Form ST 809 New York State and Local Sales and Use Tax Return for Part Quarterly Monthly Filers Revised 1024

Understanding the ST 809 Sales Tax Form

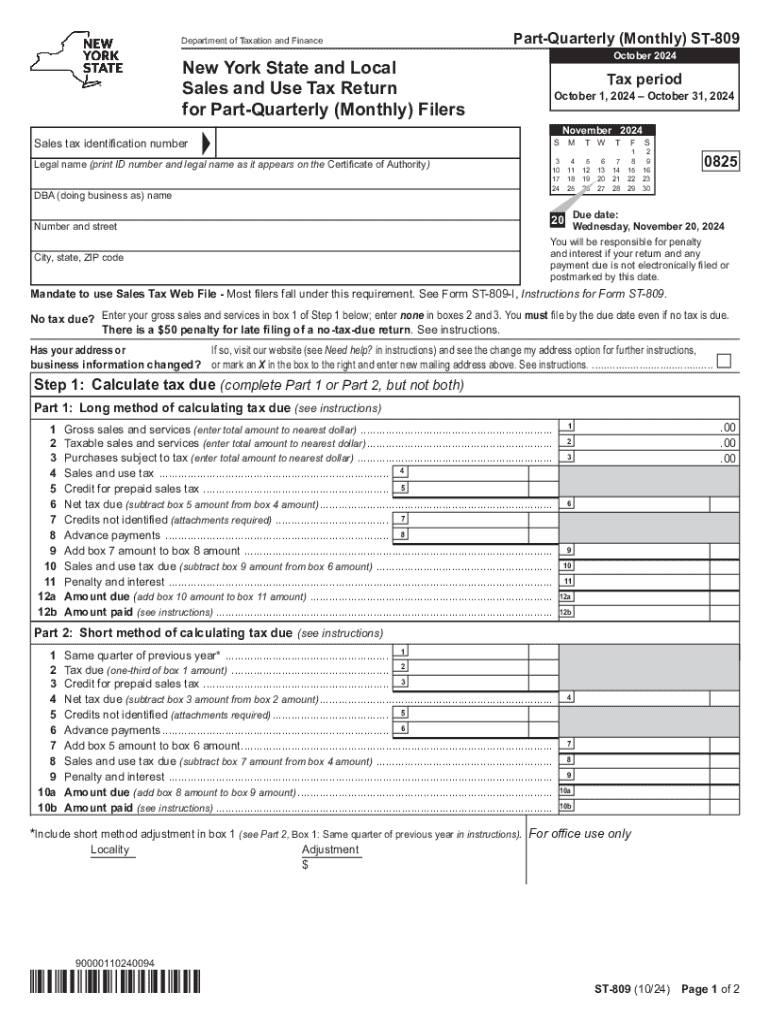

The ST 809 form is the New York State and Local Sales and Use Tax Return designed for businesses that file on a quarterly or monthly basis. This form is essential for reporting sales tax collected from customers and ensuring compliance with state tax laws. It allows businesses to detail their taxable sales, exempt sales, and any tax due. Proper completion of the ST 809 is crucial for accurate tax reporting and avoiding penalties.

Steps to Complete the ST 809 Form

Completing the ST 809 form involves several key steps:

- Gather necessary financial records, including sales receipts and tax-exempt certificates.

- Enter total sales and exempt sales in the designated sections of the form.

- Calculate the total sales tax due based on the applicable rates.

- Report any adjustments or credits that may apply.

- Review the completed form for accuracy before submission.

Each section of the form is clearly labeled, making it easier for filers to provide the required information accurately.

Obtaining the ST 809 Form

Businesses can obtain the ST 809 form through several methods. It is available on the New York State Department of Taxation and Finance website, where users can download and print it. Additionally, physical copies may be requested from local tax offices. Ensuring you have the most current version of the form is important for compliance.

Key Elements of the ST 809 Form

The ST 809 form includes several critical components:

- Identification of the business, including name and address.

- Reporting periods for which the sales tax is being filed.

- Sections for total sales, exempt sales, and sales tax collected.

- Calculation of any penalties or interest for late payments.

Understanding these elements helps ensure that all necessary information is included, reducing the risk of errors.

Filing Deadlines for the ST 809 Form

Timely filing of the ST 809 form is essential to avoid penalties. The filing deadlines depend on the frequency of your tax filings:

- Monthly filers must submit the form by the 20th of the following month.

- Quarterly filers have until the 20th of the month following the end of the quarter.

Staying aware of these deadlines helps businesses maintain compliance with state tax regulations.

Legal Use of the ST 809 Form

The ST 809 form is legally required for businesses that collect sales tax in New York State. It serves as an official record of sales and tax collected, which can be audited by state authorities. Proper use of the form ensures that businesses fulfill their tax obligations and helps maintain transparency in financial reporting.

Quick guide on how to complete form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 1024

Effortlessly Prepare Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1024 on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can easily find the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1024 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1024 effortlessly

- Find Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1024 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of the documents or obscure sensitive information with the tools offered by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new versions of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1024 to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 1024

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 809 form and how can airSlate SignNow help?

The st 809 form is a document used for various business purposes, including tax filings and compliance. airSlate SignNow simplifies the process of completing and signing the st 809 form by providing an intuitive platform that allows users to fill out, eSign, and send documents securely.

-

Is there a cost associated with using airSlate SignNow for the st 809 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the completion and signing of the st 809 form, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing the st 809 form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, all designed to enhance your experience with the st 809 form. These tools help ensure that your documents are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other applications for the st 809 form?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive, Dropbox, and Salesforce, making it easy to manage the st 809 form alongside your other business tools. This seamless integration enhances productivity and streamlines your workflow.

-

How does airSlate SignNow ensure the security of the st 809 form?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to protect your data while you complete and eSign the st 809 form, ensuring that your sensitive information remains confidential.

-

Can I access the st 809 form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage the st 809 form on the go. This flexibility ensures that you can complete and sign documents anytime, anywhere, enhancing your productivity.

-

What are the benefits of using airSlate SignNow for the st 809 form?

Using airSlate SignNow for the st 809 form offers numerous benefits, including time savings, reduced paperwork, and improved accuracy. The platform's user-friendly interface makes it easy to navigate, ensuring a smooth experience from start to finish.

Get more for Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1024

Find out other Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1024

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract