Michigan Pre Audit Questionnaire 2018

What is the Michigan Pre Audit Questionnaire

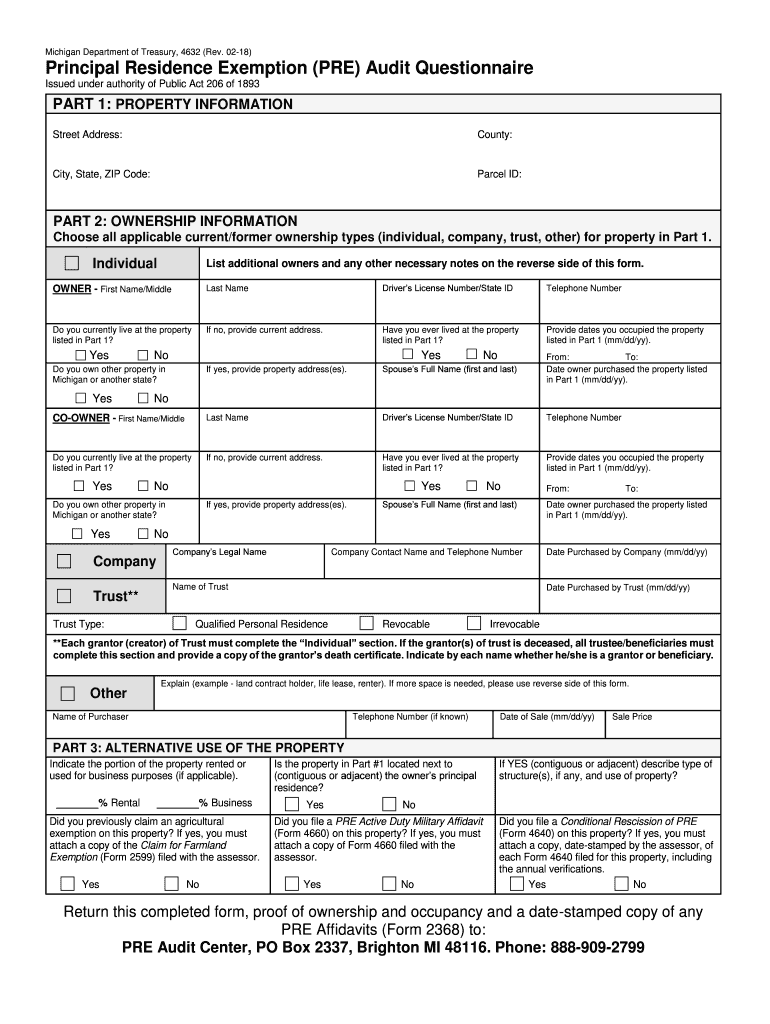

The Michigan Pre Audit Questionnaire, commonly referred to as the Michigan 4632 form, is a critical document used to assess eligibility for the principal residence exemption. This form is designed for property owners who want to claim an exemption from property taxes based on their primary residence status. Completing this questionnaire accurately is essential for ensuring compliance with state regulations and for receiving the appropriate tax benefits.

Steps to complete the Michigan Pre Audit Questionnaire

Filling out the Michigan 4632 form involves several key steps to ensure that all required information is provided accurately. Begin by gathering necessary documentation, including proof of residency and any relevant property details. Next, carefully fill out each section of the form, ensuring that all questions are answered completely. Pay special attention to sections that ask for specific information about the property and the owner’s residency status. After completing the form, review it for any errors or omissions before submitting it.

Legal use of the Michigan Pre Audit Questionnaire

The Michigan 4632 form is legally recognized as a valid document for claiming property tax exemptions. To ensure its legal standing, it must be completed in accordance with Michigan state laws and regulations. This includes providing accurate information and submitting the form by the designated deadlines. Utilizing secure electronic signature solutions, such as those offered by signNow, can further enhance the legal validity of the form by ensuring compliance with the ESIGN and UETA acts.

How to obtain the Michigan Pre Audit Questionnaire

Property owners can obtain the Michigan 4632 form through various channels. The form is typically available on the official Michigan government website, where it can be downloaded as a fillable PDF. Additionally, local county assessor offices may provide physical copies of the form. It is important to ensure that you are using the most current version of the form to avoid any issues with your application.

Required Documents

When completing the Michigan Pre Audit Questionnaire, several documents may be required to support your claim for the principal residence exemption. These documents typically include proof of identification, such as a driver’s license or state ID, and evidence of residency, which could be in the form of utility bills, bank statements, or lease agreements. Having these documents ready will streamline the completion process and help ensure that your application is processed without delays.

Form Submission Methods

The Michigan 4632 form can be submitted through various methods, providing flexibility for property owners. The form can be completed online and submitted electronically, which is often the most efficient option. Alternatively, it can be printed and mailed to the appropriate local assessor's office. In some cases, individuals may also have the option to deliver the form in person. It is advisable to check with local authorities for specific submission guidelines and requirements.

Quick guide on how to complete michigan pre audit questionnaire

Complete Michigan Pre Audit Questionnaire effortlessly on any gadget

Digital document management has gained popularity among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage Michigan Pre Audit Questionnaire on any device with airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The easiest way to edit and electronically sign Michigan Pre Audit Questionnaire without hassle

- Find Michigan Pre Audit Questionnaire and select Get Form to begin.

- Utilize the tools we provide to finish your document.

- Mark pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Craft your signature using the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Michigan Pre Audit Questionnaire and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct michigan pre audit questionnaire

Create this form in 5 minutes!

How to create an eSignature for the michigan pre audit questionnaire

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is the Michigan 4632 form?

The Michigan 4632 form is a document used for requesting a tax credit or exemption in the state of Michigan. This form is commonly utilized by individuals and businesses to claim benefits related to various tax programs. Understanding how to properly complete this form is crucial to ensure eligibility for the credits offered.

-

How do I fill out the Michigan 4632 form?

Filling out the Michigan 4632 form involves providing specific personal and financial details relevant to the tax program you are applying for. It is essential to follow the instructions carefully to avoid delays in processing. For best results, consider using tools like airSlate SignNow to easily eSign and submit the document.

-

Is there a cost associated with the Michigan 4632 form?

Typically, there is no fee to fill out and submit the Michigan 4632 form itself. However, costs may arise from services that assist you in preparing or filing the form. Using a cost-effective solution like airSlate SignNow can help streamline the process without incurring unnecessary expenses.

-

What features does airSlate SignNow offer for the Michigan 4632 form?

airSlate SignNow provides users with a simple and intuitive platform to prepare, eSign, and manage the Michigan 4632 form. Key features include drag-and-drop form creation, audit trails, and secure cloud storage, ensuring your documents are safe and easily accessible. This enhances efficiency when dealing with essential tax forms.

-

Can I integrate airSlate SignNow with other software for the Michigan 4632 form?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to work with the Michigan 4632 form within your existing systems. Popular integrations include CRMs, document management systems, and workflow tools. This connectivity allows for a more seamless document management experience.

-

What are the benefits of using airSlate SignNow for the Michigan 4632 form?

Using airSlate SignNow for the Michigan 4632 form streamlines the signing and submission process, saving you time and reducing errors. Its user-friendly interface allows for quick navigation and easy access to all your documents. Furthermore, eSigning ensures that your form is legally compliant and secure.

-

Is my data safe when using the Michigan 4632 form through airSlate SignNow?

Absolutely, airSlate SignNow prioritizes security and compliance. When you work with the Michigan 4632 form, your data is encrypted and stored securely to protect your sensitive information. The platform complies with industry regulations, ensuring that your documents are handled with the utmost care.

Get more for Michigan Pre Audit Questionnaire

- Payable on death form 34051058

- Form drs pw

- Premier pediatrics new patient history form

- Petition by owner for restitution new mexico form

- Aed departmental inspection report form b inspection checklist

- Cr 410 form

- Real estate investment partnership agreement template form

- Real estate partnership agreement template form

Find out other Michigan Pre Audit Questionnaire

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement