Instructions Schedule R 1040 Form

What is the Instructions Schedule R 1040 Form

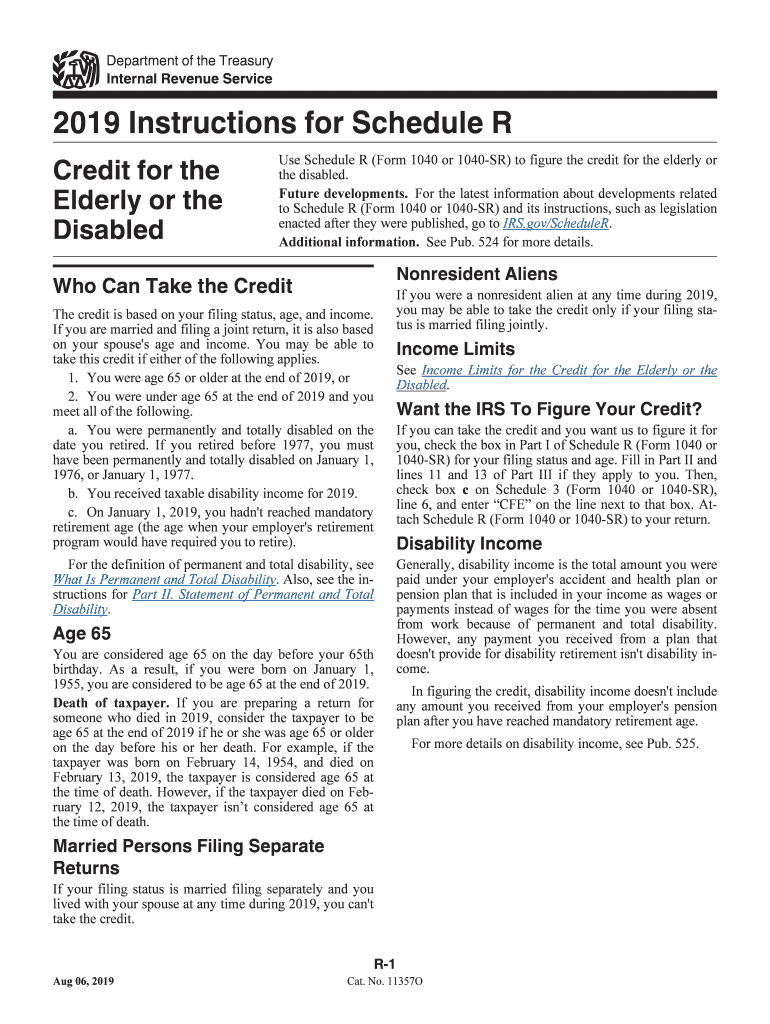

The Instructions Schedule R 1040 Form is a crucial document for taxpayers in the United States who are eligible for a property tax credit. This form is specifically designed to assist individuals in understanding how to claim the credit for property taxes paid on their primary residence. It provides detailed guidelines on eligibility criteria, the calculation of the credit, and the necessary information required to complete the form accurately. The Schedule R is typically used by senior citizens, disabled individuals, or those who meet specific income thresholds.

Steps to Complete the Instructions Schedule R 1040 Form

Completing the Instructions Schedule R 1040 Form involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary documentation, including proof of property taxes paid and any relevant income information. Next, carefully read through the instructions provided on the form to understand the eligibility requirements and calculations. Fill out the form methodically, ensuring that all sections are completed and that you have included any required attachments. Finally, review the completed form for accuracy before submitting it to the IRS.

Key Elements of the Instructions Schedule R 1040 Form

The Instructions Schedule R 1040 Form includes several key elements that are essential for taxpayers to understand. These elements encompass eligibility criteria, such as age and income limits, as well as the specific calculations needed to determine the amount of the credit. Additionally, the form outlines the documentation required to support your claim, including property tax statements and income verification. Understanding these key elements is vital for successfully claiming the property tax credit.

IRS Guidelines

The IRS provides comprehensive guidelines for completing the Instructions Schedule R 1040 Form. These guidelines include detailed instructions on eligibility, the calculation of the property tax credit, and filing requirements. Taxpayers are encouraged to refer to the IRS website or the official IRS publications for the most current information regarding any changes to the form or the credit itself. Adhering to these guidelines ensures compliance and helps avoid potential issues during the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions Schedule R 1040 Form typically align with the standard tax return deadlines. Taxpayers should be aware that the deadline for submitting their federal tax return, including the Schedule R, is usually April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these deadlines and to file on time to avoid penalties.

Eligibility Criteria

Eligibility for the Instructions Schedule R 1040 Form primarily hinges on specific criteria set by the IRS. Generally, applicants must be at least sixty-five years old or permanently disabled. Additionally, there are income limits that must be met, which vary by state. Property ownership and the amount of property taxes paid are also significant factors in determining eligibility. Understanding these criteria is essential for taxpayers seeking to claim the property tax credit effectively.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Instructions Schedule R 1040 Form. The form can be filed electronically through IRS-approved e-filing software, which offers a convenient and efficient method for submission. Alternatively, taxpayers may choose to print the completed form and mail it directly to the IRS. In some cases, individuals may also have the option to submit the form in person at designated IRS offices. Each method has its own advantages, and taxpayers should select the one that best suits their needs.

Quick guide on how to complete inst 1040 schedule r

Complete Instructions Schedule R 1040 Form effortlessly on any device

Web-based document management has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the needed form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without interruptions. Handle Instructions Schedule R 1040 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign Instructions Schedule R 1040 Form without stress

- Locate Instructions Schedule R 1040 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent parts of your documents or redact confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and eSign Instructions Schedule R 1040 Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the inst 1040 schedule r

How to create an eSignature for your Inst 1040 Schedule R online

How to create an electronic signature for the Inst 1040 Schedule R in Google Chrome

How to make an eSignature for putting it on the Inst 1040 Schedule R in Gmail

How to create an electronic signature for the Inst 1040 Schedule R straight from your smart phone

How to make an eSignature for the Inst 1040 Schedule R on iOS

How to create an electronic signature for the Inst 1040 Schedule R on Android

People also ask

-

What are the Instructions Schedule R 1040 Form for tax filing?

The Instructions Schedule R 1040 Form provide guidance on how to calculate and claim the Retirement Credit for eligible taxpayers. This credit is designed to incentivize retirement savings, and the Instructions Schedule R will help you understand eligibility criteria and how to fill out the form accurately.

-

How can airSlate SignNow assist with the Instructions Schedule R 1040 Form?

With airSlate SignNow, you can easily eSign and send your Instructions Schedule R 1040 Form securely and efficiently. Our platform simplifies the process of preparing and submitting tax documents, ensuring your forms are completed correctly and on time.

-

Is there a cost associated with using airSlate SignNow for Instructions Schedule R 1040 Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. You can choose a plan that best suits your requirements for handling documents, including Instructions Schedule R 1040 Form, while benefiting from our cost-effective solutions.

-

What features does airSlate SignNow offer for managing the Instructions Schedule R 1040 Form?

airSlate SignNow provides features like document templates, secure eSigning, and automated workflows that make managing the Instructions Schedule R 1040 Form seamless. These tools help ensure that your tax documents are organized, easily accessible, and compliant with regulations.

-

Can I integrate airSlate SignNow with other software for my Instructions Schedule R 1040 Form?

Absolutely! airSlate SignNow supports integration with various applications, enabling you to streamline your document management process for Instructions Schedule R 1040 Form. This means you can connect with accounting software or CRM systems to enhance your workflow.

-

What benefits does airSlate SignNow provide for filing the Instructions Schedule R 1040 Form?

Using airSlate SignNow for your Instructions Schedule R 1040 Form offers numerous benefits, such as reducing processing time and minimizing errors. Our user-friendly interface ensures that you can focus more on your finances while we handle the paperwork.

-

How do I get started with airSlate SignNow for the Instructions Schedule R 1040 Form?

Getting started with airSlate SignNow is simple! Just sign up for an account, explore our templates for the Instructions Schedule R 1040 Form, and begin sending and eSigning documents in minutes. Our platform is designed to be intuitive, making it easy for anyone to use.

Get more for Instructions Schedule R 1040 Form

Find out other Instructions Schedule R 1040 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors