Florida Tax Code 2017

What is the Florida Tax Code

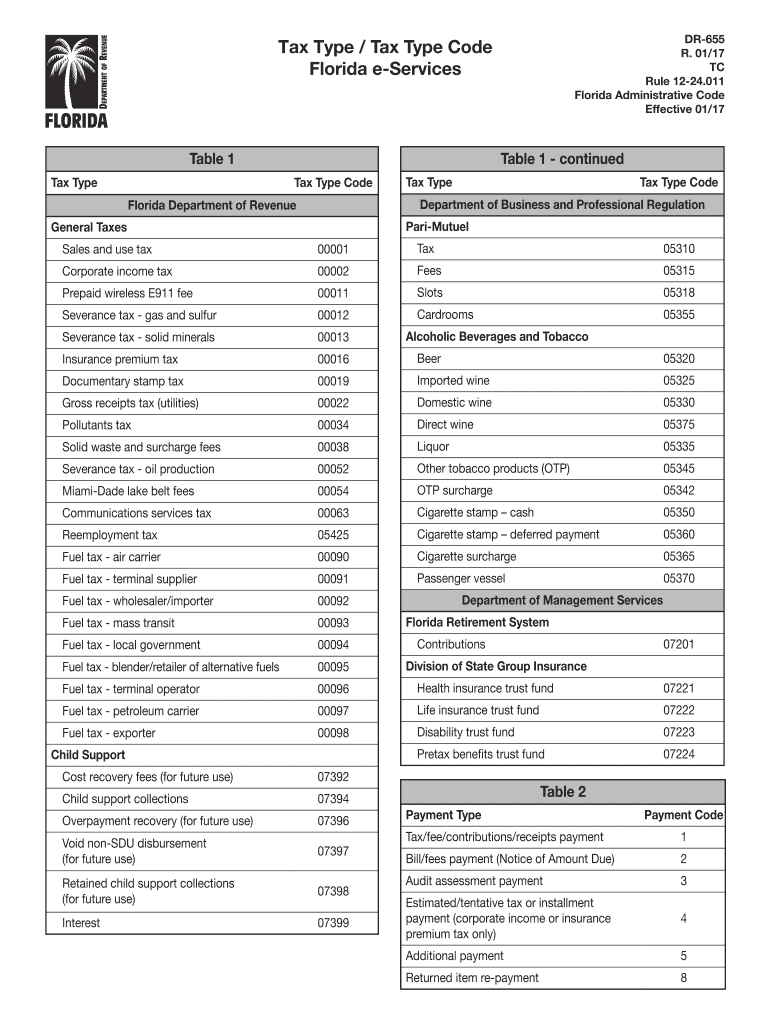

The Florida Tax Code encompasses the regulations and statutes governing taxation within the state of Florida. It includes various tax types, such as income tax, sales tax, and property tax, as well as specific provisions for different entities and individuals. Understanding the Florida Tax Code is essential for compliance and effective tax planning.

Steps to complete the Florida Tax Code

Completing forms related to the Florida Tax Code involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including personal identification details and financial records. Next, select the appropriate form, such as the DR-655 for specific tax situations. Carefully fill out the form, ensuring all sections are completed accurately. Review the completed document for any errors before submission. Finally, choose a submission method, whether online, by mail, or in person, to ensure timely processing.

Legal use of the Florida Tax Code

The legal use of the Florida Tax Code is essential for both individuals and businesses to avoid penalties and ensure compliance with state laws. Adhering to the guidelines set forth in the code helps maintain accurate records and fulfill tax obligations. This includes understanding the specific requirements for filing, payment deadlines, and documentation needed to support claims or deductions. Utilizing electronic signature solutions can also enhance the legal validity of submitted documents.

Required Documents

When dealing with the Florida Tax Code, specific documents are required to support tax filings. Commonly needed documents include proof of income, such as W-2 forms or 1099s, receipts for deductible expenses, and prior year tax returns. For business entities, additional documentation may include operating agreements, financial statements, and payroll records. Ensuring that all required documents are prepared and submitted accurately is crucial for compliance and to avoid delays in processing.

Filing Deadlines / Important Dates

Filing deadlines are critical components of the Florida Tax Code that taxpayers must adhere to. Typically, individual income tax returns are due on April 15th of each year, while corporate tax returns may have different deadlines based on the entity type. It is important to stay informed about any changes to these dates, including extensions that may be available. Marking these deadlines on a calendar can help ensure timely submissions and avoid potential penalties.

Examples of using the Florida Tax Code

Understanding practical applications of the Florida Tax Code can aid taxpayers in navigating their obligations. For instance, a self-employed individual may need to file a Schedule C along with their personal tax return to report business income and expenses. Similarly, a property owner may utilize the Florida Tax Code to apply for homestead exemptions, reducing their property tax burden. Familiarizing oneself with these examples can enhance compliance and optimize tax benefits.

Quick guide on how to complete florida tax code

Complete Florida Tax Code seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the features required to generate, modify, and electronically sign your documents swiftly without holdups. Manage Florida Tax Code on any device using airSlate SignNow mobile applications for Android or iOS and enhance any document-driven procedure today.

The easiest way to modify and electronically sign Florida Tax Code effortlessly

- Find Florida Tax Code and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Florida Tax Code to ensure outstanding communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida tax code

Create this form in 5 minutes!

How to create an eSignature for the florida tax code

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is a tax type code in airSlate SignNow?

A tax type code in airSlate SignNow is an identifier used for categorizing different types of taxes applicable to your documents. Accurate tax type codes ensure compliance and facilitate the correct processing of tax-related documents. Properly using a tax type code helps streamline your workflow and improves overall accuracy.

-

How does airSlate SignNow handle tax type codes?

airSlate SignNow allows users to easily integrate tax type codes into their document workflows. You can set tax type codes for your transactions, ensuring that all necessary tax information is included when sending or signing documents. This automation simplifies tax management for your business and improves compliance.

-

Are there any costs associated with using tax type codes in airSlate SignNow?

Using tax type codes within airSlate SignNow is included in our pricing plans. With a flexible, cost-effective solution, you can manage your document signing and eSigning processes without incurring extra charges specifically for tax type codes. Our transparent pricing ensures no hidden fees for this feature.

-

What features support tax type code management in airSlate SignNow?

airSlate SignNow offers several features that enhance the management of tax type codes, including customizable templates, automated workflows, and electronic signatures. These features help you apply the correct tax type code automatically based on predefined rules, reducing manual entry and errors. Automating your processes with these tools can save time and ensure accuracy.

-

Can I integrate tax type codes with other software using airSlate SignNow?

Yes, airSlate SignNow supports integration with various software that can help manage tax type codes efficiently. You can connect with accounting software, CRM systems, and other applications to streamline your workflow and ensure that your tax computations are accurate. This seamless integration enhances your operational efficiency.

-

How can I benefit from implementing tax type codes in my business?

Implementing tax type codes in your business with airSlate SignNow enhances accuracy in tax calculations and helps in maintaining compliance. It also simplifies your document management process, allowing you to focus on core business activities instead of manual tax tracking. Overall, it increases efficiency and reduces the risk of errors.

-

What support does airSlate SignNow provide for tax type code queries?

airSlate SignNow offers comprehensive customer support to assist users with any queries related to tax type codes. Our support team is available via chat, email, or phone to help you navigate the features that involve tax type codes. You can also access a rich knowledge base for self-help guidance.

Get more for Florida Tax Code

Find out other Florida Tax Code

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney