Mailing Addresses for DC Tax Returnsotr Form

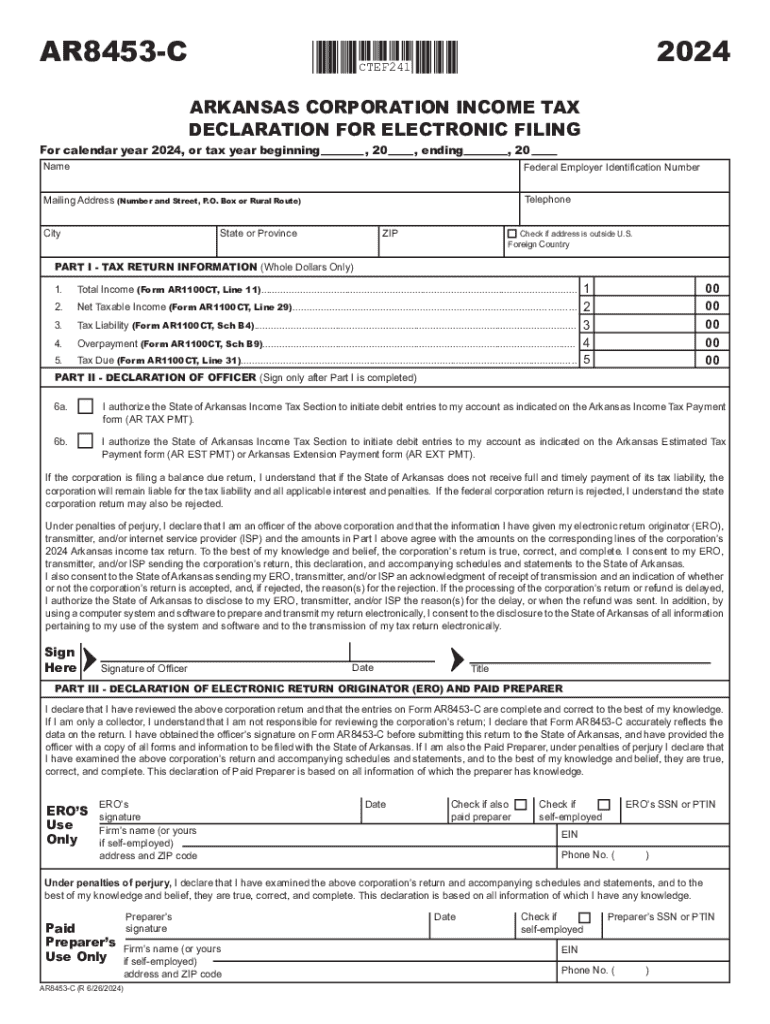

What is the AR8453 C Form?

The AR8453 C form is a document used for electronic filing of certain tax returns in the District of Columbia. This form serves as a declaration that the taxpayer has completed their tax return electronically and provides an avenue for submitting signatures electronically. It is essential for ensuring that the tax return is valid and accepted by the tax authorities.

Steps to Complete the AR8453 C Form

Completing the AR8453 C form involves several straightforward steps:

- Gather necessary information, including your tax identification number and details from your tax return.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Sign the form electronically, confirming your intention to file the return.

- Submit the completed form along with your electronic tax return.

Legal Use of the AR8453 C Form

The AR8453 C form is legally recognized as part of the electronic filing process for tax returns in the District of Columbia. By signing this form electronically, taxpayers affirm that the information provided is accurate and complete. This legal acknowledgment is critical as it helps to prevent fraud and ensures compliance with tax regulations.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the AR8453 C form. Typically, tax returns must be filed by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of any extensions they may apply for, which can affect the submission timeline.

Form Submission Methods

The AR8453 C form can be submitted electronically as part of the e-filing process. This method is efficient and ensures that the form is received promptly by the tax authorities. It is important to follow the specific guidelines provided for electronic submissions to avoid any issues with acceptance.

Required Documents

When completing the AR8453 C form, taxpayers should have the following documents on hand:

- Your completed tax return.

- Any supporting documentation that may be required for deductions or credits.

- Your Social Security number or Employer Identification Number.

Who Issues the AR8453 C Form

The AR8453 C form is issued by the District of Columbia Office of Tax and Revenue. This office is responsible for managing tax collections and ensuring compliance with local tax laws. Taxpayers can obtain the form directly from their official website or through authorized tax preparation software.

Quick guide on how to complete mailing addresses for dc tax returnsotr

Complete Mailing Addresses For DC Tax Returnsotr effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Mailing Addresses For DC Tax Returnsotr on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Mailing Addresses For DC Tax Returnsotr without exertion

- Find Mailing Addresses For DC Tax Returnsotr and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Mailing Addresses For DC Tax Returnsotr and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mailing addresses for dc tax returnsotr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ar8453 c and how does it work?

The ar8453 c is a powerful feature within airSlate SignNow that allows users to streamline their document signing process. It enables businesses to send, sign, and manage documents electronically, ensuring a fast and efficient workflow. With its user-friendly interface, the ar8453 c simplifies the eSigning experience for both senders and recipients.

-

What are the pricing options for the ar8453 c?

airSlate SignNow offers flexible pricing plans for the ar8453 c, catering to businesses of all sizes. You can choose from monthly or annual subscriptions, with options that include essential features for small teams or advanced capabilities for larger organizations. Visit our pricing page to find the plan that best suits your needs.

-

What features does the ar8453 c include?

The ar8453 c includes a variety of features designed to enhance document management and eSigning. Key features include customizable templates, real-time tracking, and secure cloud storage. These functionalities help businesses improve efficiency and maintain compliance with industry standards.

-

How can the ar8453 c benefit my business?

Implementing the ar8453 c can signNowly benefit your business by reducing the time spent on document processing. It allows for quicker turnaround times on contracts and agreements, which can lead to improved customer satisfaction. Additionally, the cost-effective nature of the ar8453 c helps businesses save on printing and mailing expenses.

-

Is the ar8453 c easy to integrate with other software?

Yes, the ar8453 c is designed to seamlessly integrate with various software applications, including CRM and project management tools. This integration capability allows businesses to enhance their existing workflows without disruption. By connecting the ar8453 c with your favorite tools, you can streamline processes and improve overall productivity.

-

What security measures are in place for the ar8453 c?

The ar8453 c prioritizes security with advanced encryption protocols and compliance with industry regulations. All documents signed through the platform are securely stored and protected against unauthorized access. This ensures that your sensitive information remains confidential and secure throughout the signing process.

-

Can I customize the ar8453 c for my specific needs?

Absolutely! The ar8453 c offers customization options that allow you to tailor the signing experience to your business requirements. You can create personalized templates, set specific signing workflows, and adjust settings to align with your operational needs, making it a versatile solution for any organization.

Get more for Mailing Addresses For DC Tax Returnsotr

Find out other Mailing Addresses For DC Tax Returnsotr

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document