Rule 810 6 4 24 01 Sales and Use Tax Certificate of 2023-2026

Understanding the Rule 810 6 4 24 01 Sales And Use Tax Certificate Of

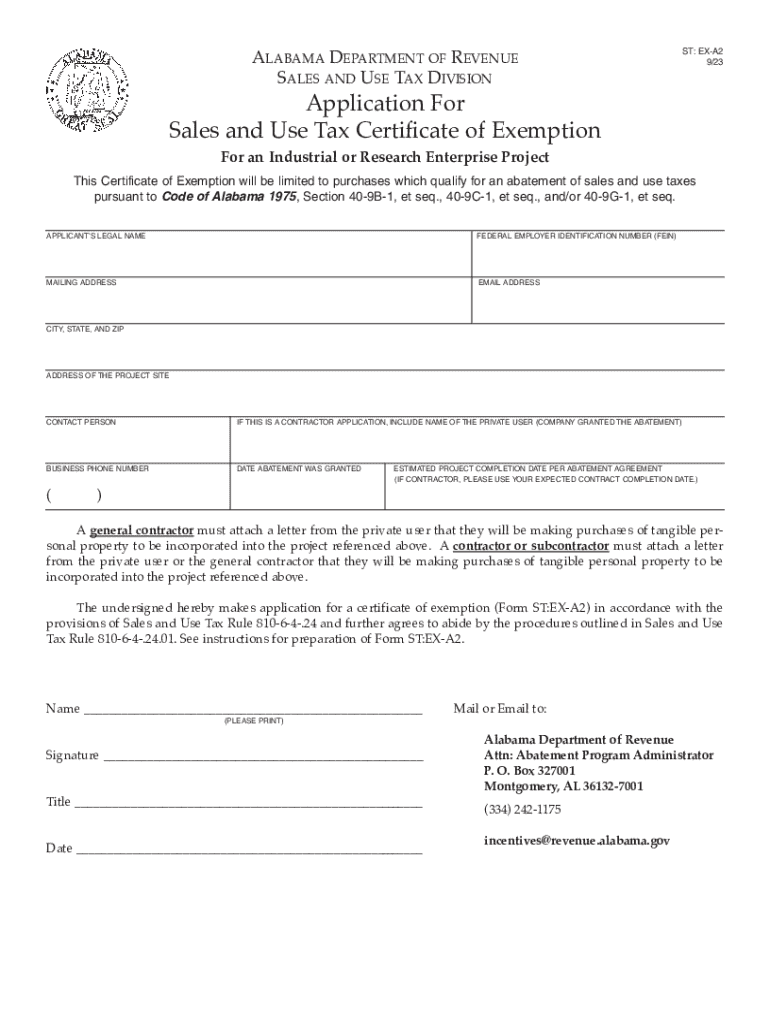

The Rule 810 6 4 24 01 Sales And Use Tax Certificate Of is a crucial document used in the United States for tax exemption purposes. This certificate allows businesses to purchase goods without paying sales tax, provided that the items are intended for resale or are otherwise exempt under state law. Understanding the specific provisions of this certificate is essential for compliance and to avoid potential tax liabilities.

How to Use the Rule 810 6 4 24 01 Sales And Use Tax Certificate Of

To effectively use the Rule 810 6 4 24 01 Sales And Use Tax Certificate Of, businesses must present it to their suppliers when making purchases. This certificate serves as proof of the buyer's intention to resell the items, thus allowing for tax exemption. It is important to ensure that the certificate is filled out accurately and completely to prevent any issues during transactions.

Steps to Complete the Rule 810 6 4 24 01 Sales And Use Tax Certificate Of

Completing the Rule 810 6 4 24 01 Sales And Use Tax Certificate Of involves several key steps:

- Obtain the certificate form from the appropriate state tax authority.

- Fill in the required information, including the buyer's name, address, and tax identification number.

- Clearly indicate the nature of the purchase and the reason for tax exemption.

- Sign and date the certificate to validate it.

Legal Use of the Rule 810 6 4 24 01 Sales And Use Tax Certificate Of

The legal use of the Rule 810 6 4 24 01 Sales And Use Tax Certificate Of is governed by state tax laws. Businesses must ensure that they are eligible to use the certificate for specific purchases. Misuse of the certificate can lead to penalties, including back taxes and fines. It is advisable to consult with a tax professional to understand the legal implications and ensure compliance.

Key Elements of the Rule 810 6 4 24 01 Sales And Use Tax Certificate Of

Key elements of the Rule 810 6 4 24 01 Sales And Use Tax Certificate Of include:

- Identification of the buyer and seller.

- Details of the items being purchased.

- The specific exemption reason.

- Signature of the buyer to confirm the accuracy of the information.

Eligibility Criteria for the Rule 810 6 4 24 01 Sales And Use Tax Certificate Of

Eligibility to use the Rule 810 6 4 24 01 Sales And Use Tax Certificate Of typically requires that the buyer is a registered business entity with a valid tax identification number. The items purchased must be intended for resale or fall under other exempt categories defined by state law. It is essential for businesses to verify their eligibility before using the certificate to avoid any compliance issues.

Quick guide on how to complete rule 810 6 4 24 01 sales and use tax certificate of

Complete Rule 810 6 4 24 01 Sales And Use Tax Certificate Of effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without waiting. Manage Rule 810 6 4 24 01 Sales And Use Tax Certificate Of on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related activity today.

The simplest way to modify and eSign Rule 810 6 4 24 01 Sales And Use Tax Certificate Of without hassle

- Find Rule 810 6 4 24 01 Sales And Use Tax Certificate Of and select Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or an invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from your chosen device. Modify and eSign Rule 810 6 4 24 01 Sales And Use Tax Certificate Of and ensure superb communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rule 810 6 4 24 01 sales and use tax certificate of

Create this form in 5 minutes!

How to create an eSignature for the rule 810 6 4 24 01 sales and use tax certificate of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ex a2 and how does it relate to airSlate SignNow?

Ex a2 refers to the advanced features offered by airSlate SignNow that enhance document management and eSigning. This solution allows users to streamline their workflows, making it easier to send and sign documents securely and efficiently.

-

How much does airSlate SignNow cost for ex a2 features?

The pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be cost-effective while providing ex a2 features. You can select from different tiers that cater to individual users or teams, ensuring you get the best value for your needs.

-

What are the key benefits of using airSlate SignNow with ex a2 capabilities?

Using airSlate SignNow with ex a2 capabilities allows businesses to improve efficiency and reduce turnaround times for document signing. The platform's user-friendly interface and robust features help teams collaborate better and maintain compliance with legal standards.

-

Can I integrate airSlate SignNow with other tools while using ex a2?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing the functionality of ex a2. You can connect it with popular tools like Google Drive, Salesforce, and more, allowing for a cohesive workflow across your business processes.

-

Is airSlate SignNow secure for handling sensitive documents with ex a2?

Absolutely! airSlate SignNow prioritizes security, especially when dealing with sensitive documents through ex a2. The platform employs advanced encryption and compliance measures to ensure that your data remains protected at all times.

-

How does airSlate SignNow improve document workflows with ex a2?

AirSlate SignNow enhances document workflows by automating the eSigning process with ex a2 features. This automation reduces manual tasks, minimizes errors, and accelerates the overall document turnaround time, making it easier for teams to focus on their core activities.

-

What types of documents can I send and sign using airSlate SignNow with ex a2?

You can send and sign a wide variety of documents using airSlate SignNow with ex a2, including contracts, agreements, and forms. The platform supports multiple file formats, ensuring that you can manage all your document needs in one place.

Get more for Rule 810 6 4 24 01 Sales And Use Tax Certificate Of

Find out other Rule 810 6 4 24 01 Sales And Use Tax Certificate Of

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template