Line Instructions for Form it 201 ATT, Other Tax Credits and 2024-2026

Understanding the Line Instructions for Form IT-201 ATT

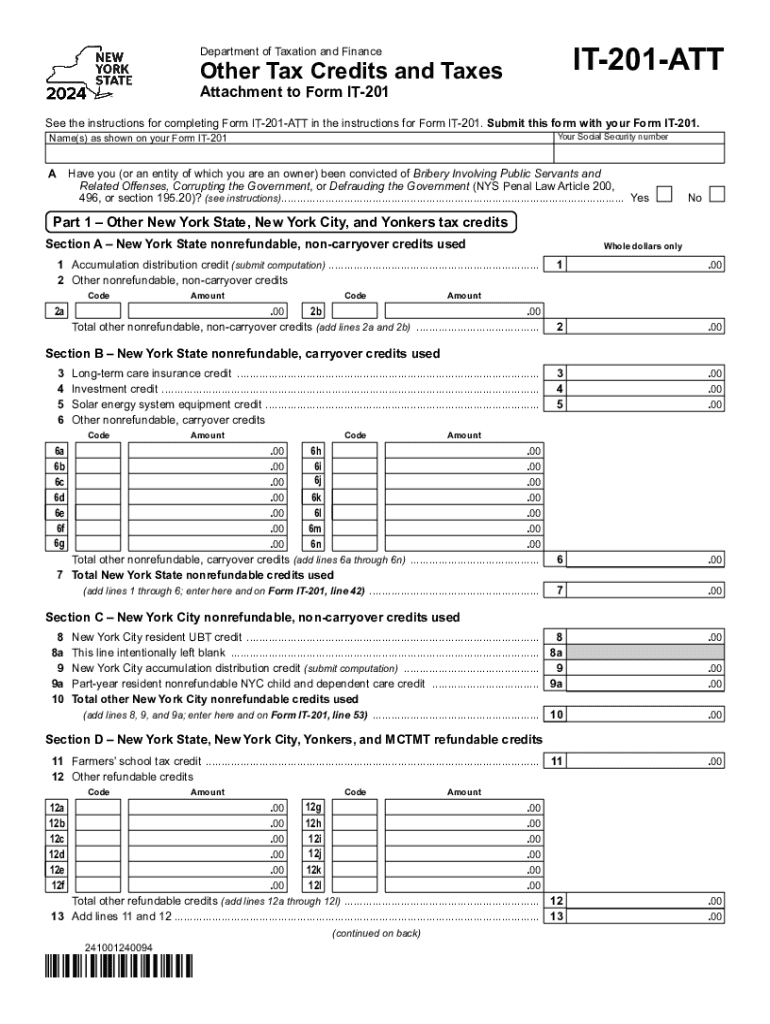

The Line Instructions for Form IT-201 ATT provide essential guidance for taxpayers in New York who are claiming various tax credits. This form is specifically designed for individuals who need to report additional tax credits that may reduce their overall tax liability. The instructions outline how to properly fill out each line of the form, ensuring that taxpayers can accurately report their credits and avoid potential errors that could lead to delays or penalties.

Steps to Complete the Line Instructions for Form IT-201 ATT

Completing the Line Instructions for Form IT-201 ATT involves several key steps. First, gather all necessary documents, including your income statements and any documentation related to the credits you are claiming. Next, carefully read through the instructions to understand what information is required for each line. Fill out the form methodically, ensuring that all figures are accurate and correspond to your supporting documents. After completing the form, review it for any mistakes before submission.

Eligibility Criteria for Form IT-201 ATT

To qualify for the credits listed on Form IT-201 ATT, taxpayers must meet specific eligibility criteria. Generally, these criteria include residency in New York State for the tax year, having taxable income, and fulfilling any additional requirements associated with the specific credits being claimed. It is important to review the eligibility guidelines provided in the instructions to ensure compliance and maximize potential tax benefits.

Required Documents for Form IT-201 ATT

When filing Form IT-201 ATT, certain documents are required to substantiate the claims made on the form. Taxpayers should prepare copies of their W-2 forms, 1099 forms, and any other relevant income documentation. Additionally, documentation supporting the specific tax credits claimed, such as proof of residency or eligibility for certain programs, should be included. Having these documents ready can streamline the filing process and help avoid complications.

Filing Deadlines for Form IT-201 ATT

Filing deadlines for Form IT-201 ATT align with the general tax filing deadlines set by the state of New York. Typically, taxpayers must submit their forms by April fifteenth of the following year. It is crucial to be aware of any changes to these deadlines, especially in light of special circumstances that may arise, such as extensions or changes in tax legislation. Timely filing helps avoid penalties and ensures that taxpayers can receive any refunds due promptly.

Form Submission Methods for IT-201 ATT

Taxpayers can submit Form IT-201 ATT through various methods, including online, by mail, or in person. Online submission is often the quickest and most efficient method, allowing for immediate processing. For those choosing to file by mail, it is important to send the form to the correct address as specified in the instructions. In-person submissions may be available at designated tax offices, providing an option for individuals who prefer direct assistance.

Common Taxpayer Scenarios for Form IT-201 ATT

Different taxpayer scenarios can affect how Form IT-201 ATT is completed. For instance, self-employed individuals may need to account for additional deductions and credits related to their business expenses. Retired individuals may have different income sources that impact their eligibility for certain credits. Understanding these scenarios can help taxpayers accurately complete the form and ensure they are claiming all applicable credits based on their unique financial situations.

Create this form in 5 minutes or less

Find and fill out the correct line instructions for form it 201 att other tax credits and

Create this form in 5 minutes!

How to create an eSignature for the line instructions for form it 201 att other tax credits and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is nys it 201 att and how does it relate to airSlate SignNow?

NYS IT 201 ATT refers to a specific form used in New York State for IT-related transactions. airSlate SignNow simplifies the process of completing and signing this form electronically, ensuring compliance and efficiency.

-

How much does airSlate SignNow cost for using nys it 201 att?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose a plan that fits your budget while ensuring you can efficiently manage documents like the nys it 201 att.

-

What features does airSlate SignNow offer for nys it 201 att?

With airSlate SignNow, you can easily create, send, and eSign the nys it 201 att form. Features like templates, reminders, and secure storage enhance your document management experience.

-

Can I integrate airSlate SignNow with other software for nys it 201 att?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to streamline your workflow for the nys it 201 att. This integration helps in automating processes and improving productivity.

-

What are the benefits of using airSlate SignNow for nys it 201 att?

Using airSlate SignNow for the nys it 201 att provides numerous benefits, including faster turnaround times, reduced paper usage, and enhanced security. It allows businesses to operate more efficiently and stay compliant.

-

Is airSlate SignNow secure for handling nys it 201 att documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including the nys it 201 att. Your data is encrypted and stored securely, ensuring confidentiality and compliance.

-

How can I get started with airSlate SignNow for nys it 201 att?

Getting started with airSlate SignNow is easy. Simply sign up for an account, and you can begin creating and managing your nys it 201 att documents in minutes. Our user-friendly interface makes the process straightforward.

Get more for Line Instructions For Form IT 201 ATT, Other Tax Credits And

- Scrap metal receipt template form

- Hud fraud is it worth it brochure form

- Cni 037 smokeco alarm self verification form sonoma county sonoma county

- Worksheet federalism answer key form

- Compensation agreement template form

- Medicine expiry return format pdf

- Pringle real estate form

- Vegetated road verge nature strip maintenance approval yoursay blacktown nsw gov form

Find out other Line Instructions For Form IT 201 ATT, Other Tax Credits And

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast