Property TaxesNassau County, NY Form

Understanding Florida Millage Rates

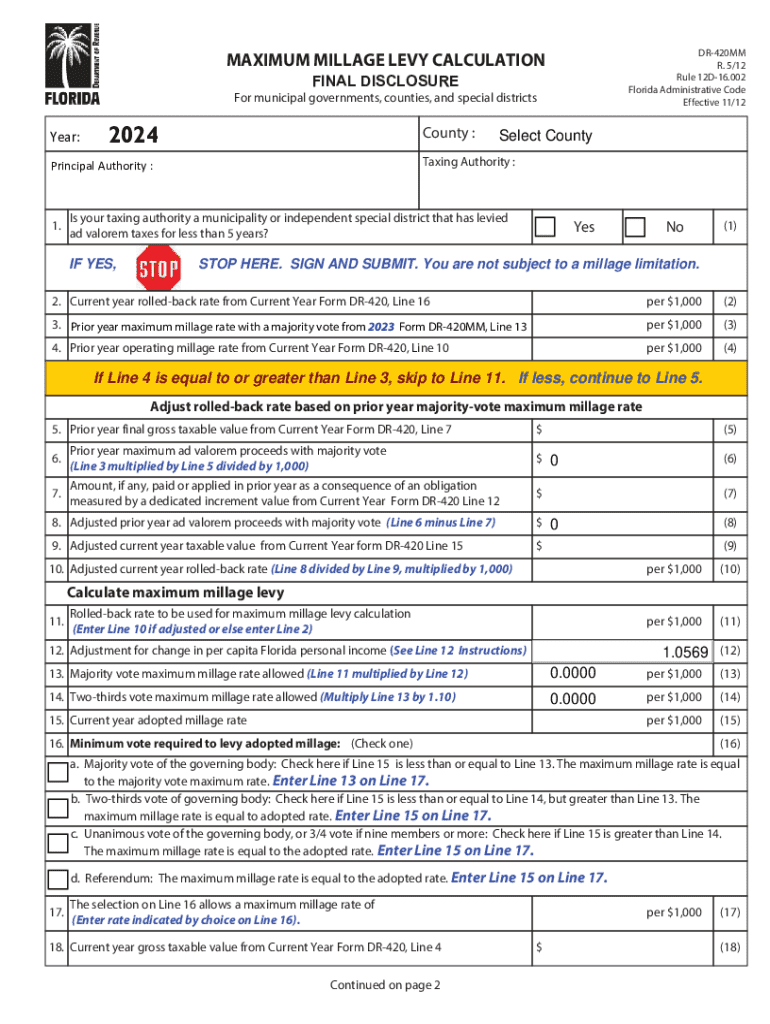

Florida millage rates are crucial for determining property taxes within the state. A millage rate is the amount per $1,000 of property value that is used to calculate local property taxes. For instance, if a property is valued at $200,000 and the millage rate is 15 mills, the property tax would be calculated as follows: (200,000 / 1,000) * 15 = $3,000 in property taxes. Understanding these rates helps property owners anticipate their tax obligations and budget accordingly.

How to Calculate Millage in Florida

To perform a millage calculation in Florida, follow these steps:

- Determine the assessed value of your property, which is typically provided by the local property appraiser.

- Identify the applicable millage rate for your area, which can vary based on local government budgets and services.

- Use the formula: (Assessed Value / 1,000) * Millage Rate = Annual Property Tax.

This straightforward calculation allows homeowners to estimate their annual tax liability based on current property values and local rates.

Key Elements of Florida Millage Levy

The Florida millage levy consists of several key components that affect property taxes:

- Ad Valorem Taxes: These taxes are based on the assessed value of property.

- Non-Ad Valorem Assessments: These are charges for specific services, such as fire protection or street lighting, that are not based on property value.

- Exemptions: Certain exemptions, like the homestead exemption, can reduce the taxable value of a property, impacting the overall millage calculation.

Understanding these elements is essential for property owners to navigate their tax responsibilities effectively.

Filing Deadlines for Florida Millage Forms

Property owners in Florida should be aware of important filing deadlines related to millage calculations and property taxes. Typically, the following deadlines apply:

- Assessment Notices: Property appraisers must send assessment notices by August 1 each year.

- Tax Notices: The final property tax notices are usually mailed by November 1.

- Payment Deadlines: Property taxes are generally due by March 31 of the following year, with discounts available for early payment.

Staying informed about these deadlines helps ensure compliance and can lead to potential savings on property taxes.

Eligibility Criteria for Florida Property Tax Exemptions

Florida offers various property tax exemptions that can significantly reduce the tax burden for eligible homeowners. Key eligibility criteria include:

- Property must be the primary residence of the owner.

- Applicants must be permanent residents of Florida.

- Specific exemptions, such as the senior citizen exemption or disability exemption, may have additional requirements.

Understanding these criteria is essential for homeowners looking to benefit from available tax relief options.

Digital Submission Methods for Florida Millage Forms

Submitting Florida millage forms digitally can streamline the process for property owners. The following methods are commonly used:

- Online Portals: Many counties provide online systems where property owners can submit their millage-related forms directly.

- Email Submissions: Some jurisdictions allow forms to be submitted via email, ensuring quick processing.

- Electronic Signatures: Utilizing digital signature solutions can enhance the submission process, making it more efficient.

Embracing digital submission methods can save time and reduce the likelihood of errors in the filing process.

Quick guide on how to complete property taxesnassau county ny

Complete Property TaxesNassau County, NY effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents swiftly without interruptions. Manage Property TaxesNassau County, NY on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign Property TaxesNassau County, NY with minimal effort

- Access Property TaxesNassau County, NY and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, monotonous form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Property TaxesNassau County, NY to ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the property taxesnassau county ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Florida millage and how does it affect my business?

Florida millage refers to the tax rate applied to property values in Florida, which can impact your business expenses. Understanding Florida millage is crucial for budgeting and financial planning. By utilizing airSlate SignNow, you can streamline document management related to property taxes and ensure timely submissions.

-

How can airSlate SignNow help with Florida millage documentation?

airSlate SignNow simplifies the process of managing documents related to Florida millage. With our eSigning capabilities, you can quickly sign and send tax-related documents, ensuring compliance and reducing delays. This efficiency can save your business time and resources.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses dealing with Florida millage and other documentation. Our cost-effective solutions ensure you get the best value while managing your document workflows. Visit our pricing page for detailed information on plans and features.

-

What features does airSlate SignNow offer for managing Florida millage documents?

Our platform provides features such as customizable templates, automated workflows, and secure eSigning, all essential for managing Florida millage documents. These tools enhance productivity and ensure that your documents are handled efficiently. Explore our features to see how they can benefit your business.

-

Can I integrate airSlate SignNow with other software for Florida millage management?

Yes, airSlate SignNow seamlessly integrates with various software applications, making it easier to manage Florida millage-related tasks. Whether you use accounting software or property management tools, our integrations enhance your workflow. Check our integration options to find the best fit for your needs.

-

What are the benefits of using airSlate SignNow for Florida millage processes?

Using airSlate SignNow for Florida millage processes offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick document turnaround, which is vital for meeting tax deadlines. Experience the convenience of digital document management with airSlate SignNow.

-

Is airSlate SignNow secure for handling sensitive Florida millage documents?

Absolutely! airSlate SignNow prioritizes security, ensuring that all your Florida millage documents are protected with advanced encryption and compliance measures. You can trust our platform to keep your sensitive information safe while you manage your documentation. Learn more about our security features on our website.

Get more for Property TaxesNassau County, NY

Find out other Property TaxesNassau County, NY

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed