MW506NRS Maryland Return of Income Tax Witholding for Nonresident Sale of Real Property MW506NRS Maryland Return of Income Tax W Form

Understanding the MW506NRS Maryland Return of Income Tax Withholding for Nonresident Sale of Real Property

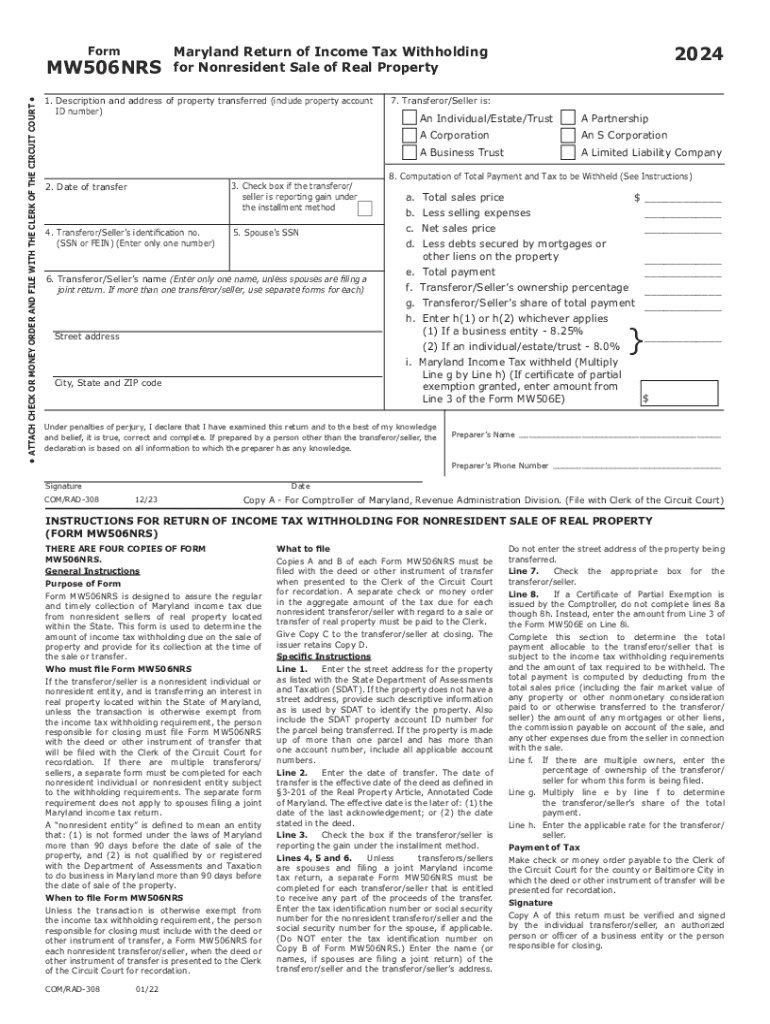

The MW506NRS is a specific tax form used in Maryland for reporting income tax withholding related to the sale of real property by nonresidents. This form is essential for sellers who do not reside in Maryland but are involved in real estate transactions within the state. It ensures that the appropriate taxes are withheld and reported to the Maryland Comptroller's office, thereby complying with state tax laws. The form captures vital information about the property sale, including the seller's details, the buyer's information, and the amount of tax being withheld.

Steps to Complete the MW506NRS Form

Completing the MW506NRS form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the property address, sale price, and details about both the seller and buyer. Next, fill out the form by providing the required information in the designated sections. It is crucial to calculate the withholding amount correctly, which is typically a percentage of the sale price. After completing the form, review all entries for accuracy before submitting it to the Maryland Comptroller's office. Ensure that you keep a copy for your records.

Required Documents for Filing the MW506NRS

When filing the MW506NRS, certain documents are necessary to support the information provided on the form. These include a copy of the sales contract, proof of the sale price, and any additional documentation that verifies the seller's nonresident status. It is also advisable to have identification documents ready, such as a driver's license or passport, to confirm the identity of the seller. Having these documents prepared can streamline the filing process and help avoid any potential issues with the Maryland tax authorities.

Filing Deadlines for the MW506NRS Form

Timely submission of the MW506NRS is essential to avoid penalties. The form must be filed within a specific timeframe, typically due at the time of the sale closing. It is important to check the exact deadlines as they may vary based on the date of the transaction. Additionally, if the withholding tax is not remitted on time, the seller may face penalties, including interest on the unpaid amount. Staying informed about these deadlines can help ensure compliance and prevent unnecessary financial consequences.

Legal Use of the MW506NRS Form

The MW506NRS form is legally mandated for nonresidents selling real property in Maryland. It serves to ensure that the state collects the appropriate income tax from transactions involving nonresident sellers. Failure to use this form can result in legal repercussions, including fines or additional tax liabilities. Understanding the legal implications of the MW506NRS is crucial for nonresident sellers to protect themselves and comply with Maryland tax laws.

State-Specific Rules for the MW506NRS

Maryland has specific regulations governing the use of the MW506NRS form. These rules dictate the withholding rates, eligibility criteria for nonresidents, and the process for filing the form. It is important for sellers to familiarize themselves with these state-specific guidelines to ensure compliance. For instance, the withholding rate may vary based on the sale price of the property, and certain exemptions may apply depending on the seller's circumstances. Understanding these nuances can help sellers navigate the tax implications of their real estate transactions effectively.

Quick guide on how to complete mw506nrs maryland return of income tax witholding for nonresident sale of real property mw506nrs maryland return of income tax

Easily prepare MW506NRS Maryland Return Of Income Tax Witholding For Nonresident Sale Of Real Property MW506NRS Maryland Return Of Income Tax W on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an exceptional eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents rapidly without delays. Manage MW506NRS Maryland Return Of Income Tax Witholding For Nonresident Sale Of Real Property MW506NRS Maryland Return Of Income Tax W on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign MW506NRS Maryland Return Of Income Tax Witholding For Nonresident Sale Of Real Property MW506NRS Maryland Return Of Income Tax W effortlessly

- Obtain MW506NRS Maryland Return Of Income Tax Witholding For Nonresident Sale Of Real Property MW506NRS Maryland Return Of Income Tax W and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign MW506NRS Maryland Return Of Income Tax Witholding For Nonresident Sale Of Real Property MW506NRS Maryland Return Of Income Tax W and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mw506nrs maryland return of income tax witholding for nonresident sale of real property mw506nrs maryland return of income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland MW506NRS form?

The Maryland MW506NRS form is a tax document used for reporting non-resident withholding tax in Maryland. It is essential for businesses that hire non-resident employees or contractors. Understanding how to properly fill out the Maryland MW506NRS can help ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the Maryland MW506NRS form?

airSlate SignNow provides an efficient platform for electronically signing and sending the Maryland MW506NRS form. With its user-friendly interface, you can easily manage your documents and ensure they are securely signed. This streamlines the process and reduces the time spent on paperwork.

-

What are the pricing options for using airSlate SignNow for the Maryland MW506NRS?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for those specifically handling the Maryland MW506NRS. Each plan provides access to essential features like eSigning and document management. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Maryland MW506NRS?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for the Maryland MW506NRS. These tools help you manage your documents efficiently and ensure that all necessary signatures are obtained promptly. This enhances your workflow and compliance.

-

Are there any benefits to using airSlate SignNow for the Maryland MW506NRS?

Using airSlate SignNow for the Maryland MW506NRS offers numerous benefits, including increased efficiency and reduced turnaround time for document signing. The platform also enhances security and compliance, ensuring that your sensitive information is protected. This can lead to improved business operations overall.

-

Can I integrate airSlate SignNow with other software for the Maryland MW506NRS?

Yes, airSlate SignNow can be integrated with various software solutions to streamline the process of managing the Maryland MW506NRS. This includes popular CRM and accounting software, allowing for seamless data transfer and improved workflow. Integrations can enhance your overall efficiency.

-

Is airSlate SignNow compliant with Maryland regulations for the MW506NRS?

Absolutely, airSlate SignNow is designed to comply with Maryland regulations regarding the MW506NRS. The platform ensures that all electronic signatures meet legal standards, providing peace of mind for businesses. This compliance is crucial for avoiding potential legal issues.

Get more for MW506NRS Maryland Return Of Income Tax Witholding For Nonresident Sale Of Real Property MW506NRS Maryland Return Of Income Tax W

- Warranty deed from corporation to two individuals texas form

- Texas contempt form

- Texas demand payment form

- Texas payment contractor form

- Warranty deed from individual to a trust texas form

- Warranty deed from husband and wife to a trust texas form

- Affidavit of payment of subcontractors etc by contractor on residential project mechanics liens corporation or llc texas form

- Texas disbursement form

Find out other MW506NRS Maryland Return Of Income Tax Witholding For Nonresident Sale Of Real Property MW506NRS Maryland Return Of Income Tax W

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement