Liquor Tax Form 2024-2026

What is the Liquor Tax Form

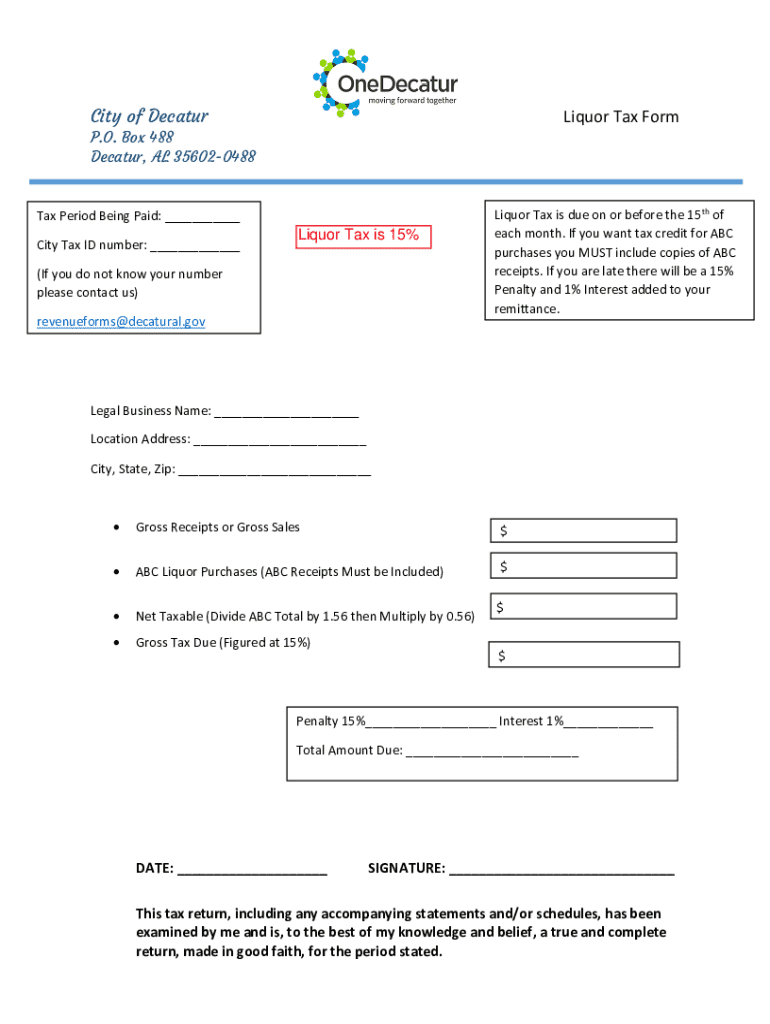

The Liquor Tax Form is a regulatory document required by state and federal authorities in the United States for businesses involved in the sale or distribution of alcoholic beverages. This form is used to report and remit taxes associated with the production, importation, and sale of liquor. It plays a crucial role in ensuring compliance with local laws and regulations governing the alcohol industry. Understanding the purpose and requirements of this form is essential for any business operating in this sector.

Steps to complete the Liquor Tax Form

Completing the Liquor Tax Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including business details, sales figures, and tax rates applicable to your specific state. Next, fill out the form accurately, ensuring that all figures are correct and that you have included any required supporting documentation. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form by the designated deadline to avoid penalties.

How to obtain the Liquor Tax Form

The Liquor Tax Form can typically be obtained through your state’s alcohol regulatory agency or department of revenue. Many states provide downloadable versions of the form on their official websites. Alternatively, you may contact the agency directly to request a physical copy. It is important to ensure you are using the most current version of the form, as regulations and requirements can change.

Filing Deadlines / Important Dates

Filing deadlines for the Liquor Tax Form vary by state and can depend on the specific type of liquor tax being reported. Generally, businesses must file the form on a monthly, quarterly, or annual basis, depending on their sales volume. It is essential to familiarize yourself with your state’s specific deadlines to avoid late fees or penalties. Keeping a calendar of important dates related to filing can help ensure timely submissions.

Key elements of the Liquor Tax Form

The Liquor Tax Form typically includes several key elements that must be accurately completed. These elements may include the business name and address, tax identification number, details of liquor sales, applicable tax rates, and total tax owed. Additionally, some forms may require information about the types of alcoholic beverages sold and any exemptions that may apply. Understanding these components is vital for accurate reporting and compliance.

Penalties for Non-Compliance

Failing to file the Liquor Tax Form on time or providing inaccurate information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from regulatory authorities. In some cases, repeated non-compliance can lead to the suspension or revocation of a business’s liquor license. It is crucial for businesses to adhere to all filing requirements to avoid these serious consequences.

State-specific rules for the Liquor Tax Form

Each state in the U.S. has its own rules and regulations regarding the Liquor Tax Form. These rules can dictate the filing frequency, tax rates, and specific information required on the form. Businesses must be aware of their state’s unique requirements to ensure compliance. Consulting with a tax professional or legal advisor familiar with local laws can provide valuable guidance in navigating these regulations.

Quick guide on how to complete liquor tax form

Complete Liquor Tax Form effortlessly on any device

Managing documents online has gained signNow popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Liquor Tax Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Liquor Tax Form with ease

- Find Liquor Tax Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Verify all details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device of your choice. Edit and eSign Liquor Tax Form and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct liquor tax form

Create this form in 5 minutes!

How to create an eSignature for the liquor tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Liquor Tax Form and why is it important?

A Liquor Tax Form is a document required by state and local governments to report and pay taxes on the sale of alcoholic beverages. It is important for businesses in the liquor industry to ensure compliance with tax regulations, avoiding potential fines and legal issues.

-

How can airSlate SignNow help with Liquor Tax Form submissions?

airSlate SignNow streamlines the process of completing and submitting Liquor Tax Forms by providing an easy-to-use platform for eSigning and document management. This ensures that your forms are filled out accurately and submitted on time, helping you stay compliant with tax regulations.

-

Is there a cost associated with using airSlate SignNow for Liquor Tax Forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to be cost-effective, allowing you to manage your Liquor Tax Forms efficiently without breaking the bank.

-

What features does airSlate SignNow offer for Liquor Tax Form management?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for Liquor Tax Forms. These features enhance your workflow, making it easier to manage your tax documentation.

-

Can I integrate airSlate SignNow with other software for Liquor Tax Forms?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to connect your Liquor Tax Form processes with your existing systems. This integration helps streamline your operations and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for Liquor Tax Forms?

Using airSlate SignNow for Liquor Tax Forms provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform simplifies the entire process, allowing you to focus on your business rather than administrative tasks.

-

Is airSlate SignNow secure for handling Liquor Tax Forms?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Liquor Tax Forms are handled with the utmost care. The platform uses advanced encryption and security measures to protect your sensitive information.

Get more for Liquor Tax Form

- Application for sublease louisiana form

- Inventory and condition of leased premises for pre lease and post lease louisiana form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out louisiana form

- Property manager agreement louisiana form

- Agreement for delayed or partial rent payments louisiana form

- Tenants maintenance repair request form louisiana

- Guaranty attachment to lease for guarantor or cosigner louisiana form

- Amendment to lease or rental agreement louisiana form

Find out other Liquor Tax Form

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile