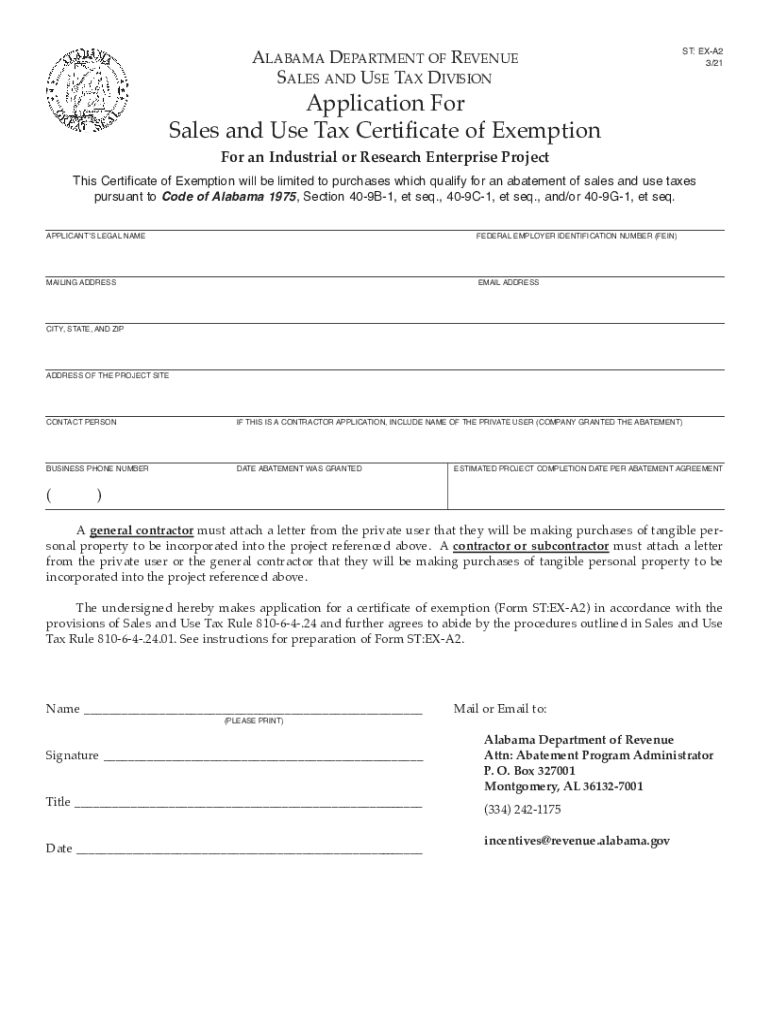

PDF ST EX A2 WInstructions3 21 Qxp Alabama Department of Revenue 2021

Understanding the Alabama Sales Tax Form STE-1

The Alabama sales tax form, known as the Alabama state sales and use tax certificate of exemption form STE-1, is essential for businesses and individuals looking to claim an exemption from sales tax on certain purchases. This form is particularly important for those who qualify under specific categories, such as resale or exempt use. Understanding the purpose and requirements of this form is crucial for compliance with Alabama tax regulations.

Steps to Complete the Alabama Sales Tax Form STE-1

Completing the Alabama sales tax form STE-1 involves several important steps:

- Gather necessary information, including your business name, address, and tax identification number.

- Identify the reason for the exemption, such as resale or specific exempt use.

- Fill out the form accurately, ensuring all required fields are completed.

- Sign and date the form to validate your claim for exemption.

- Submit the completed form to the appropriate vendor or supplier to avoid sales tax charges.

Legal Use of the Alabama Sales Tax Form STE-1

The legal use of the Alabama sales tax form STE-1 is governed by state tax laws. When properly completed and submitted, this form serves as a declaration of your eligibility for sales tax exemption. It is essential to ensure that the information provided is accurate and truthful, as any discrepancies may lead to penalties or audits by the Alabama Department of Revenue.

Key Elements of the Alabama Sales Tax Form STE-1

Several key elements must be included in the Alabama sales tax form STE-1 for it to be valid:

- Business Information: Name, address, and tax identification number of the purchaser.

- Exemption Reason: A clear statement of the reason for claiming the exemption.

- Signature: The form must be signed by an authorized representative of the business.

- Date: The date of signing is crucial for record-keeping and compliance purposes.

Filing Deadlines and Important Dates

Understanding the filing deadlines for the Alabama sales tax form STE-1 is vital for compliance. Typically, this form should be submitted before making a purchase to ensure that sales tax is not applied. It is advisable to check with the Alabama Department of Revenue for any specific deadlines related to your business type or exemption category.

Penalties for Non-Compliance

Failure to comply with the requirements of the Alabama sales tax form STE-1 can result in significant penalties. Businesses may face back taxes, interest on unpaid amounts, and potential legal action from the state. It is crucial to ensure that all forms are completed accurately and submitted on time to avoid these consequences.

Quick guide on how to complete pdf st ex a2 winstructions3 21qxp alabama department of revenue

Complete PDF ST EX A2 WInstructions3 21 qxp Alabama Department Of Revenue seamlessly on any device

Digital document management has gained immense popularity among businesses and individuals alike. It offers a flawless eco-friendly substitute to conventional printed and signed paperwork, allowing you to obtain the correct form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without any holdups. Manage PDF ST EX A2 WInstructions3 21 qxp Alabama Department Of Revenue on any platform using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to modify and eSign PDF ST EX A2 WInstructions3 21 qxp Alabama Department Of Revenue effortlessly

- Obtain PDF ST EX A2 WInstructions3 21 qxp Alabama Department Of Revenue and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow portions of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional handwritten signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you wish to deliver your form: via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or mistakes that require the printing of new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Edit and eSign PDF ST EX A2 WInstructions3 21 qxp Alabama Department Of Revenue while ensuring excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf st ex a2 winstructions3 21qxp alabama department of revenue

Create this form in 5 minutes!

How to create an eSignature for the pdf st ex a2 winstructions3 21qxp alabama department of revenue

How to make an e-signature for a PDF online

How to make an e-signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The way to create an e-signature straight from your smartphone

The best way to make an e-signature for a PDF on iOS

The way to create an e-signature for a PDF document on Android

People also ask

-

What is the importance of understanding Alabama sales tax when using airSlate SignNow?

Understanding Alabama sales tax is crucial for businesses operating in the state to ensure compliance with tax laws. airSlate SignNow helps streamline the document signing process, making it easier to include necessary tax documentation. This ensures your contracts and agreements adhere to Alabama sales tax regulations, reducing the risk of errors.

-

How does airSlate SignNow help with Alabama sales tax documentation?

airSlate SignNow provides templates and customizable forms that allow users to include Alabama sales tax details in their agreements. By automating the signing process, you can quickly gather necessary tax documentation from clients. This not only saves time but also ensures accuracy in managing Alabama sales tax obligations.

-

Is there a pricing plan for businesses based in Alabama that focuses on sales tax solutions?

Yes, airSlate SignNow offers competitive pricing plans designed for businesses in Alabama. These plans include features that support sales tax documentation alongside other e-signature services. By investing in a plan, businesses can effectively manage their Alabama sales tax needs while streamlining their document workflows.

-

Can airSlate SignNow integrate with accounting software that tracks Alabama sales tax?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software that can help manage Alabama sales tax. This ensures that your signed documents reflect sales tax calculations accurately and are easily accessible for tax filing purposes. Effortless integration minimizes manual input and enhances operational efficiency.

-

What are the benefits of using airSlate SignNow for managing Alabama sales tax compliance?

Using airSlate SignNow simplifies efforts to comply with Alabama sales tax regulations. Users can easily access templates that include tax clauses, ensuring all documents are compliant. This efficiency helps avoid costly mistakes and minimizes the time spent on tax-related paperwork.

-

How can airSlate SignNow assist businesses in Alabama with remote signing related to sales tax?

airSlate SignNow allows businesses in Alabama to handle remote signing for sales tax-related documents securely. This feature lets you send important tax forms for e-signature, enhancing productivity while adhering to Alabama sales tax requirements. As a result, businesses can operate more flexibly and efficiently.

-

What features does airSlate SignNow offer that are especially useful for Alabama sales tax scenarios?

Key features of airSlate SignNow that benefit Alabama sales tax scenarios include customizable templates, automated reminders, and tracking capabilities. These features help ensure that all tax-related documents are signed promptly and stored securely. By leveraging these functionalities, businesses can maintain compliance with Alabama sales tax laws.

Get more for PDF ST EX A2 WInstructions3 21 qxp Alabama Department Of Revenue

- Temporary agreement for form

- 1 deed of dedication and deed of temporary construction form

- Certificate of occupancy wikipedia form

- City council agenda city of rye form

- Tenants consent form

- Easement negotiation 101 focus on gas pipelines and form

- Assignment and subletting winstead pc form

- Tenants consent to right of way agreement form

Find out other PDF ST EX A2 WInstructions3 21 qxp Alabama Department Of Revenue

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online