Wisconsin Schedule Wd Form

What is the Wisconsin Schedule WD?

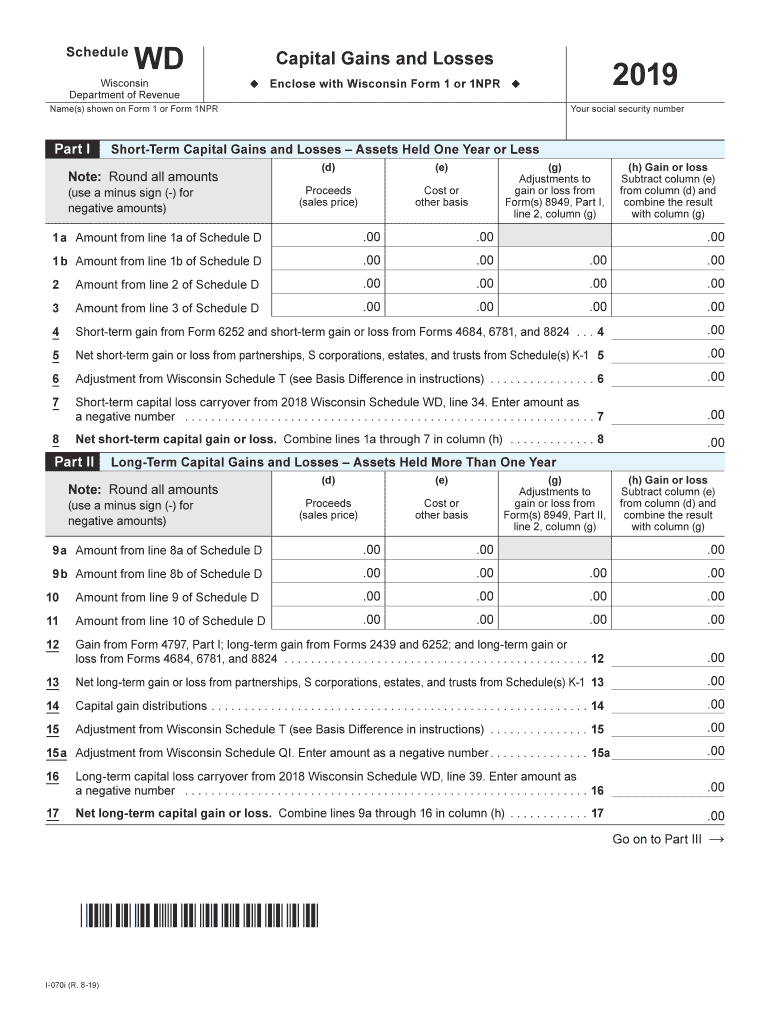

The Wisconsin Schedule WD is a tax form used by residents to report capital gains and losses from the sale of assets. This form is specifically designed for individuals who have incurred capital losses that can be deducted from their taxable income. The Schedule WD allows taxpayers to calculate their net capital gain or loss, which is essential for accurate tax reporting. It is an integral part of the Wisconsin income tax return process, ensuring that taxpayers comply with state tax laws while accurately reflecting their financial situation.

How to use the Wisconsin Schedule WD

Using the Wisconsin Schedule WD involves several key steps. First, gather all relevant documentation related to your capital gains and losses, including purchase and sale records of assets. Next, fill out the form by reporting each transaction, detailing the asset type, purchase date, sale date, and amounts involved. After calculating your total gains and losses, transfer the net figure to your main tax return. It is crucial to ensure that all calculations are accurate to avoid potential issues with the Wisconsin Department of Revenue.

Steps to complete the Wisconsin Schedule WD

Completing the Wisconsin Schedule WD requires careful attention to detail. Follow these steps:

- Collect all necessary documents, including records of asset purchases and sales.

- List each transaction on the form, specifying the type of asset, dates, and financial amounts.

- Calculate total capital gains and losses by summing individual entries.

- Determine your net capital gain or loss by subtracting total losses from total gains.

- Transfer the net figure to your main Wisconsin income tax return.

Legal use of the Wisconsin Schedule WD

The legal use of the Wisconsin Schedule WD is governed by state tax laws. To ensure compliance, it is essential that taxpayers accurately report their capital gains and losses. The form must be filed alongside the Wisconsin income tax return, and any discrepancies can lead to penalties or audits. Using electronic signature solutions like airSlate SignNow can enhance the legal validity of your submissions by ensuring secure and compliant electronic filing.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin Schedule WD align with the general income tax return deadlines. Typically, individual taxpayers must submit their returns by April 15 of each year. If you require additional time, you may file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these important dates is crucial for maintaining compliance with state tax regulations.

Required Documents

To complete the Wisconsin Schedule WD, several documents are necessary:

- Records of asset purchases and sales, including dates and amounts.

- Previous tax returns, if applicable, to reference prior capital gains or losses.

- Any supporting documentation related to deductions or credits that may apply.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete 2019 i 070 wisconsin schedule wd capital gains and losses fillable

Finish Wisconsin Schedule Wd effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the proper form and securely archive it online. airSlate SignNow provides all the tools necessary for you to create, amend, and electronically sign your documents quickly and without interruptions. Manage Wisconsin Schedule Wd on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest method to modify and electronically sign Wisconsin Schedule Wd with ease

- Obtain Wisconsin Schedule Wd and then click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Verify the information and click on the Done button to preserve your modifications.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate reprinting document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Wisconsin Schedule Wd and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 i 070 wisconsin schedule wd capital gains and losses fillable

How to generate an eSignature for the 2019 I 070 Wisconsin Schedule Wd Capital Gains And Losses Fillable in the online mode

How to generate an electronic signature for your 2019 I 070 Wisconsin Schedule Wd Capital Gains And Losses Fillable in Google Chrome

How to make an electronic signature for putting it on the 2019 I 070 Wisconsin Schedule Wd Capital Gains And Losses Fillable in Gmail

How to generate an electronic signature for the 2019 I 070 Wisconsin Schedule Wd Capital Gains And Losses Fillable straight from your smart phone

How to make an electronic signature for the 2019 I 070 Wisconsin Schedule Wd Capital Gains And Losses Fillable on iOS devices

How to make an electronic signature for the 2019 I 070 Wisconsin Schedule Wd Capital Gains And Losses Fillable on Android devices

People also ask

-

What is Wisconsin Schedule WD 2019 and why is it important?

Wisconsin Schedule WD 2019 is a tax form used to report Wisconsin income and calculate your state tax obligations. Understanding this form is crucial for individuals and businesses to ensure compliance with state tax laws. By using airSlate SignNow, you can easily manage and eSign your tax documents efficiently.

-

How can airSlate SignNow help me with Wisconsin Schedule WD 2019?

airSlate SignNow provides a seamless platform for sending and signing essential documents, including Wisconsin Schedule WD 2019. With our user-friendly interface, you can easily prepare, send, and store your tax forms securely online, ensuring you never miss a deadline.

-

Are there any costs associated with using airSlate SignNow for Wisconsin Schedule WD 2019?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Our cost-effective solutions allow you to manage Wisconsin Schedule WD 2019 eSignatures and workflows without breaking the bank. Explore our pricing page for more details on plans that suit you best.

-

What features does airSlate SignNow offer for managing tax documents like Wisconsin Schedule WD 2019?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking of your documents. These functionalities make it easier to manage your Wisconsin Schedule WD 2019 and ensure that all necessary signatures are collected promptly.

-

Can I integrate airSlate SignNow with other software for my tax needs?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as accounting software, CRM systems, and cloud storage services. This integration allows for streamlined processes when working with tax documents, including Wisconsin Schedule WD 2019.

-

Is airSlate SignNow compliant with Wisconsin state regulations for e-signatures?

Yes, airSlate SignNow complies with all relevant laws and regulations regarding electronic signatures in Wisconsin. This ensures that your eSigned documents, including Wisconsin Schedule WD 2019, are legally binding and secure.

-

What are the benefits of using airSlate SignNow for Wisconsin Schedule WD 2019?

Using airSlate SignNow for Wisconsin Schedule WD 2019 offers several benefits, including enhanced efficiency and reduced paperwork. You'll save time on administrative tasks and minimize the risk of errors, ensuring your tax documentation is handled accurately and professionally.

Get more for Wisconsin Schedule Wd

- Michigan application for master electrician form

- Tr 13a form

- Michigan fire alarm specialty license form

- Michigan pardon governor form

- Michigan department of licensing and regulatory affairs board of nursing michigan form

- Tr52 form

- Missouri employer withholding tax form

- Temporary third license plate application form

Find out other Wisconsin Schedule Wd

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors