Pass through Entity TaxArkansas Department of Finance 2024-2026

Understanding the Pass-through Entity Tax

The Pass-through Entity Tax is a tax structure that allows certain business entities, such as partnerships and S corporations, to pass their income directly to their owners or shareholders. This means that the income is taxed at the individual level rather than at the corporate level. In Arkansas, this tax is particularly important for businesses looking to minimize their overall tax burden while complying with state regulations. Understanding this tax can help business owners make informed decisions about their tax strategies and business structure.

Steps to Complete the Pass-through Entity Tax

Completing the Pass-through Entity Tax involves several key steps:

- Determine Eligibility: Ensure that your business qualifies as a pass-through entity under Arkansas law.

- Gather Required Information: Collect all necessary financial documents, including income statements and prior tax returns.

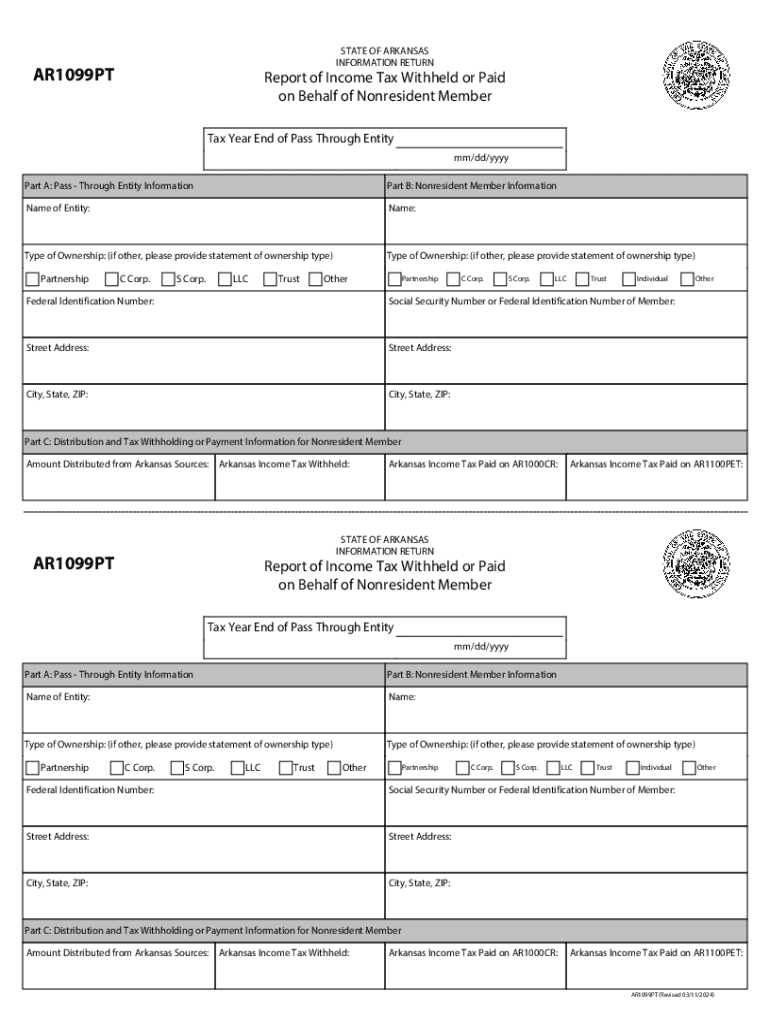

- Complete the Tax Form: Fill out the appropriate tax form for your entity type, ensuring all information is accurate and complete.

- Review and Verify: Double-check all entries for accuracy to avoid potential penalties.

- Submit the Form: File the completed form with the Arkansas Department of Finance, either online or by mail.

Required Documents for Filing

When filing the Pass-through Entity Tax, several documents are necessary to ensure compliance and accuracy:

- Income statements for the relevant tax year

- Prior year tax returns for comparison

- Partnership agreements or corporate bylaws

- Any supporting documentation for deductions or credits claimed

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the Pass-through Entity Tax to avoid penalties:

- The standard filing deadline is typically April 15 for most entities.

- Extensions may be available, but must be requested prior to the original deadline.

- Be mindful of any state-specific deadlines that may differ from federal requirements.

Penalties for Non-Compliance

Failure to comply with the Pass-through Entity Tax regulations can result in significant penalties:

- Late filing penalties may apply if the tax form is submitted after the deadline.

- Incorrect information can lead to additional fines or interest charges on unpaid taxes.

- Persistent non-compliance may result in more severe legal consequences, including audits.

IRS Guidelines for Pass-through Entities

The Internal Revenue Service (IRS) provides guidelines that govern how pass-through entities must report their income and expenses. It is essential for business owners to familiarize themselves with these guidelines to ensure compliance:

- Pass-through entities must report income on Schedule K-1, which details each owner's share of income.

- Understanding the tax implications of distributions is vital for accurate reporting.

- Consulting IRS publications can provide additional clarity on specific tax situations.

Quick guide on how to complete pass through entity taxarkansas department of finance

Complete Pass through Entity TaxArkansas Department Of Finance effortlessly on any device

Digital document management has gained signNow traction among enterprises and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, enabling you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your paperwork swiftly without delays. Manage Pass through Entity TaxArkansas Department Of Finance on any device using airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The simplest way to modify and eSign Pass through Entity TaxArkansas Department Of Finance with ease

- Find Pass through Entity TaxArkansas Department Of Finance and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight key parts of your documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet signature.

- Review all the information carefully and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and eSign Pass through Entity TaxArkansas Department Of Finance and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pass through entity taxarkansas department of finance

Create this form in 5 minutes!

How to create an eSignature for the pass through entity taxarkansas department of finance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ar1099pt and how does it work?

The ar1099pt is a specific form used for reporting payments made to independent contractors. With airSlate SignNow, you can easily fill out, send, and eSign your ar1099pt documents, streamlining your reporting process. Our platform ensures that your forms are completed accurately and securely.

-

How can airSlate SignNow help with ar1099pt forms?

airSlate SignNow simplifies the process of managing ar1099pt forms by providing an intuitive interface for document creation and eSigning. You can quickly generate these forms, collect signatures, and store them securely in the cloud. This efficiency helps you meet deadlines and stay compliant with tax regulations.

-

What are the pricing options for using airSlate SignNow for ar1099pt?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need basic features for occasional use or advanced functionalities for high-volume transactions, there’s a plan that fits your needs. Check our website for detailed pricing information related to ar1099pt management.

-

Are there any integrations available for ar1099pt with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software, making it easier to manage your ar1099pt forms. These integrations allow for automatic data transfer, reducing manual entry errors and saving you time. Explore our integration options to enhance your workflow.

-

What are the benefits of using airSlate SignNow for ar1099pt?

Using airSlate SignNow for your ar1099pt forms offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. Our platform allows you to track document status in real-time, ensuring that you never miss a deadline. Additionally, eSigning reduces the time spent on paperwork.

-

Is airSlate SignNow secure for handling ar1099pt documents?

Absolutely! airSlate SignNow prioritizes the security of your ar1099pt documents with advanced encryption and secure cloud storage. We comply with industry standards to protect your sensitive information, giving you peace of mind while managing your forms. Your data's safety is our top priority.

-

Can I customize my ar1099pt forms in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your ar1099pt forms to meet your specific needs. You can add your branding, modify fields, and include any necessary instructions for signers. This customization ensures that your forms align with your business identity and requirements.

Get more for Pass through Entity TaxArkansas Department Of Finance

- Personal services partnership agreement form

- Waiver treatment form

- Agreement assign lease 497330544 form

- Denial sample letter form

- Sample fiat form

- Release lien 497330547 form

- Contract disc jockey 497330548 form

- Non exclusive license agreement to use real property including waiver assumption of risk and indemnification agreement form

Find out other Pass through Entity TaxArkansas Department Of Finance

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document