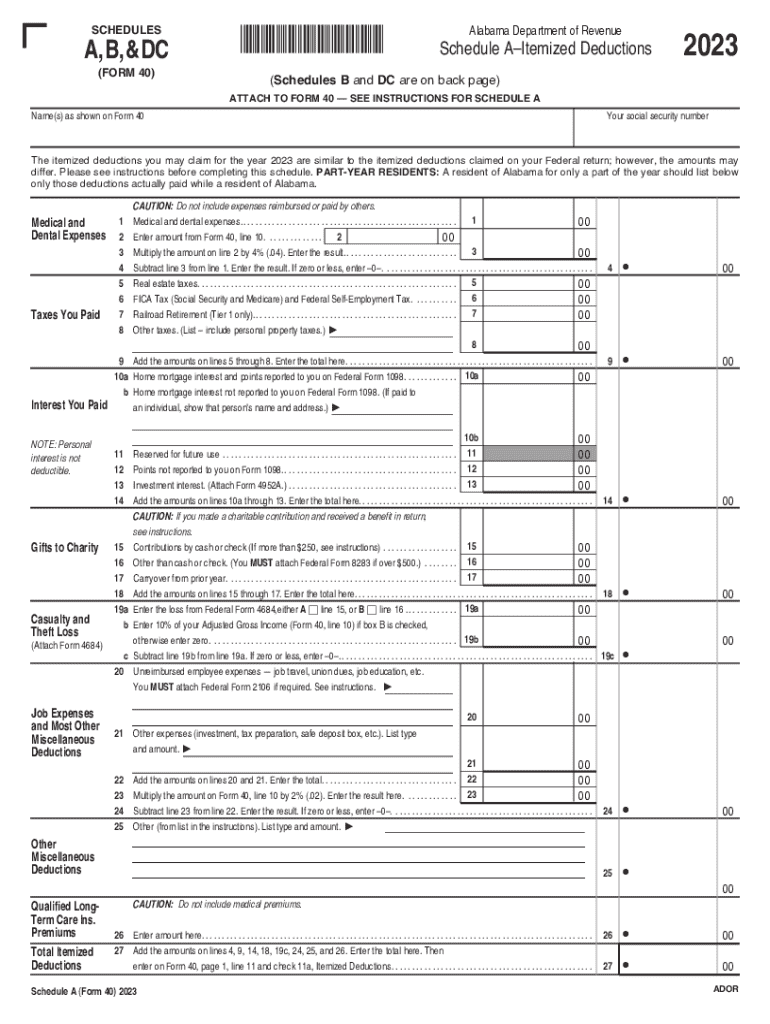

Schedule A,B,&DC TY 20237 14 23F 2023-2026

Understanding the Schedule D Example

The Schedule D is a critical tax form used for reporting capital gains and losses from the sale or exchange of capital assets. This form is essential for individuals and businesses that have sold stocks, bonds, or other investments. By accurately completing the Schedule D, taxpayers can determine their overall capital gain or loss for the tax year, which directly impacts their taxable income. Understanding how to fill out this form is vital for compliance with IRS regulations and for optimizing tax obligations.

Key Elements of the Schedule D Example

Several key components make up the Schedule D. These include:

- Part I: This section reports short-term capital gains and losses, which are typically assets held for one year or less.

- Part II: This part focuses on long-term capital gains and losses, covering assets held for more than one year.

- Part III: This section summarizes the total capital gains and losses, allowing taxpayers to calculate their net gain or loss.

- Additional Information: Taxpayers may need to provide details about specific transactions, including dates of acquisition and sale, amounts, and any adjustments.

Steps to Complete the Schedule D Example

Completing the Schedule D involves several steps to ensure accuracy:

- Gather all necessary documents, including transaction records and statements from brokers.

- Identify which transactions are short-term and which are long-term based on the holding period.

- Enter short-term capital gains and losses in Part I, ensuring to include all relevant transactions.

- Record long-term capital gains and losses in Part II, following the same thorough approach.

- Calculate the totals for both parts and transfer the net gain or loss to the appropriate section of your tax return.

IRS Guidelines for the Schedule D Example

The IRS provides specific guidelines for completing the Schedule D. These guidelines include:

- Ensuring that all transactions are reported accurately to avoid penalties.

- Consulting the IRS instructions for Schedule D to understand specific definitions and requirements.

- Maintaining thorough records of all transactions, as the IRS may request documentation during audits.

Filing Deadlines for the Schedule D Example

Taxpayers must adhere to specific filing deadlines for the Schedule D. Generally, the deadline coincides with the annual tax return due date, which is typically April fifteenth for most individuals. However, if you file for an extension, ensure that the Schedule D is submitted by the extended deadline. It is crucial to stay informed about any changes in deadlines, especially in light of potential IRS adjustments.

Examples of Using the Schedule D Example

Practical examples can help clarify how to use the Schedule D effectively:

- A taxpayer sells stocks purchased for $5,000 and sells them for $8,000. The $3,000 gain must be reported on Schedule D.

- A business owner sells a piece of equipment for $10,000 that was originally purchased for $15,000, resulting in a $5,000 loss that should also be reported.

Quick guide on how to complete schedule abdc ty 20237 14 23f

Effortlessly Prepare Schedule A,B,&DC TY 20237 14 23F on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Schedule A,B,&DC TY 20237 14 23F across any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to Adjust and eSign Schedule A,B,&DC TY 20237 14 23F with Ease

- Find Schedule A,B,&DC TY 20237 14 23F and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections or redact sensitive information using the specific tools provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to submit your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, and mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Adjust and eSign Schedule A,B,&DC TY 20237 14 23F and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule abdc ty 20237 14 23f

Create this form in 5 minutes!

How to create an eSignature for the schedule abdc ty 20237 14 23f

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a schedule d example in the context of airSlate SignNow?

A schedule d example refers to a specific format or template used for documenting and managing various types of agreements and contracts within airSlate SignNow. This tool allows users to easily create, send, and eSign documents, ensuring compliance and efficiency in their business processes.

-

How can I create a schedule d example using airSlate SignNow?

Creating a schedule d example in airSlate SignNow is straightforward. Users can start by selecting a template or creating a new document from scratch, then customize it to fit their specific needs. The platform's user-friendly interface makes it easy to add fields for signatures, dates, and other essential information.

-

What are the pricing options for using airSlate SignNow for schedule d examples?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to features that facilitate the creation and management of schedule d examples, ensuring that users can find a solution that fits their budget.

-

What features does airSlate SignNow offer for managing schedule d examples?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities, all of which enhance the management of schedule d examples. Additionally, users can track document status and receive notifications, ensuring a seamless signing process.

-

Can I integrate airSlate SignNow with other applications for schedule d examples?

Yes, airSlate SignNow offers integrations with various applications, allowing users to streamline their workflow when managing schedule d examples. Popular integrations include CRM systems, cloud storage services, and productivity tools, making it easier to incorporate eSigning into existing processes.

-

What benefits does airSlate SignNow provide for businesses using schedule d examples?

Using airSlate SignNow for schedule d examples provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced document security. Businesses can save time and resources by automating the signing process and ensuring that all documents are legally binding and compliant.

-

Is airSlate SignNow suitable for small businesses needing schedule d examples?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Its intuitive interface and affordable pricing plans make it an ideal choice for those looking to manage schedule d examples without the complexity of traditional document management systems.

Get more for Schedule A,B,&DC TY 20237 14 23F

- Legal last will form for a widow or widower with no children texas

- Legal last will and testament form for a widow or widower with adult and minor children texas

- Legal last will and testament form for divorced and remarried person with mine yours and ours children texas

- Legal last will and testament form with all property to trust called a pour over will texas

- Written revocation of will texas form

- Texas persons form

- Texas beneficiaries form

- Estate planning questionnaire and worksheets texas form

Find out other Schedule A,B,&DC TY 20237 14 23F

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document