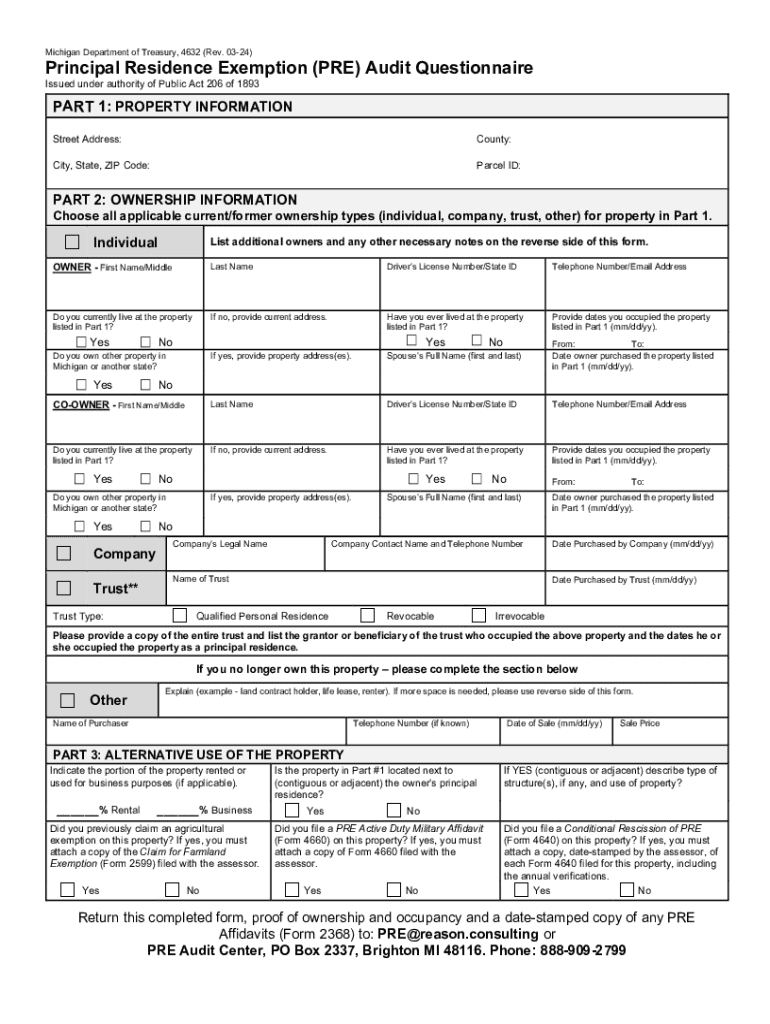

Instructions for Completing Form 4632, Principal 2024-2026

What is the principal residence exemption audit?

The principal residence exemption audit is a review process conducted by tax authorities to ensure that taxpayers are correctly claiming the exemption on their primary residence. This exemption allows homeowners to exclude a portion of their capital gains from taxation when selling their primary home. The audit examines whether the property qualifies as a principal residence based on specific criteria set by the IRS.

During the audit, the tax authority may request documentation to verify the homeowner's residency status, such as utility bills, tax returns, and other relevant records. Understanding the rules and requirements surrounding this exemption is crucial for homeowners to avoid potential penalties or adjustments to their tax filings.

Steps to complete the Instructions for Completing Form 4632

Completing Form 4632 for the principal residence exemption requires careful attention to detail. Here are the essential steps to follow:

- Gather necessary documentation, including proof of residency and any relevant financial records.

- Fill out the form accurately, ensuring all sections are completed as per the instructions provided.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline to avoid penalties.

Following these steps can help ensure that the form is processed smoothly and that the exemption is applied correctly.

Required documents for the principal residence exemption audit

To support a principal residence exemption audit, homeowners should prepare the following documents:

- Proof of residency, such as utility bills or lease agreements.

- Tax returns from the years in question.

- Closing documents from the purchase of the home.

- Any correspondence with tax authorities regarding the exemption.

Having these documents readily available can facilitate the audit process and help substantiate claims made on the tax return.

IRS guidelines for the principal residence exemption

The IRS provides specific guidelines regarding the principal residence exemption, outlining eligibility criteria and the process for claiming the exemption. Homeowners must meet certain conditions, including:

- The property must be the taxpayer's primary residence for at least two of the five years preceding the sale.

- The exemption can only be claimed once every two years.

- Homeowners must report the sale of the property on their tax return if the gain exceeds the exemption limit.

Familiarizing oneself with these guidelines is essential for homeowners to ensure compliance and maximize their tax benefits.

Penalties for non-compliance with principal residence exemption rules

Failure to comply with the rules surrounding the principal residence exemption can result in significant penalties. Homeowners may face:

- Tax liabilities for any unreported gains from the sale of the property.

- Interest charges on unpaid taxes.

- Potential audits or further scrutiny from tax authorities.

Understanding these penalties underscores the importance of accurate reporting and compliance with IRS regulations.

Eligibility criteria for the principal residence exemption

To qualify for the principal residence exemption, homeowners must meet specific eligibility criteria set by the IRS. These include:

- The property must be owned and occupied as the primary residence for at least two years.

- The homeowner must not have claimed the exemption on another property within the last two years.

- The total gain from the sale must not exceed the exemption limit, which is typically up to $250,000 for single filers and $500,000 for married couples filing jointly.

Meeting these criteria is essential for homeowners to benefit from the exemption and avoid complications during an audit.

Quick guide on how to complete instructions for completing form 4632 principal

Complete Instructions For Completing Form 4632, Principal seamlessly on any device

Digital document management has become popular among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Handle Instructions For Completing Form 4632, Principal on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to adjust and eSign Instructions For Completing Form 4632, Principal with ease

- Locate Instructions For Completing Form 4632, Principal and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes moments and possesses the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Decide how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Adjust and eSign Instructions For Completing Form 4632, Principal and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for completing form 4632 principal

Create this form in 5 minutes!

How to create an eSignature for the instructions for completing form 4632 principal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a principal residence exemption audit?

A principal residence exemption audit is a review process conducted by tax authorities to ensure that a property qualifies for the principal residence exemption. This exemption allows homeowners to avoid capital gains tax on the sale of their primary residence. Understanding this audit is crucial for homeowners to maintain their tax benefits.

-

How can airSlate SignNow assist with principal residence exemption audits?

airSlate SignNow provides a streamlined solution for managing documents related to principal residence exemption audits. With our eSigning capabilities, you can easily send, sign, and store necessary documents securely. This ensures that you have all your paperwork in order when facing an audit.

-

What features does airSlate SignNow offer for document management during audits?

Our platform offers features such as customizable templates, secure cloud storage, and real-time tracking of document status. These tools are essential for efficiently managing documents required for a principal residence exemption audit. You can also collaborate with your team seamlessly to ensure all necessary information is gathered.

-

Is airSlate SignNow cost-effective for small businesses facing audits?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses facing principal residence exemption audits. Our pricing plans are flexible, allowing you to choose the best option that fits your budget while still providing robust features to manage your documents efficiently.

-

Can I integrate airSlate SignNow with other tools for audit preparation?

Absolutely! airSlate SignNow integrates with various tools and platforms, enhancing your workflow during principal residence exemption audits. Whether you use CRM systems, cloud storage, or accounting software, our integrations help streamline the document management process.

-

What are the benefits of using airSlate SignNow for audits?

Using airSlate SignNow for principal residence exemption audits offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the document signing process, allowing you to focus on preparing for the audit rather than getting bogged down by administrative tasks.

-

How secure is airSlate SignNow for handling sensitive audit documents?

Security is a top priority at airSlate SignNow. We employ advanced encryption and compliance measures to ensure that your documents related to principal residence exemption audits are protected. You can trust that your sensitive information is safe with us.

Get more for Instructions For Completing Form 4632, Principal

Find out other Instructions For Completing Form 4632, Principal

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors