NH 1041 ES Form 2024-2026

What is the NH 1041 ES Form

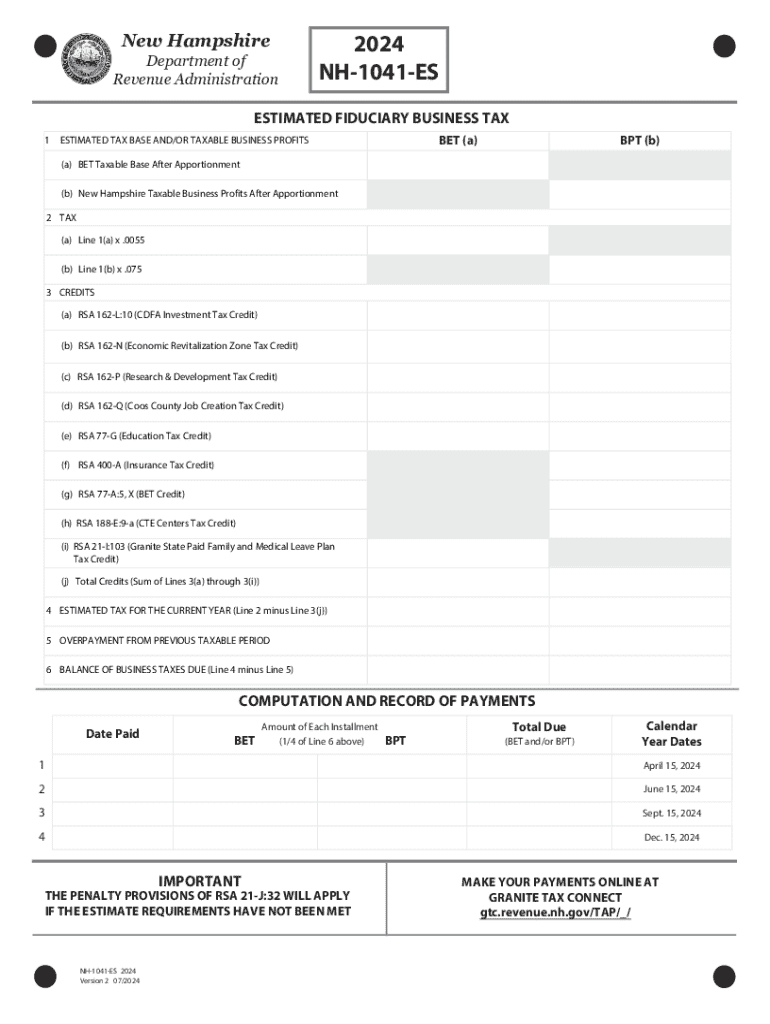

The NH 1041 ES Form is a tax form used by individuals and entities in New Hampshire to report estimated income tax payments. This form is particularly relevant for taxpayers who expect to owe tax of one thousand dollars or more when they file their annual income tax return. The NH 1041 ES Form allows taxpayers to make quarterly estimated payments, ensuring they meet their tax obligations throughout the year.

How to use the NH 1041 ES Form

To effectively use the NH 1041 ES Form, taxpayers must first determine their estimated tax liability for the year. This involves calculating expected income, deductions, and credits. Once the estimated tax amount is established, taxpayers can fill out the NH 1041 ES Form, indicating the amount they plan to pay each quarter. It is important to submit the form along with the payment by the specified deadlines to avoid penalties.

Steps to complete the NH 1041 ES Form

Completing the NH 1041 ES Form involves several key steps:

- Gather necessary financial information, including income sources and deductions.

- Calculate your estimated tax liability for the year.

- Fill out the NH 1041 ES Form with your personal information and estimated payment amounts.

- Review the form for accuracy to ensure all calculations are correct.

- Submit the form along with your payment by the due date.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing the NH 1041 ES Form. Estimated payments are typically due on the fifteenth day of April, June, September, and January of the following year. It is crucial to mark these dates on your calendar to ensure timely submissions and avoid any late fees or penalties.

Legal use of the NH 1041 ES Form

The NH 1041 ES Form is legally required for taxpayers who expect to owe significant tax amounts. Failing to file the form or make estimated payments can result in penalties and interest charges. It is essential for taxpayers to understand their obligations under New Hampshire tax law to remain compliant and avoid legal issues.

Who Issues the Form

The NH 1041 ES Form is issued by the New Hampshire Department of Revenue Administration. This state agency is responsible for overseeing tax collection and ensuring compliance with state tax laws. Taxpayers can obtain the form directly from the department's website or through authorized distribution channels.

Quick guide on how to complete nh 1041 es form

Complete NH 1041 ES Form effortlessly on any device

Online document administration has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly substitute to traditional printed and signed papers, allowing you to obtain the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage NH 1041 ES Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign NH 1041 ES Form with ease

- Locate NH 1041 ES Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Set aside concerns about lost or mislaid files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Alter and eSign NH 1041 ES Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nh 1041 es form

Create this form in 5 minutes!

How to create an eSignature for the nh 1041 es form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NH 1041 ES Form?

The NH 1041 ES Form is a tax form used by businesses in New Hampshire to report estimated income tax payments. It is essential for ensuring compliance with state tax regulations. Understanding how to properly fill out the NH 1041 ES Form can help avoid penalties and ensure timely payments.

-

How can airSlate SignNow help with the NH 1041 ES Form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the NH 1041 ES Form. With our solution, you can streamline the process, ensuring that your documents are securely signed and submitted on time. This efficiency can save you valuable time and reduce the risk of errors.

-

What are the pricing options for using airSlate SignNow for the NH 1041 ES Form?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while providing access to features that simplify the NH 1041 ES Form process. Check our website for detailed pricing information.

-

Are there any features specifically designed for the NH 1041 ES Form?

Yes, airSlate SignNow includes features that enhance the experience of managing the NH 1041 ES Form. These features include customizable templates, automated reminders, and secure storage options. These tools help ensure that your tax documents are handled efficiently and securely.

-

What are the benefits of using airSlate SignNow for the NH 1041 ES Form?

Using airSlate SignNow for the NH 1041 ES Form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to track the status of your documents in real-time, ensuring that you never miss a deadline. Additionally, electronic signatures are legally binding, making your submissions valid.

-

Can I integrate airSlate SignNow with other software for the NH 1041 ES Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for the NH 1041 ES Form. Whether you use accounting software or document management systems, our integrations help streamline the process and improve overall efficiency.

-

Is airSlate SignNow secure for handling the NH 1041 ES Form?

Yes, airSlate SignNow prioritizes security, ensuring that your NH 1041 ES Form and other documents are protected. We utilize advanced encryption and secure storage solutions to safeguard your sensitive information. You can trust that your data is safe with us.

Get more for NH 1041 ES Form

- Warranty deed from individual to corporation louisiana form

- Movables form

- Notice of nonpayment seller of movables individual louisiana form

- Quitclaim deed from individual to llc louisiana form

- La llc company form

- Notice nonpayment template form

- Louisiana notice form

- Quitclaim deed from husband and wife to corporation louisiana form

Find out other NH 1041 ES Form

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer