Payment on Delaware 200 V Form

What is the Payment on Delaware Form 200 V

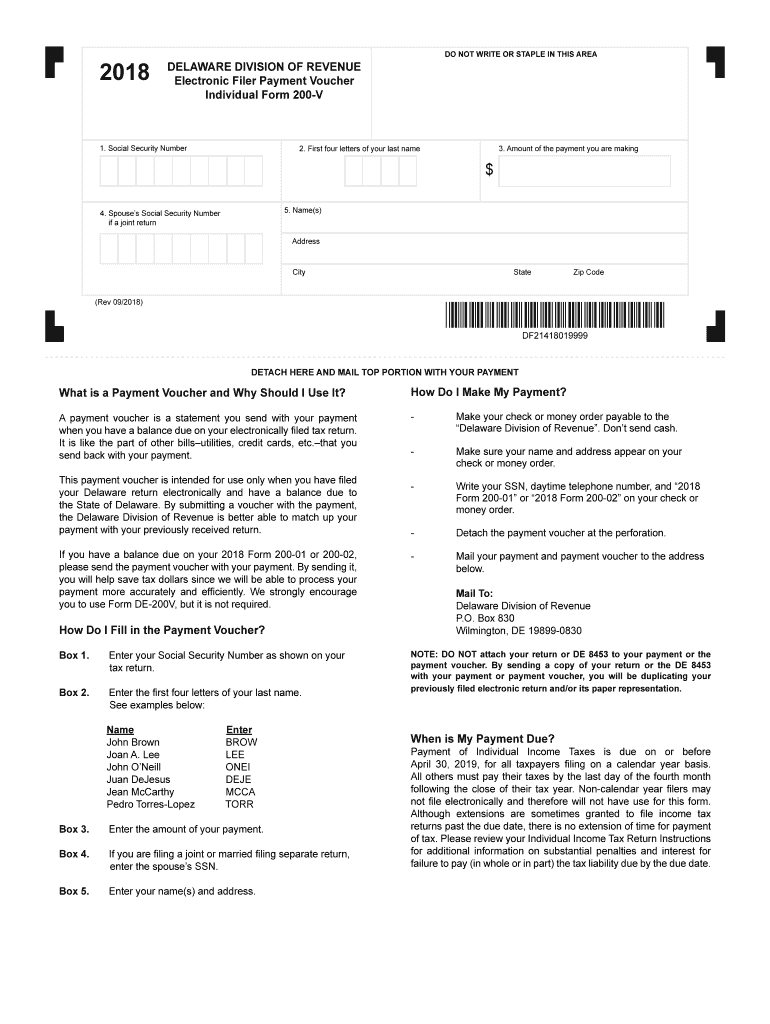

The Payment on Delaware Form 200 V is an estimated payment voucher used by individuals and businesses in the state of Delaware to remit their estimated income tax payments. This form is essential for taxpayers who expect to owe tax of one thousand dollars or more when they file their annual tax return. By submitting this voucher, taxpayers can ensure they meet their tax obligations throughout the year, thereby avoiding potential penalties for underpayment.

Steps to Complete the Payment on Delaware Form 200 V

Completing the Delaware Form 200 V involves several straightforward steps:

- Gather necessary information: Collect your previous year's tax return and any relevant financial documents.

- Calculate your estimated tax: Use your expected income, deductions, and credits to determine your estimated tax liability for the year.

- Fill out the form: Enter your personal information, including your name, address, and Social Security number, as well as the calculated estimated tax amount.

- Choose your payment method: Decide whether to pay electronically or by check.

- Review and sign: Ensure all information is accurate before signing the form.

- Submit the form: Send the completed voucher to the appropriate state tax authority.

Legal Use of the Payment on Delaware Form 200 V

The Delaware Form 200 V is legally recognized as a valid method for making estimated tax payments. To ensure compliance, taxpayers must adhere to state regulations regarding the submission of this form. It is crucial to submit the payment on or before the due dates specified by the Delaware Division of Revenue to avoid penalties. The form serves as proof of payment and can be used for record-keeping purposes in case of audits or inquiries.

Filing Deadlines / Important Dates

Timely submission of the Delaware Form 200 V is essential to avoid penalties. The deadlines for estimated payments typically align with the following schedule:

- First payment: April 30

- Second payment: June 30

- Third payment: September 30

- Fourth payment: January 31 of the following year

Taxpayers should mark these dates on their calendars to ensure they meet their obligations without incurring late fees.

Form Submission Methods

Taxpayers have several options for submitting the Delaware Form 200 V:

- Online: Payments can be made electronically through the Delaware Division of Revenue’s online portal.

- By Mail: Completed forms can be mailed to the appropriate tax office address provided on the form.

- In-Person: Taxpayers may also submit the form in person at designated tax offices.

Choosing the right submission method can enhance convenience and ensure timely processing of payments.

Key Elements of the Payment on Delaware Form 200 V

Understanding the key elements of the Delaware Form 200 V is crucial for accurate completion:

- Taxpayer Information: This includes your name, address, and Social Security number or Employer Identification Number.

- Estimated Tax Amount: The total estimated tax you expect to owe for the year.

- Payment Method: Indicate whether you are paying electronically or by check.

- Signature: A signature is required to validate the submission.

Each of these components must be completed accurately to ensure the form is processed correctly.

Quick guide on how to complete electronic filer payment voucher

Prepare Payment On Delaware 200 V effortlessly on any device

Online document management has gained popularity among enterprises and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Handle Payment On Delaware 200 V on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Payment On Delaware 200 V seamlessly

- Find Payment On Delaware 200 V and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your adjustments.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Payment On Delaware 200 V to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the electronic filer payment voucher

How to create an eSignature for your Electronic Filer Payment Voucher online

How to generate an electronic signature for your Electronic Filer Payment Voucher in Google Chrome

How to generate an eSignature for putting it on the Electronic Filer Payment Voucher in Gmail

How to generate an eSignature for the Electronic Filer Payment Voucher right from your smartphone

How to generate an electronic signature for the Electronic Filer Payment Voucher on iOS devices

How to create an electronic signature for the Electronic Filer Payment Voucher on Android OS

People also ask

-

What is the Delaware 200 V form?

The Delaware 200 V form is a vital document required for the filing of annual reports in the state of Delaware. It helps businesses ensure compliance with state regulations and is essential for maintaining good standing. Understanding the importance of the Delaware 200 V form can streamline your annual report filing.

-

How can airSlate SignNow help with the Delaware 200 V form?

AirSlate SignNow simplifies the process of completing and eSigning the Delaware 200 V form. With our user-friendly platform, you can easily prepare your form and obtain the necessary signatures in a secure manner. Our solution ensures timely submission and compliance with Delaware's requirements.

-

Is there a cost associated with using airSlate SignNow for the Delaware 200 V form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our solutions provide cost-effective options for managing essential documents, including the Delaware 200 V form. By streamlining the signing process, you can save time and reduce administrative costs.

-

What features does airSlate SignNow offer for eSigning the Delaware 200 V form?

AirSlate SignNow offers features such as customizable templates, real-time tracking, and secure cloud storage to assist with the Delaware 200 V form. Our platform also allows multi-party signing, ensuring all necessary stakeholders can easily sign the document. Additionally, we provide reminders to help you stay on track with your filings.

-

Can I integrate airSlate SignNow with other tools for managing the Delaware 200 V form?

Yes, airSlate SignNow integrates seamlessly with a variety of tools, including CRM and project management software. This integration allows you to manage the Delaware 200 V form alongside other business documents and workflows efficiently. By centralizing your document management, you can boost productivity and ensure compliance.

-

What are the benefits of using airSlate SignNow for the Delaware 200 V form?

Using airSlate SignNow for the Delaware 200 V form enhances efficiency and accuracy in your document management. With electronic signing, you can complete the form faster, reducing the risk of errors. Moreover, our solution provides tracking and notifications to help you monitor the process and maintain compliance.

-

Is airSlate SignNow secure for handling the Delaware 200 V form?

Absolutely. AirSlate SignNow prioritizes security and employs industry-standard encryption protocols to protect your sensitive information, including the Delaware 200 V form. We also offer features like audit trails and customizable permissions to ensure that only authorized users can access your documents.

Get more for Payment On Delaware 200 V

- 470 0745 adoption notice of decision form

- Adoption u s embassy ampamp consulate in vietnam form

- Ny dtf ct 34 i fill out tax template online form

- Flatmate contract template form

- Flat rent contract template form

- Flea market contract template form

- Flea market vendor contract template form

- Fleet management contract template form

Find out other Payment On Delaware 200 V

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast