Form 1040 Schedule D IRS Gov 2014

What is the Form 1040 Schedule D?

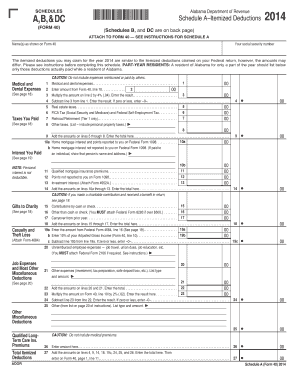

The Form 1040 Schedule D is a crucial document used by U.S. taxpayers to report capital gains and losses from the sale of assets. This form is an attachment to the main tax return, Form 1040, and is essential for accurately calculating the tax owed on investments. Taxpayers must report transactions involving stocks, bonds, real estate, and other capital assets. The information on Schedule D helps the IRS determine the taxpayer's overall tax liability based on their investment activities during the tax year.

How to use the Form 1040 Schedule D

To effectively use the Form 1040 Schedule D, taxpayers should first gather all relevant documentation related to their capital gains and losses. This includes records of purchase prices, sale prices, and any associated transaction costs. The form consists of two main sections: one for reporting short-term capital gains and losses, and another for long-term capital gains and losses. Taxpayers should accurately complete each section, ensuring that all transactions are reported correctly. It is important to transfer the totals from Schedule D to the main Form 1040 to reflect the correct tax liability.

Steps to complete the Form 1040 Schedule D

Completing the Form 1040 Schedule D involves several key steps:

- Gather all necessary documents, including brokerage statements and records of asset purchases and sales.

- Determine whether each transaction is a short-term or long-term capital gain or loss.

- Fill out the short-term section by listing all short-term transactions and calculating the total short-term gains and losses.

- Complete the long-term section in a similar manner, listing long-term transactions and calculating the totals.

- Combine the totals from both sections to determine the overall capital gain or loss.

- Transfer the final amount to the appropriate line on Form 1040.

Key elements of the Form 1040 Schedule D

Understanding the key elements of the Form 1040 Schedule D is essential for accurate reporting. The form includes:

- Short-term capital gains and losses: Reported for assets held for one year or less.

- Long-term capital gains and losses: Reported for assets held for more than one year.

- Net capital gain or loss: The final calculation that determines the taxpayer's overall capital gain or loss for the year.

- Carryover amounts: If capital losses exceed gains, taxpayers may carry over the excess to future tax years.

IRS Guidelines for Schedule D

The IRS provides specific guidelines for completing the Form 1040 Schedule D. Taxpayers should refer to the IRS instructions for detailed information on reporting requirements, including what constitutes a capital asset and how to calculate gains and losses. The IRS also outlines the importance of maintaining accurate records to support the information reported on the form. Adhering to these guidelines ensures compliance and minimizes the risk of errors that could lead to penalties.

Filing Deadlines for Schedule D

The filing deadline for the Form 1040 Schedule D aligns with the general tax return due date, which is typically April 15 for most taxpayers. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should ensure that all forms, including Schedule D, are submitted by this deadline to avoid penalties and interest on any taxes owed. Extensions may be available, but they do not extend the time to pay any taxes due.

Quick guide on how to complete 2014 form 1040 schedule d irs gov

Effortlessly Prepare Form 1040 Schedule D IRS gov on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and electronically sign your documents quickly without delays. Manage Form 1040 Schedule D IRS gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-based operation today.

How to Modify and Electronically Sign Form 1040 Schedule D IRS gov with Ease

- Locate Form 1040 Schedule D IRS gov and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form: via email, text message (SMS), or using an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and electronically sign Form 1040 Schedule D IRS gov and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 1040 schedule d irs gov

FAQs

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

Startup I am no longer working with is requesting that I fill out a 2014 w9 form. Is this standard, could someone please provide any insight as to why a startup may be doing this and how would I go about handling it?

It appears that the company may be trying to reclassify you as an independent contractor rather than an employee.Based on the information provided, it appears that such reclassification (a) would be a violation of applicable law by the employer and (b) potentially could be disadvantageous for you (e.g., depriving you of unemployment compensation if you are fired without cause).The most prudent approach would be to retain a lawyer who represents employees in employment matters.In any event, it appears that you would be justified in refusing to complete and sign the W-9, telling the company that there is no business or legal reason for you to do so.Edit: After the foregoing answer was written, the OP added Q details concerning restricted stock repurchase being the reason for the W-9 request. As a result, the foregoing answer appears to be irrelevant. However, I will leave it, for now, in case Q details are changed yet again in a way that reestablishes the answer's relevance.

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 1040 schedule d irs gov

How to create an electronic signature for the 2014 Form 1040 Schedule D Irs Gov in the online mode

How to create an eSignature for the 2014 Form 1040 Schedule D Irs Gov in Chrome

How to make an electronic signature for putting it on the 2014 Form 1040 Schedule D Irs Gov in Gmail

How to make an eSignature for the 2014 Form 1040 Schedule D Irs Gov straight from your smart phone

How to create an eSignature for the 2014 Form 1040 Schedule D Irs Gov on iOS

How to generate an eSignature for the 2014 Form 1040 Schedule D Irs Gov on Android

People also ask

-

What is Schedule D on tax return?

Schedule D is a form used in the United States tax returns to report capital gains and losses. It helps individuals and businesses understand their investment income and tax implications. Learning what is Schedule D on tax return is crucial for accurate filing and maximizing potential refunds.

-

How does airSlate SignNow simplify the document signing process?

airSlate SignNow streamlines the document signing process by allowing users to send and eSign documents electronically. This eliminates the need for physical signatures and speeds up transaction times. Understanding how to navigate eSignatures can help users efficiently manage their filing, especially when dealing with what is Schedule D on tax return.

-

What features does airSlate SignNow offer to enhance document management?

airSlate SignNow includes a variety of features such as templates, custom workflows, and real-time tracking. These tools allow users to easily manage their documentation and ensure accuracy in their tax filings. Knowing these features can help users efficiently prepare forms like what is Schedule D on tax return.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow offers competitive pricing plans tailored for small businesses, ensuring a cost-effective solution for document management. With transparent pricing, users can find a plan that fits their budget while enjoying robust features. This affordability is particularly beneficial for businesses needing clarity on what is Schedule D on tax return.

-

Can airSlate SignNow integrate with other software applications?

Absolutely, airSlate SignNow seamlessly integrates with various software applications, including CRMs and financial tools. This interoperability allows businesses to enhance their workflows and data management signNowly. Understanding these integrations is crucial for users processing financial documents like what is Schedule D on tax return.

-

What benefits does eSigning provide for tax-related documents?

eSigning provides numerous benefits, including increased efficiency, enhanced security, and reduced paper usage. By leveraging eSignature technology, users can swiftly manage tax-related documents, such as understanding what is Schedule D on tax return, which simplifies the tax preparation process.

-

How secure is the airSlate SignNow platform?

The airSlate SignNow platform prioritizes security, employing advanced encryption and compliance with legal standards. This ensures that all documents, including sensitive tax-related information, are safely handled. Users can trust that their inquiries about what is Schedule D on tax return remain confidential and secure.

Get more for Form 1040 Schedule D IRS gov

Find out other Form 1040 Schedule D IRS gov

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer