990 Ez Form

What is the 990 EZ Form

The 990 EZ Form is a simplified version of the IRS Form 990, designed for small tax-exempt organizations, including charities and nonprofits. This form provides essential information about the organization's financial activities, governance, and compliance with federal tax regulations. Organizations that qualify to use the 990 EZ Form typically have gross receipts of less than two hundred fifty thousand dollars and total assets of less than five hundred thousand dollars. By using this streamlined form, organizations can efficiently report their financial status while fulfilling their IRS obligations.

Steps to Complete the 990 EZ Form

Completing the 990 EZ Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including income statements, balance sheets, and any relevant supporting documents. Next, follow these steps:

- Begin by filling out the organization’s basic information, including its name, address, and Employer Identification Number (EIN).

- Report total revenue and expenses for the year, ensuring that all figures are accurate and reflect the organization’s financial activities.

- Complete the balance sheet section, detailing the organization’s assets, liabilities, and net assets.

- Provide information about the organization’s mission, programs, and any changes in governance or structure.

- Review the form for completeness and accuracy before submitting it to the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 990 EZ Form are crucial for maintaining compliance with IRS regulations. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations that operate on a calendar year, this means the form is typically due by May fifteenth. Organizations can request an automatic six-month extension to file by submitting Form 8868, but this extension does not extend the time for payment of any taxes owed.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 990 EZ Form. Organizations must ensure that they meet the eligibility criteria to use this form, as well as adhere to all reporting requirements. The IRS emphasizes the importance of accuracy in financial reporting and encourages organizations to maintain thorough records to support the information provided on the form. Additionally, organizations should be aware of any changes in IRS regulations or requirements that may affect their filing.

Required Documents

When completing the 990 EZ Form, organizations must have several documents on hand to ensure accurate reporting. Required documents include:

- Financial statements, including income and expense reports.

- Balance sheets detailing assets and liabilities.

- Records of contributions and grants received during the reporting period.

- Documentation of any significant changes in the organization’s structure or governance.

Legal Use of the 990 EZ Form

The 990 EZ Form serves as a legal document that provides transparency regarding an organization’s financial activities. Properly completing and submitting this form is essential for maintaining tax-exempt status and complying with federal regulations. Failure to file the form or inaccuracies in reporting can lead to penalties, including loss of tax-exempt status. Organizations should ensure they understand the legal implications of the information reported on the form and seek assistance if needed.

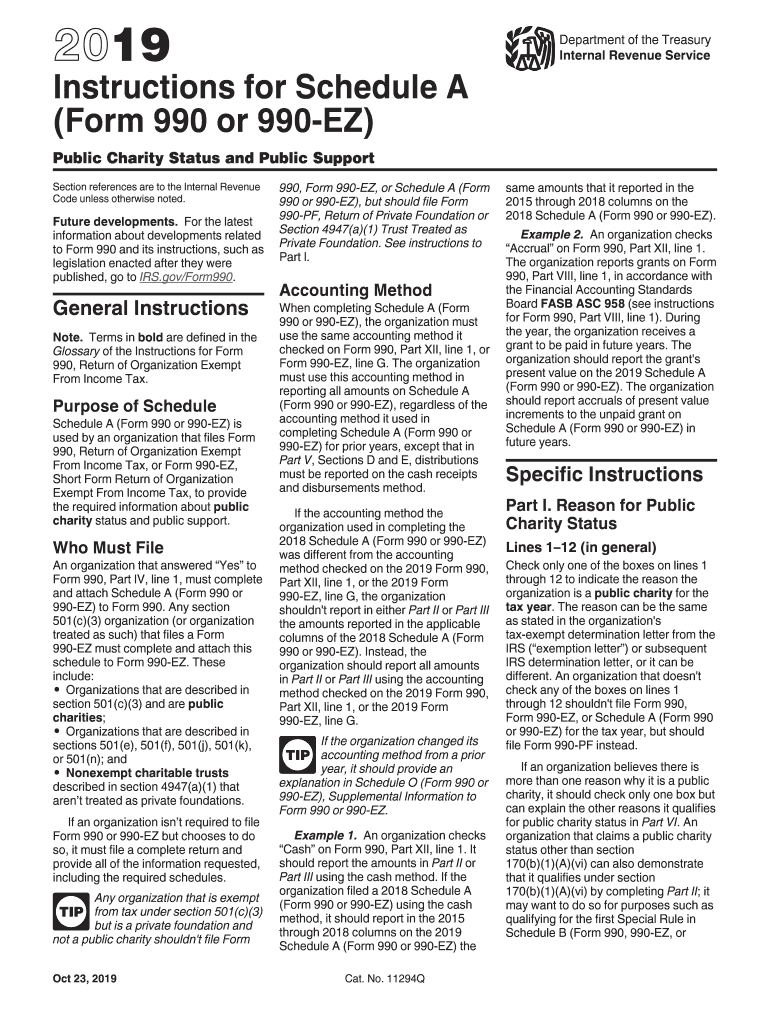

Quick guide on how to complete 2019 instructions for schedule a form 990 or 990 ez instructions for schedule a form 990 or 990 ez public charity status and

Prepare 990 Ez Form effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, alter, and eSign your documents quickly without delays. Handle 990 Ez Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The easiest way to alter and eSign 990 Ez Form seamlessly

- Locate 990 Ez Form and click Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Alter and eSign 990 Ez Form and guarantee efficient communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for schedule a form 990 or 990 ez instructions for schedule a form 990 or 990 ez public charity status and

How to make an eSignature for your 2019 Instructions For Schedule A Form 990 Or 990 Ez Instructions For Schedule A Form 990 Or 990 Ez Public Charity Status And online

How to make an eSignature for your 2019 Instructions For Schedule A Form 990 Or 990 Ez Instructions For Schedule A Form 990 Or 990 Ez Public Charity Status And in Google Chrome

How to generate an eSignature for signing the 2019 Instructions For Schedule A Form 990 Or 990 Ez Instructions For Schedule A Form 990 Or 990 Ez Public Charity Status And in Gmail

How to make an eSignature for the 2019 Instructions For Schedule A Form 990 Or 990 Ez Instructions For Schedule A Form 990 Or 990 Ez Public Charity Status And from your mobile device

How to generate an electronic signature for the 2019 Instructions For Schedule A Form 990 Or 990 Ez Instructions For Schedule A Form 990 Or 990 Ez Public Charity Status And on iOS

How to create an eSignature for the 2019 Instructions For Schedule A Form 990 Or 990 Ez Instructions For Schedule A Form 990 Or 990 Ez Public Charity Status And on Android devices

People also ask

-

What are the IRS instructions for scheduling a 990 form?

The IRS instructions for scheduling a 990 form provide detailed guidelines on how to complete and file the form accurately. They cover eligibility, required information, and deadlines, ensuring compliance with IRS regulations. Reviewing these instructions is crucial for accurate reporting and to avoid potential penalties.

-

How does airSlate SignNow simplify the process of filing a 990 form?

airSlate SignNow streamlines the process of filing a 990 form by enabling users to create, edit, and eSign required documents digitally. This eliminates the need for cumbersome paper forms and ensures that all signatures and submissions are managed efficiently. The platform's intuitive interface makes adhering to IRS instructions for scheduling a 990 form straightforward.

-

What features does airSlate SignNow offer for nonprofit organizations filing a 990 form?

For nonprofit organizations, airSlate SignNow offers a range of features tailored to simplify filing a 990 form, including template management, custom workflows, and collaboration tools. These features enable organizations to gather required information easily while ensuring compliance with IRS instructions for scheduling a 990 form. Additionally, support for multi-user access ensures transparency throughout the filing process.

-

Are there any integration options with airSlate SignNow for managing 990 forms?

Yes, airSlate SignNow provides integration options with multiple platforms, making it easy to manage 990 forms alongside your existing tools. You can connect with accounting software, CRMs, and other business applications to streamline your document workflows. This facilitates efficient management while adhering to IRS instructions for scheduling a 990 form.

-

What is the pricing structure for using airSlate SignNow for filing a 990 form?

airSlate SignNow offers flexible pricing plans designed to accommodate different organizational sizes and needs. Users can select from monthly or annual subscriptions that offer various features for eSigning and document management, thus making it a cost-effective solution for organizations needing to comply with IRS instructions for scheduling a 990 form.

-

Can airSlate SignNow help with understanding the IRS instructions for scheduling a 990 form?

While airSlate SignNow simplifies the filing process, it is recommended to consult the IRS website for detailed instructions on scheduling a 990 form. The platform assists in completing the necessary documentation accurately, but users should familiarize themselves with the specific requirements laid out in the IRS instructions. This combined approach helps ensure successful filing.

-

Is airSlate SignNow suitable for all types of organizations filing a 990 form?

Yes, airSlate SignNow is suitable for various types of organizations, including nonprofits, charities, and other entities required to file a 990 form. Its user-friendly platform caters to the unique needs of different users, ensuring that everyone can follow IRS instructions for scheduling a 990 form effectively. This versatility makes it a popular choice for diverse organizations.

Get more for 990 Ez Form

Find out other 990 Ez Form

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy