1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1

Understanding the 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1

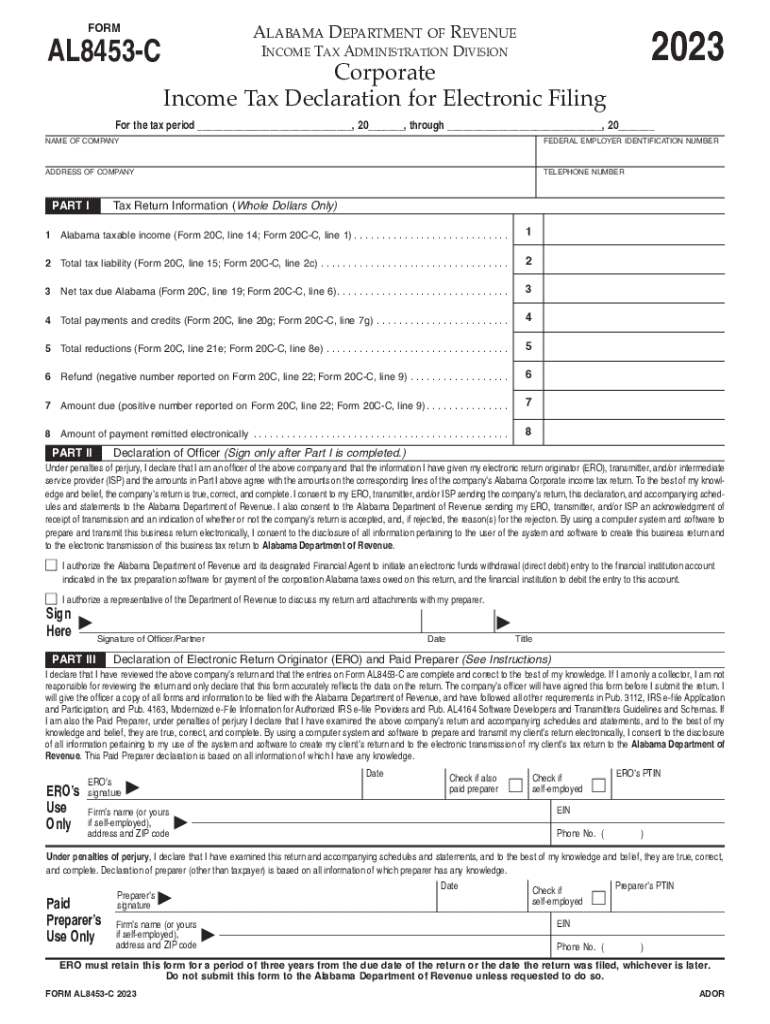

The 1 Alabama Taxable Income Form 20C is a crucial document for businesses operating in Alabama. Specifically, Line 14 of Form 20C and Line 1 of Form 20C C focus on reporting taxable income. These lines require accurate figures to ensure compliance with state tax laws. Understanding the purpose of these lines helps businesses calculate their tax obligations correctly and avoid potential penalties.

How to Complete the 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1

Filling out the 1 Alabama Taxable Income Form 20C involves several steps. First, gather all relevant financial documents, including income statements and expense reports. Next, locate Line 14 on Form 20C and Line 1 on Form 20C C. Enter the total taxable income as calculated from your financial records. Ensure that all figures are accurate and reflect your business's financial activity for the tax year. Double-check your entries to minimize errors before submission.

Obtaining the 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1

The 1 Alabama Taxable Income Form 20C can be obtained through the Alabama Department of Revenue's official website. The forms are typically available in PDF format, allowing for easy printing and completion. Additionally, businesses may consult with tax professionals who can provide guidance on obtaining and filling out these forms correctly.

Key Elements of the 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1

Key elements of the 1 Alabama Taxable Income Form 20C include specific lines that capture essential financial data. Line 14 focuses on total taxable income, while Line 1 of Form 20C C may pertain to adjustments or specific deductions. Understanding these elements is vital for accurate tax reporting and compliance with Alabama tax regulations.

Filing Deadlines for the 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1

Filing deadlines for the 1 Alabama Taxable Income Form 20C are typically aligned with the federal tax deadlines. Businesses should be aware of these dates to avoid late filing penalties. It is advisable to check the Alabama Department of Revenue's website for any updates or changes to the filing schedule, ensuring timely submission of the required forms.

Digital Submission Methods for the 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1

Businesses can submit the 1 Alabama Taxable Income Form 20C digitally through the Alabama Department of Revenue’s online portal. This method provides a convenient and efficient way to file tax forms. Digital submission often allows for quicker processing times, reducing the wait for confirmation of filing. Ensure that all information is complete and accurate before submitting online.

Quick guide on how to complete 1 alabama taxable income form 20c line 14 form 20c c line 1

Complete 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1 effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Handle 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to modify and eSign 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1 with ease

- Acquire 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1 and click on Get Form to begin.

- Make use of the tools available to complete your form.

- Highlight important sections of the documents or black out sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1 and ensure excellent communication at any stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1 alabama taxable income form 20c line 14 form 20c c line 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1?

The 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1 is a specific line item on Alabama tax forms used to report taxable income. It is essential for accurately calculating your state tax obligations. Understanding how to fill out this form correctly can help ensure compliance and avoid penalties.

-

How can airSlate SignNow help with the 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1?

airSlate SignNow provides an efficient platform for electronically signing and sending documents, including tax forms like the 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1. This streamlines the process, making it easier to manage your tax documentation securely and efficiently.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to features that simplify the completion and signing of documents like the 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available with airSlate SignNow for tax preparation?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This allows users to easily import and export data related to the 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1, enhancing your workflow and ensuring accuracy in your tax filings.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow includes features such as document templates, automated workflows, and secure cloud storage. These tools are particularly useful for managing tax documents like the 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1, ensuring that you can access and complete your forms efficiently.

-

Is airSlate SignNow secure for handling sensitive tax information?

Absolutely, airSlate SignNow prioritizes security and compliance, utilizing encryption and secure access protocols. This ensures that your sensitive information, including details from the 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1, is protected throughout the signing and storage process.

-

Can I track the status of my documents with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your documents in real-time. This is particularly beneficial for important tax forms like the 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1, ensuring you know when it has been signed and submitted.

Get more for 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1

Find out other 1 Alabama Taxable Income Form 20C, Line 14; Form 20C C, Line 1

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter

- How To Sign Hawaii Military Leave Policy

- How Do I Sign Alaska Paid-Time-Off Policy

- Sign Virginia Drug and Alcohol Policy Easy

- How To Sign New Jersey Funeral Leave Policy

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter