OFFER in COMPROMISE INSTRUCTION BOOKLET Form

What is the Offer in Compromise Instruction Booklet

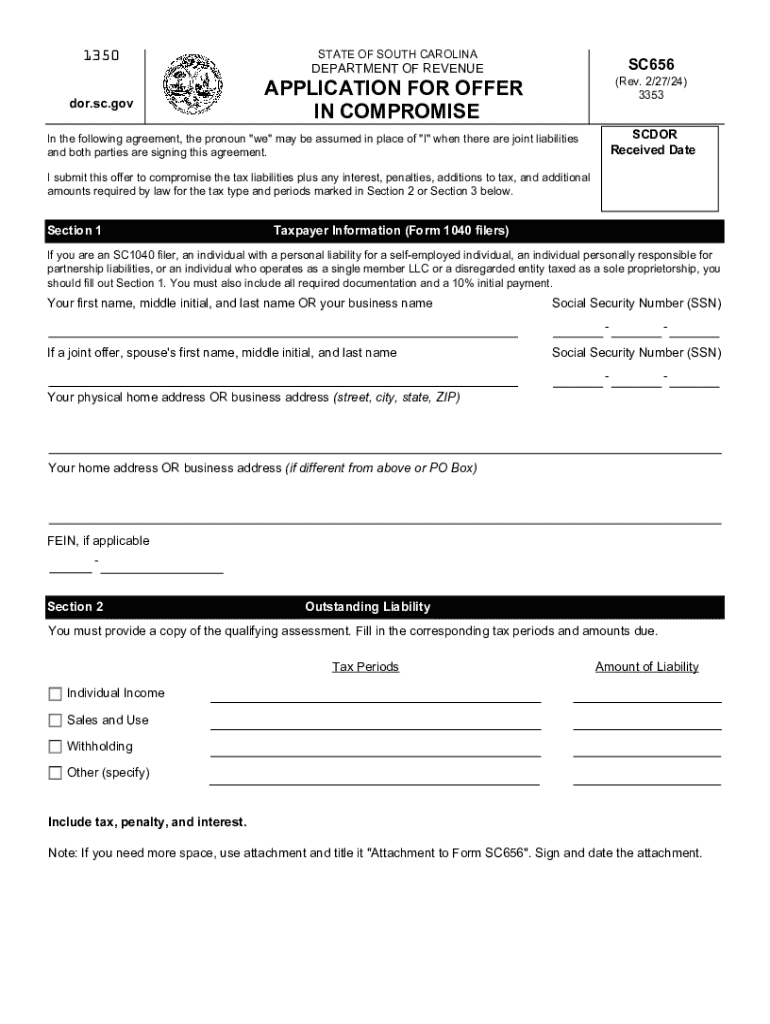

The Offer in Compromise Instruction Booklet provides essential guidelines for taxpayers seeking to settle their tax liabilities with the state for less than the full amount owed. This booklet outlines the criteria and processes involved in submitting an offer, including the necessary forms and documentation. It serves as a comprehensive resource for understanding the offer in compromise, ensuring that taxpayers are well-informed about their options.

Steps to Complete the Offer in Compromise Instruction Booklet

Completing the Offer in Compromise Instruction Booklet involves several key steps:

- Review the eligibility criteria to ensure you qualify for an offer in compromise.

- Gather the required financial documents, including income statements and asset details.

- Fill out the necessary forms, ensuring all information is accurate and complete.

- Submit the forms along with any required fees and supporting documentation to the appropriate state agency.

- Await a response regarding the acceptance or rejection of your offer.

Required Documents

When submitting an offer in compromise, specific documents are required to support your application. These typically include:

- Proof of income, such as pay stubs or tax returns.

- Details of assets, including bank statements and property valuations.

- Documentation of monthly expenses to demonstrate financial hardship.

- A completed Offer in Compromise form, such as SC Form SC656.

Eligibility Criteria

To qualify for an offer in compromise, taxpayers must meet certain eligibility criteria. These may include:

- Demonstrating an inability to pay the full tax liability due to financial hardship.

- Being current on all tax filings and payments.

- Providing accurate and complete financial information in the application.

Application Process & Approval Time

The application process for an offer in compromise can vary in duration. Generally, the steps include:

- Submitting the completed Offer in Compromise form along with required documentation.

- Paying the application fee, if applicable.

- Awaiting a review by the state agency, which may take several months.

- Receiving notification of the decision on your offer.

Form Submission Methods

Taxpayers can submit their Offer in Compromise forms through various methods, including:

- Online submission via the state’s tax portal, if available.

- Mailing the completed forms to the designated state agency address.

- In-person submission at local tax offices, if permitted.

Quick guide on how to complete offer in compromise instruction booklet

Complete OFFER IN COMPROMISE INSTRUCTION BOOKLET effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly and without interruptions. Manage OFFER IN COMPROMISE INSTRUCTION BOOKLET on any system with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and eSign OFFER IN COMPROMISE INSTRUCTION BOOKLET with ease

- Find OFFER IN COMPROMISE INSTRUCTION BOOKLET and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your alterations.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign OFFER IN COMPROMISE INSTRUCTION BOOKLET while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the offer in compromise instruction booklet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the revenue 3353 compromise and how does it affect businesses?

The revenue 3353 compromise refers to a specific regulatory challenge that businesses may face regarding revenue recognition. It impacts how companies report their earnings and can lead to compliance issues if not addressed properly. Understanding this compromise is crucial for businesses to ensure they remain compliant and avoid potential penalties.

-

How can airSlate SignNow help with the revenue 3353 compromise?

airSlate SignNow provides a streamlined solution for managing documents related to the revenue 3353 compromise. By enabling businesses to eSign and send documents securely, it ensures that all necessary compliance paperwork is handled efficiently. This helps businesses stay organized and compliant with regulatory requirements.

-

What features does airSlate SignNow offer to address the revenue 3353 compromise?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking that are essential for managing the revenue 3353 compromise. These tools allow businesses to create compliant documents quickly and monitor their status in real-time. This enhances efficiency and reduces the risk of errors.

-

Is airSlate SignNow cost-effective for managing the revenue 3353 compromise?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses dealing with the revenue 3353 compromise. With flexible pricing plans, companies can choose a package that fits their needs without overspending. This affordability makes it accessible for businesses of all sizes.

-

Can airSlate SignNow integrate with other tools to assist with the revenue 3353 compromise?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and software, enhancing its functionality in managing the revenue 3353 compromise. This integration allows for a more cohesive workflow, enabling businesses to connect their document management processes with existing systems.

-

What are the benefits of using airSlate SignNow for the revenue 3353 compromise?

Using airSlate SignNow for the revenue 3353 compromise offers numerous benefits, including improved compliance, faster document turnaround, and enhanced security. These advantages help businesses mitigate risks associated with regulatory challenges while streamlining their operations. Ultimately, it leads to better resource management and increased productivity.

-

How does airSlate SignNow ensure the security of documents related to the revenue 3353 compromise?

airSlate SignNow prioritizes document security, especially for sensitive information related to the revenue 3353 compromise. The platform employs advanced encryption and secure access controls to protect documents from unauthorized access. This commitment to security helps businesses maintain confidentiality and comply with regulations.

Get more for OFFER IN COMPROMISE INSTRUCTION BOOKLET

Find out other OFFER IN COMPROMISE INSTRUCTION BOOKLET

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online