Form 500 Authorization to Disclose Tax Information 2013

What is the Form 500 Authorization To Disclose Tax Information

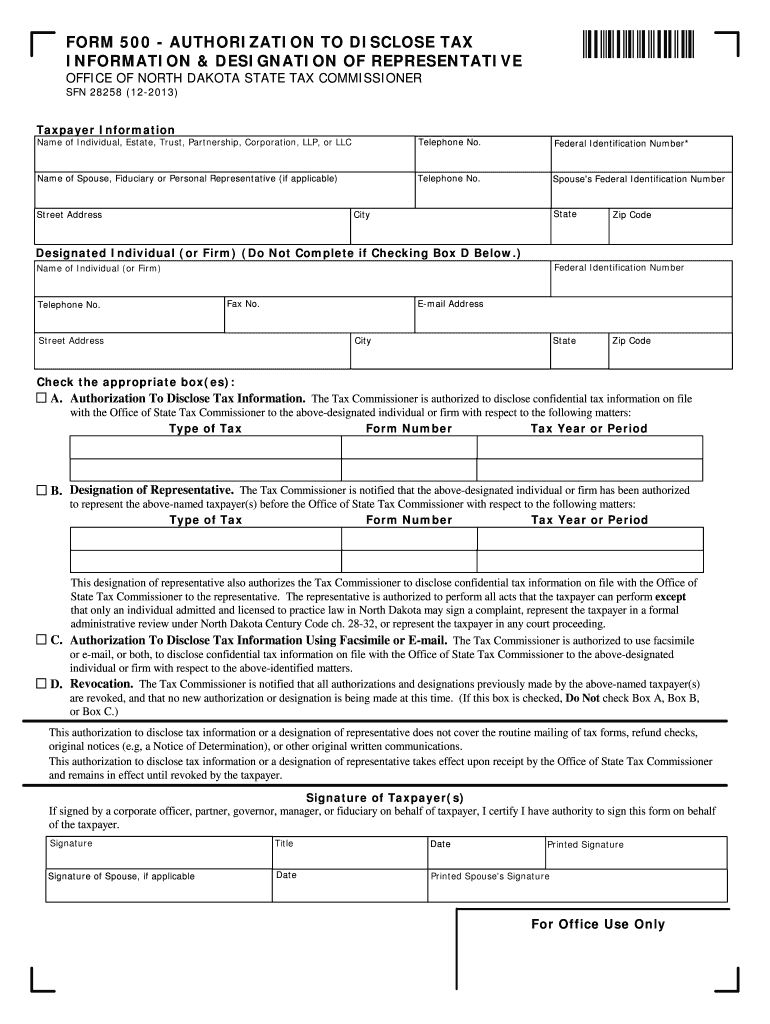

The Form 500 Authorization To Disclose Tax Information is a legal document that allows taxpayers to authorize the release of their tax information to designated third parties. This form is essential for individuals who need to share their tax data with financial institutions, tax preparers, or other entities for various purposes, such as loan applications or tax assistance. By completing this form, taxpayers ensure that their sensitive information is handled appropriately and shared only with authorized individuals or organizations.

How to use the Form 500 Authorization To Disclose Tax Information

Using the Form 500 Authorization To Disclose Tax Information involves several straightforward steps. First, the taxpayer must accurately fill out the form, providing necessary details such as their name, Social Security number, and the specific information they wish to disclose. Next, they should specify the recipient of the tax information and the purpose for which it is being shared. After completing the form, the taxpayer must sign and date it to validate the authorization. It is important to ensure that all information is correct to avoid delays or complications.

Steps to complete the Form 500 Authorization To Disclose Tax Information

Completing the Form 500 Authorization To Disclose Tax Information requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source.

- Fill in your personal information, including your full name and Social Security number.

- Indicate the specific tax information you wish to disclose.

- List the name and contact information of the individual or organization receiving the information.

- State the purpose for the disclosure.

- Sign and date the form to confirm your authorization.

After completing these steps, the form can be submitted to the designated recipient as instructed.

Legal use of the Form 500 Authorization To Disclose Tax Information

The legal use of the Form 500 Authorization To Disclose Tax Information is governed by federal and state laws. This form must be used in compliance with the Internal Revenue Service (IRS) guidelines to ensure that the disclosure of tax information is lawful. Taxpayers should be aware that unauthorized disclosure can lead to legal penalties. Proper completion and submission of the form protect both the taxpayer's rights and the confidentiality of their tax information.

Key elements of the Form 500 Authorization To Disclose Tax Information

Several key elements must be included in the Form 500 Authorization To Disclose Tax Information to ensure its validity:

- Taxpayer Information: Full name and Social Security number.

- Recipient Information: Name and contact details of the individual or organization receiving the information.

- Information to be Disclosed: Specific details about the tax information being shared.

- Purpose of Disclosure: Clear explanation of why the information is being shared.

- Signature and Date: The taxpayer's signature and the date of authorization.

Including these elements ensures that the form is complete and legally binding.

Disclosure Requirements

Disclosure requirements for the Form 500 Authorization To Disclose Tax Information are established to protect taxpayer privacy. The form must clearly state what information is being disclosed and to whom. Taxpayers should only authorize disclosures that are necessary for the intended purpose. Additionally, the recipient of the information must comply with applicable privacy laws, ensuring that the shared data is handled securely and used appropriately. Understanding these requirements helps maintain the integrity of the taxpayer's sensitive information.

Quick guide on how to complete form 500 authorization to disclose tax information

Complete Form 500 Authorization To Disclose Tax Information effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Form 500 Authorization To Disclose Tax Information on any platform using airSlate SignNow apps for Android or iOS and streamline any document-related tasks today.

How to modify and eSign Form 500 Authorization To Disclose Tax Information effortlessly

- Obtain Form 500 Authorization To Disclose Tax Information and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the information and then click the Done button to save your changes.

- Select how you wish to send your form, through email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form 500 Authorization To Disclose Tax Information to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 500 authorization to disclose tax information

Create this form in 5 minutes!

How to create an eSignature for the form 500 authorization to disclose tax information

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is the Form 500 Authorization To Disclose Tax Information?

The Form 500 Authorization To Disclose Tax Information is a document that allows individuals to permit the sharing of their tax-related information with third parties. This form is essential for ensuring that the relevant authorities can provide the necessary data to authorized entities, simplifying the process for tax inquiries and aids.

-

How can airSlate SignNow help with the Form 500 Authorization To Disclose Tax Information?

airSlate SignNow streamlines the process of preparing and eSigning the Form 500 Authorization To Disclose Tax Information. With our user-friendly platform, you can easily create, send, and manage your documents all in one place, ensuring a smooth experience without any hassles.

-

Is there a cost associated with using airSlate SignNow for the Form 500 Authorization To Disclose Tax Information?

Yes, there are pricing plans available for using airSlate SignNow, which provide cost-effective solutions for businesses. These plans include features tailored for handling documents like the Form 500 Authorization To Disclose Tax Information, allowing you to choose the one that best fits your needs and budget.

-

What features does airSlate SignNow offer for managing the Form 500 Authorization To Disclose Tax Information?

airSlate SignNow offers a variety of features to assist with the Form 500 Authorization To Disclose Tax Information, including customizable templates, secure storage, and seamless eSignature capabilities. These tools help you ensure compliance while efficiently managing your tax-related documents.

-

Can I integrate airSlate SignNow with other software for processing the Form 500 Authorization To Disclose Tax Information?

Yes, airSlate SignNow offers integrations with numerous applications and platforms, enhancing your workflow for the Form 500 Authorization To Disclose Tax Information. This allows you to connect with tools you already use, ensuring a cohesive and efficient document management system.

-

What are the benefits of using airSlate SignNow for the Form 500 Authorization To Disclose Tax Information?

Using airSlate SignNow for the Form 500 Authorization To Disclose Tax Information provides benefits such as increased speed in document signing, improved security, and reduced administrative tasks. By automating processes, you can save time and reduce the risk of errors in your tax document management.

-

How secure is the airSlate SignNow platform for submitting the Form 500 Authorization To Disclose Tax Information?

airSlate SignNow prioritizes security, implementing robust measures to protect your documents, including the Form 500 Authorization To Disclose Tax Information. Our platform uses encryption and complies with industry standards to ensure the safety and confidentiality of your sensitive tax information.

Get more for Form 500 Authorization To Disclose Tax Information

Find out other Form 500 Authorization To Disclose Tax Information

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word