation on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruption. Manage Form 500 Authorization To Disclose Tax Information & Designation on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Form 500 Authorization To Disclose Tax Information & Designation with ease

- Obtain Form 500 Authorization To Disclose Tax Information & Designation and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure confidential details using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 500 Authorization To Disclose Tax Information & Designation to ensure effective communication at every phase of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 500 authorization to disclose tax information designation

Create this form in 5 minutes!

How to create an eSignature for the form 500 authorization to disclose tax information designation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nd 500 plan offered by airSlate SignNow?

The nd 500 plan is a cost-effective solution designed for businesses that need to send and eSign up to 500 documents per month. This plan provides essential features that streamline document management and enhance workflow efficiency. With the nd 500 plan, users can easily manage their signing processes without breaking the bank.

-

What features are included in the nd 500 plan?

The nd 500 plan includes a variety of features such as customizable templates, real-time tracking, and advanced security options. Users can also enjoy integrations with popular applications, making it easier to manage documents across platforms. These features ensure that businesses can operate smoothly while utilizing the nd 500 plan.

-

How does the pricing of the nd 500 plan compare to other plans?

The nd 500 plan is competitively priced, making it an attractive option for small to medium-sized businesses. Compared to higher-tier plans, the nd 500 offers essential features at a lower cost, allowing businesses to save money while still benefiting from robust eSigning capabilities. This makes the nd 500 plan a smart choice for budget-conscious organizations.

-

Can I integrate the nd 500 plan with other software?

Yes, the nd 500 plan supports integrations with various software applications, including CRM systems and cloud storage services. This allows users to streamline their workflows and enhance productivity by connecting their existing tools with airSlate SignNow. Integrating the nd 500 plan with other software can signNowly improve document management efficiency.

-

What are the benefits of using the nd 500 plan for my business?

Using the nd 500 plan provides numerous benefits, including increased efficiency in document handling and improved turnaround times for signatures. Businesses can also reduce paper usage and associated costs, contributing to a more sustainable operation. Overall, the nd 500 plan empowers organizations to manage their documents effectively.

-

Is there a free trial available for the nd 500 plan?

Yes, airSlate SignNow offers a free trial for the nd 500 plan, allowing prospective customers to explore its features without any commitment. This trial period enables users to assess how the nd 500 plan fits their business needs before making a purchase. It's a great way to experience the benefits firsthand.

-

How secure is the nd 500 plan for document signing?

The nd 500 plan prioritizes security, employing advanced encryption and authentication measures to protect sensitive documents. Users can trust that their information is safe while using airSlate SignNow for eSigning. This commitment to security makes the nd 500 plan a reliable choice for businesses concerned about data protection.

Get more for Form 500 Authorization To Disclose Tax Information & Designation

Find out other Form 500 Authorization To Disclose Tax Information & Designation

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe