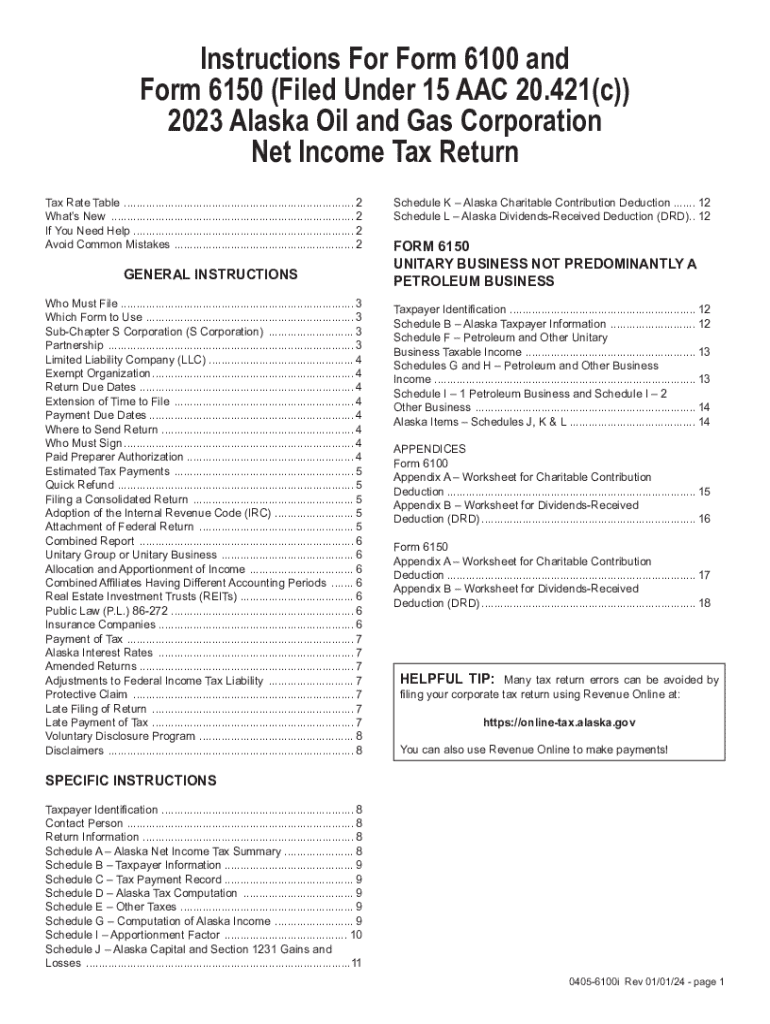

Alaska Oil and Gas Corporation Net Income Tax Return 2023-2026

What is the Alaska Oil And Gas Corporation Net Income Tax Return

The Alaska Oil And Gas Corporation Net Income Tax Return is a specific tax form required for corporations engaged in oil and gas activities within Alaska. This form is essential for reporting income, deductions, and calculating the tax liability for corporations operating in this sector. It ensures compliance with state tax laws and provides the state with necessary financial information about the corporation's operations.

How to use the Alaska Oil And Gas Corporation Net Income Tax Return

Using the Alaska Oil And Gas Corporation Net Income Tax Return involves several steps. First, gather all relevant financial documents, including income statements and expense records. Next, accurately fill out the form, ensuring that all income and deductions are reported correctly. After completing the form, review it for accuracy before submitting it to the appropriate state tax authority. It is crucial to keep a copy for your records.

Steps to complete the Alaska Oil And Gas Corporation Net Income Tax Return

Completing the Alaska Oil And Gas Corporation Net Income Tax Return requires a systematic approach:

- Collect financial records, including profit and loss statements.

- Fill in the corporation’s identifying information at the top of the form.

- Report total income from oil and gas activities, including any other business income.

- Detail allowable deductions, such as operating expenses and depreciation.

- Calculate the net income by subtracting total deductions from total income.

- Determine the tax liability based on the net income using the applicable tax rate.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Alaska Oil And Gas Corporation Net Income Tax Return. Typically, the return is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. Extensions may be available, but they must be requested before the original deadline.

Required Documents

To complete the Alaska Oil And Gas Corporation Net Income Tax Return, several documents are necessary:

- Financial statements, including income and expense reports.

- Records of all deductions claimed.

- Previous tax returns for reference.

- Any supporting documentation for credits or deductions.

Penalties for Non-Compliance

Failure to file the Alaska Oil And Gas Corporation Net Income Tax Return on time or inaccurately reporting income can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to ensure compliance to avoid these consequences, which can significantly impact the corporation's financial standing.

Quick guide on how to complete alaska oil and gas corporation net income tax return

Effortlessly Prepare Alaska Oil And Gas Corporation Net Income Tax Return on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed forms, as you can obtain the necessary template and securely keep it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Manage Alaska Oil And Gas Corporation Net Income Tax Return using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Alaska Oil And Gas Corporation Net Income Tax Return with ease

- Obtain Alaska Oil And Gas Corporation Net Income Tax Return and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your files or redact sensitive information using tools provided specifically for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, monotonous form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Edit and eSign Alaska Oil And Gas Corporation Net Income Tax Return and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska oil and gas corporation net income tax return

Create this form in 5 minutes!

How to create an eSignature for the alaska oil and gas corporation net income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alaska Oil And Gas Corporation Net Income Tax Return?

The Alaska Oil And Gas Corporation Net Income Tax Return is a tax form specifically designed for corporations engaged in oil and gas activities in Alaska. This return helps businesses report their income and calculate the taxes owed to the state. Understanding this form is crucial for compliance and financial planning.

-

How can airSlate SignNow assist with the Alaska Oil And Gas Corporation Net Income Tax Return?

airSlate SignNow provides a streamlined platform for businesses to prepare, sign, and submit their Alaska Oil And Gas Corporation Net Income Tax Return. With its user-friendly interface, you can easily manage documents and ensure timely submissions. This efficiency can save you time and reduce the risk of errors.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as eSignature capabilities, document templates, and secure cloud storage, all of which are beneficial for managing the Alaska Oil And Gas Corporation Net Income Tax Return. These tools help ensure that your documents are signed and stored securely, making tax season less stressful.

-

Is airSlate SignNow cost-effective for handling tax returns?

Yes, airSlate SignNow is a cost-effective solution for managing the Alaska Oil And Gas Corporation Net Income Tax Return. With various pricing plans available, businesses can choose an option that fits their budget while still accessing essential features. This affordability makes it an attractive choice for corporations of all sizes.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with popular accounting software, which can simplify the process of preparing your Alaska Oil And Gas Corporation Net Income Tax Return. By connecting your tools, you can streamline data transfer and enhance overall efficiency in your tax preparation process.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your Alaska Oil And Gas Corporation Net Income Tax Return provides numerous benefits, including enhanced security, ease of use, and faster processing times. The platform ensures that your documents are securely signed and stored, reducing the risk of loss or unauthorized access.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your Alaska Oil And Gas Corporation Net Income Tax Return and other sensitive documents. This commitment to security helps ensure that your information remains confidential and safe from unauthorized access.

Get more for Alaska Oil And Gas Corporation Net Income Tax Return

- South dakota business form

- South dakota pre incorporation agreement shareholders agreement and confidentiality agreement south dakota form

- Sd corporation form

- Corporate records maintenance package for existing corporations south dakota form

- South dakota limited liability company llc formation package south dakota

- Limited liability company llc operating agreement south dakota form

- Single member limited liability company llc operating agreement south dakota form

- Sd limited company form

Find out other Alaska Oil And Gas Corporation Net Income Tax Return

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement