DR 655 R 01 17 TC 07 24 Final 7 10 24 PDF 2024-2026

Understanding the DR 655 Form

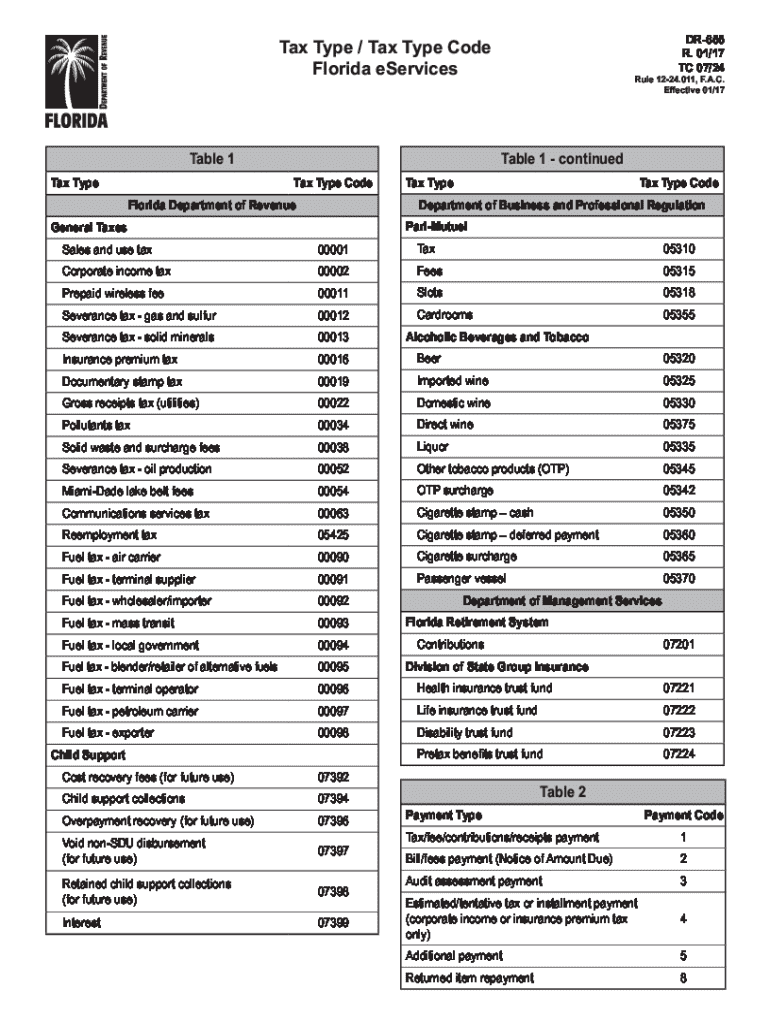

The DR 655 form, also known as the Florida Type Tax form, is essential for businesses operating within the state of Florida. This form is utilized to report various tax types and is crucial for compliance with the Florida tax code. It allows businesses to declare their tax liabilities accurately, ensuring that they meet state requirements and avoid potential penalties.

Steps to Complete the DR 655 Form

Completing the DR 655 form involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Identify the specific tax type applicable to your business, as outlined in the Florida tax code.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline to avoid penalties.

Obtaining the DR 655 Form

The DR 655 form can be obtained through the Florida Department of Revenue's website or by visiting their local offices. It is available in both digital and paper formats, allowing businesses to choose the method that best suits their needs. Ensure you have the most current version of the form, as updates may occur.

Legal Use of the DR 655 Form

The DR 655 form must be used in accordance with Florida state laws. It serves as a legal document that businesses must file to report their tax obligations. Failure to use this form correctly can result in legal repercussions, including fines and audits. It is important for businesses to understand the legal implications of their tax filings.

Filing Deadlines for the DR 655 Form

Filing deadlines for the DR 655 form vary depending on the specific tax type being reported. Businesses should be aware of these deadlines to ensure timely submissions. Late filings may incur penalties, so it is advisable to mark these dates on your calendar and prepare the necessary documentation in advance.

Examples of Using the DR 655 Form

Businesses in various sectors utilize the DR 655 form to report their tax liabilities. For instance, a retail store may use this form to declare sales tax collected from customers, while a service provider might report service taxes. Understanding how different industries apply the DR 655 can help businesses ensure compliance and accurate reporting.

Quick guide on how to complete dr 655 r 01 17 tc 07 24 final 7 10 24 pdf

Complete DR 655 R 01 17 TC 07 24 Final 7 10 24 pdf effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary templates and securely store them online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage DR 655 R 01 17 TC 07 24 Final 7 10 24 pdf on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to update and eSign DR 655 R 01 17 TC 07 24 Final 7 10 24 pdf effortlessly

- Locate DR 655 R 01 17 TC 07 24 Final 7 10 24 pdf and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to store your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks on any device of your choice. Modify and eSign DR 655 R 01 17 TC 07 24 Final 7 10 24 pdf and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 655 r 01 17 tc 07 24 final 7 10 24 pdf

Create this form in 5 minutes!

How to create an eSignature for the dr 655 r 01 17 tc 07 24 final 7 10 24 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Florida type tax and how does it affect my business?

A Florida type tax refers to various taxes imposed by the state of Florida, including sales tax, corporate income tax, and others. Understanding these taxes is crucial for compliance and financial planning. airSlate SignNow can help streamline document management related to tax filings, ensuring your business stays organized and compliant.

-

How can airSlate SignNow assist with Florida type tax documentation?

airSlate SignNow simplifies the process of preparing and signing documents related to Florida type tax. With our eSignature solution, you can easily send tax forms for signature, ensuring timely submissions. This efficiency can help reduce the risk of penalties associated with late filings.

-

What are the pricing options for airSlate SignNow for businesses dealing with Florida type tax?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses managing Florida type tax documentation. Our plans are designed to be cost-effective, allowing you to choose the features that best suit your requirements. You can start with a free trial to explore how our solution can benefit your tax processes.

-

Are there any specific features in airSlate SignNow that cater to Florida type tax needs?

Yes, airSlate SignNow includes features specifically designed to assist with Florida type tax documentation, such as customizable templates and automated workflows. These features help ensure that your tax documents are accurate and compliant with state regulations. Additionally, our platform allows for easy tracking of document status.

-

Can I integrate airSlate SignNow with other tools for managing Florida type tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage Florida type tax documentation. This integration allows for a more streamlined workflow, reducing the time spent on administrative tasks. You can connect with tools like QuickBooks and Xero for enhanced efficiency.

-

What benefits does airSlate SignNow provide for handling Florida type tax?

Using airSlate SignNow for Florida type tax documentation offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our eSignature solution ensures that your documents are signed quickly and securely, helping you meet tax deadlines. Additionally, the platform's user-friendly interface makes it accessible for all team members.

-

Is airSlate SignNow secure for managing sensitive Florida type tax documents?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive Florida type tax documents. Our platform is designed to meet industry standards for data protection, ensuring that your information remains confidential. You can trust us to handle your tax documentation securely.

Get more for DR 655 R 01 17 TC 07 24 Final 7 10 24 pdf

Find out other DR 655 R 01 17 TC 07 24 Final 7 10 24 pdf

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors