Ar1099pt 2017

What is the Ar1099pt

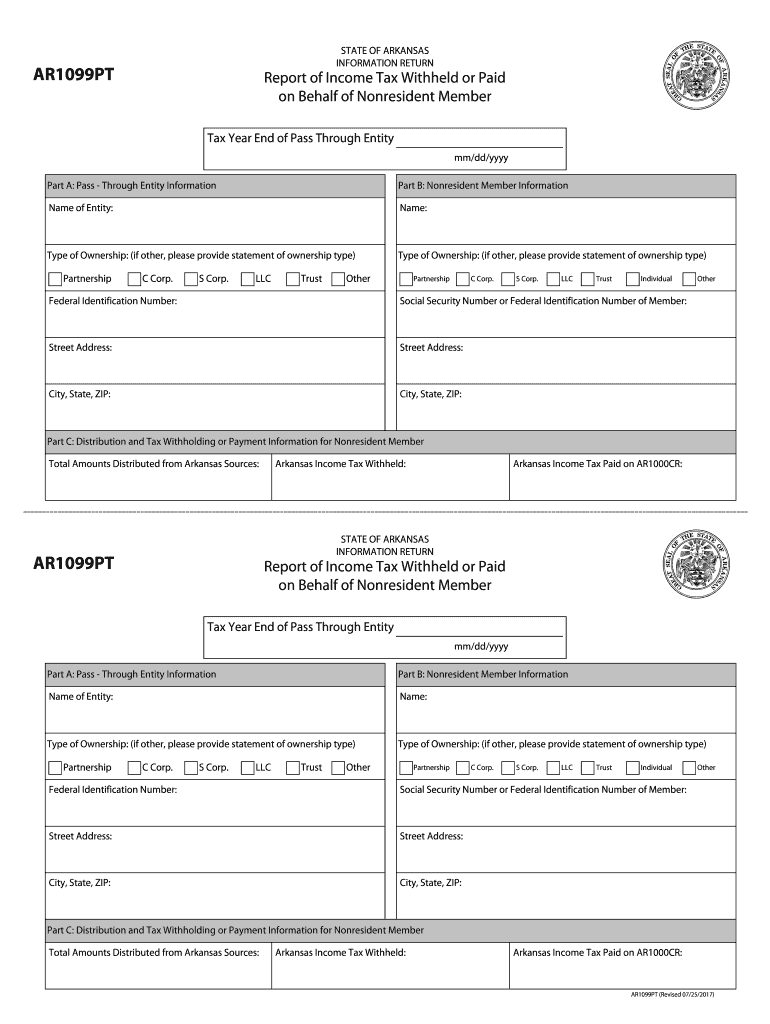

The Ar1099pt is a tax form used in the state of Arkansas to report income earned by nonresident members. This form is essential for individuals or entities that have received income from Arkansas sources but do not reside in the state. The Ar1099pt ensures that the appropriate state income tax is withheld and reported, facilitating compliance with Arkansas tax laws. It is particularly relevant for businesses and individuals engaging in transactions that involve Arkansas-sourced income.

Steps to complete the Ar1099pt

Completing the Ar1099pt involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the nonresident member's income, including the total amount earned and any tax withheld. Next, accurately fill out the form, ensuring that all required fields are completed, such as the recipient’s name, address, and taxpayer identification number. After completing the form, review it for any errors before submitting it to the Arkansas Department of Finance and Administration. It is advisable to keep a copy for your records.

Legal use of the Ar1099pt

The legal use of the Ar1099pt is governed by Arkansas state tax regulations. To be considered valid, the form must be filled out completely and accurately. Additionally, it must be submitted within the specified deadlines to avoid penalties. The form serves as an official record of income and tax withheld, which may be required for both the recipient and the state during tax audits. Using an electronic signature solution can enhance the legal standing of the document, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Ar1099pt are crucial for compliance with Arkansas tax regulations. Typically, the form must be submitted to the Arkansas Department of Finance and Administration by January thirty-first of the year following the tax year in which the income was earned. It is important to stay informed about any changes to these deadlines, as late submissions may result in penalties or interest charges. Marking your calendar with these key dates can help ensure timely filing.

Who Issues the Form

The Ar1099pt is issued by businesses or entities that have paid income to nonresident members. These payers are responsible for accurately completing and submitting the form to report the income and any state tax withheld. It is essential for the issuer to maintain accurate records of payments made to nonresident members, as this information is necessary for completing the Ar1099pt correctly. The form must then be provided to the recipient for their records and tax reporting purposes.

Examples of using the Ar1099pt

Examples of using the Ar1099pt include various scenarios where nonresident members earn income from Arkansas sources. For instance, a nonresident contractor providing services to an Arkansas-based company would receive an Ar1099pt to report the income earned. Similarly, a nonresident investor receiving dividends from an Arkansas corporation would also be issued this form. These examples illustrate the form's role in ensuring that income earned from Arkansas is reported and taxed appropriately, even for those who do not reside in the state.

Quick guide on how to complete ar ar1099pt 2017

Accomplish Ar1099pt effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documentation, as you can locate the proper form and safely archive it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Ar1099pt on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to alter and eSign Ar1099pt without hassle

- Obtain Ar1099pt and click on Get Form to initiate.

- Employ the tools we offer to complete your document.

- Emphasize necessary sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes moments and holds the same legal significance as a traditional handwritten signature.

- Verify all the details and click on the Done button to apply your modifications.

- Select how you wish to send your document, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from a device of your choosing. Alter and eSign Ar1099pt and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ar ar1099pt 2017

Create this form in 5 minutes!

How to create an eSignature for the ar ar1099pt 2017

How to make an electronic signature for your Ar Ar1099pt 2017 in the online mode

How to generate an eSignature for the Ar Ar1099pt 2017 in Chrome

How to generate an electronic signature for putting it on the Ar Ar1099pt 2017 in Gmail

How to make an eSignature for the Ar Ar1099pt 2017 straight from your smartphone

How to make an eSignature for the Ar Ar1099pt 2017 on iOS

How to create an electronic signature for the Ar Ar1099pt 2017 on Android devices

People also ask

-

What is ar1099pt and how does it relate to airSlate SignNow?

The ar1099pt is a crucial tax form used for reporting certain types of income, and airSlate SignNow simplifies the process of sending and eSigning this form. Our platform allows users to efficiently manage their 1099 forms digitally, ensuring compliance and accuracy. With airSlate SignNow, you can streamline your tax documentation process effortlessly.

-

How does airSlate SignNow help with the 1099 filing process?

airSlate SignNow provides an effective way to prepare and send ar1099pt forms for electronic signature. By using our service, businesses can minimize delays, ensure compliance, and enhance accuracy in their filing process. Our user-friendly interface makes it easy to manage your 1099 filings from any device.

-

What are the pricing options for using airSlate SignNow for ar1099pt forms?

airSlate SignNow offers flexible pricing plans tailored to various business needs, including functionalities for handling ar1099pt forms. We provide cost-effective solutions that ensure you only pay for what you use. Check our pricing page for detailed information on plans designed for frequent 1099 filers.

-

Are there any integrations with other tools for managing ar1099pt forms?

Yes, airSlate SignNow integrates seamlessly with various accounting and payroll software, making it easier to manage ar1099pt forms alongside your financial operations. These integrations streamline the documentation process, making it more efficient and error-free. Connect your existing tools effortlessly for an enhanced workflow.

-

What security measures does airSlate SignNow implement for ar1099pt document management?

Security is a top priority for airSlate SignNow, especially when handling sensitive ar1099pt documents. Our platform employs advanced encryption protocols and multiple authentication methods to protect your data. You can trust that your signed forms are secure and compliant with industry standards.

-

Can I track the status of my ar1099pt forms sent through airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of your sent ar1099pt forms in real-time. Our platform provides notifications and updates, allowing you to know when your documents have been viewed or signed, ensuring a smooth workflow.

-

What features does airSlate SignNow offer for managing ar1099pt signatures?

airSlate SignNow includes robust features specifically designed for managing signatures on ar1099pt forms. You can customize signing workflows, set signature fields, and even use templates for repeated use. These features enhance efficiency and make the completion of 1099 forms a breeze.

Get more for Ar1099pt

Find out other Ar1099pt

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word